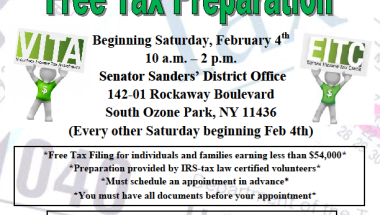

Senator Sanders presents Free Tax Preparation at his District Office!

142-01 Rockaway Boulevard

South Ozone Park,

NY

11434

Why pay to get your taxes filed for a charge when you can be eligible to have an IRS-certified volunteer prepare your return at no cost. If your income is under $54,000, you can have your taxes prepared for free at a Senator Sanders District Office located at 142-01 Rockaway Blvd, Jamaica, NY 11436 beginning Friday, February 4th from 10 a.m. – 2 p.m. then continuing bi-weekly.

Find out if you are eligible for Earned Income Tax Credit (EITC). If you worked last year and your income is less than $53,505 you may be entitled to EITC which can mean up to a $6,269 refund when you file a return and have qualifying children. Workers with no qualifying children could be eligible for a smaller credit, up to $506. On average, EITC adds $2,400 to refunds. Volunteers trained by the Internal Revenue Service ask you the needed questions to find out if you qualify for the EITC and other refundable tax credits.

If you would like to learn how to become a volunteer, to schedule an appointment or for more information contact Kevin JeanBaptiste at 718-523-3069 or via email at jean@nysenate.gov.

How a Bill Becomes Law

Learn More-

Senator has new policy idea

-

Idea is drafted into a Bill

-

Bill undergoes committee process

-

Senate and Assembly pass bill

-

Bill is signed by Governor