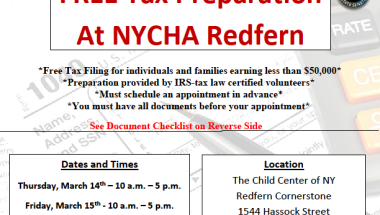

Free Tax Prep at NYCHA Redfern

1544 Hassock Street

Far Rockaway,

NY

11691

Senator James Sanders Jr. (D-Rochdale Village, Far Rockaway) in partnership with York College and the IRS is bringing FREE TAX PREPARATION and filing to NYCHA REDFERN for individuals and families earning less than $50,000 dollars. You must make an appointment and have have all required documents ready before you come in. To sign up, call Senator Sanders' Office at 718-327-7017 or 718-523-3069. DON’T WAIT CALL NOW!

Dates and Times

Thursday, March 14th - 10 a.m. – 5 p.m.

Friday, March 15th - 10 a.m. – 5 p.m.

Location

The Child Center of NY

Redfern Cornerstone

1544 Hassock Street

Far Rockaway, NY 11691

Items To Bring Checklist

Proof of identification- Government issued photo ID (State ID, Driver’s License, or Passport)

Social Security Cards for you your spouse and dependents or a Social Security number verification letter issued by the Social Security Administration

An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

Proof of foreign status, if applying for an ITIN

Birth dates for you, your spouse and dependents on the tax return

Wage and earning statements (Form W-2, W2G, 1099-R, 1099-Misc) from all employers interest and dividend statement from bank ( Form 1099)

A copy of last year’s federal and state tax returns, if available

Proof of bank account routing and account numbers for direct deposit such as blank check

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

Forms 1095-A,B or C Affordable Health Care Statements

Copies of income transcripts from IRS and state, if applicable

How a Bill Becomes Law

Learn More-

Senator has new policy idea

-

Idea is drafted into a Bill

-

Bill undergoes committee process

-

Senate and Assembly pass bill

-

Bill is signed by Governor