|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 05, 2022 |

referred to budget and revenue |

| Nov 10, 2021 |

print number 31b |

| Nov 10, 2021 |

amend and recommit to budget and revenue |

| Oct 20, 2021 |

amend by restoring to original print 31 |

| Apr 22, 2021 |

amend (t) and recommit to budget and revenue |

| Jan 06, 2021 |

referred to budget and revenue |

| Apr 22, 2021 |

print number 31a |

Senate Bill S31A

2021-2022 Legislative Session

Sponsored By

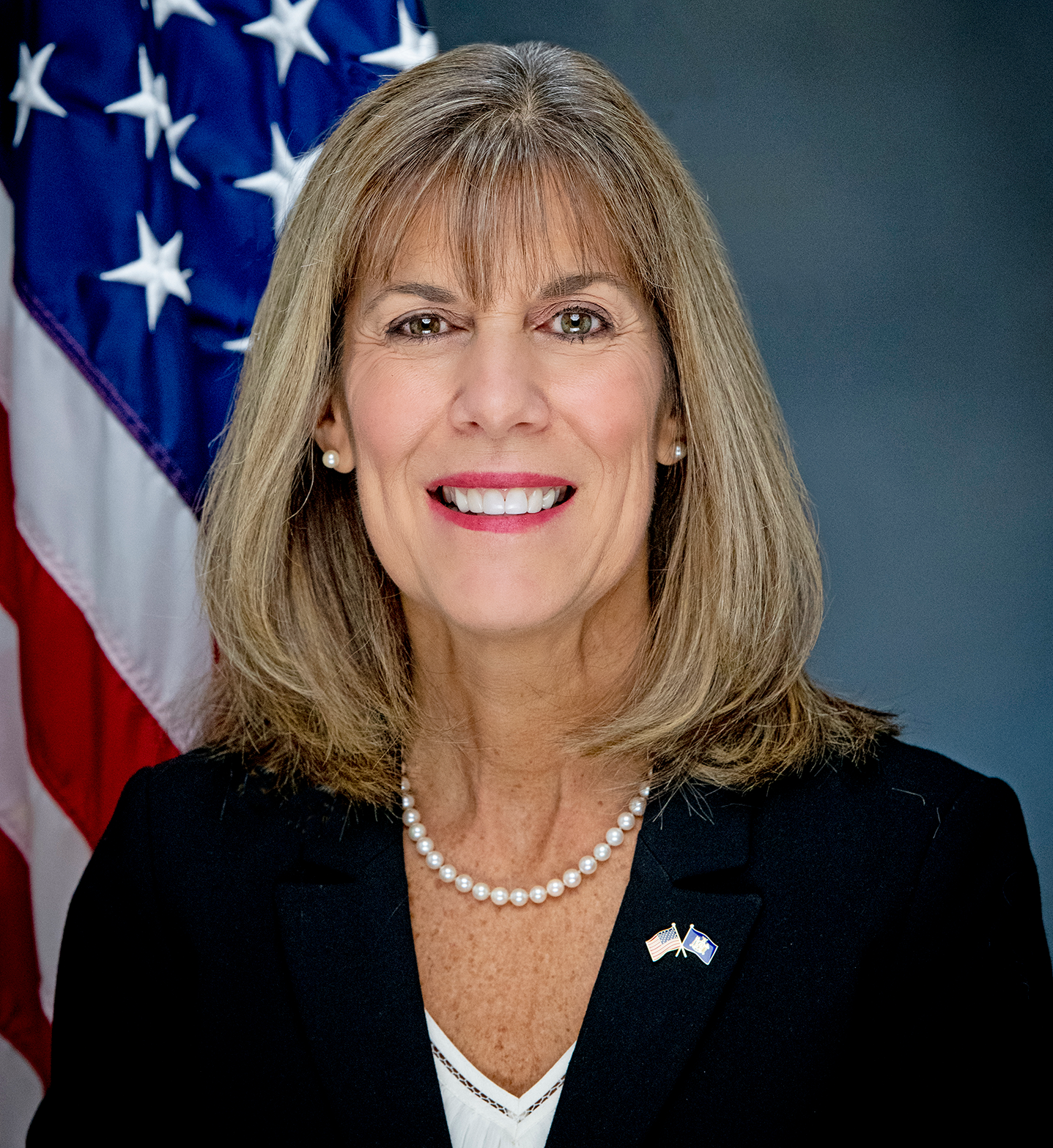

(D, IP, WF) Senate District

Archive: Last Bill Status - In Senate Committee Budget And Revenue Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Bill Amendments

co-Sponsors

(D) Senate District

(D, WF) 40th Senate District

(D, WF) 47th Senate District

(R, C, IP, RFM) Senate District

2021-S31 - Details

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §§1115, 210-B & 606, Tax L

- Versions Introduced in 2019-2020 Legislative Session:

-

S8394

2021-S31 - Sponsor Memo

BILL NUMBER: S31

SPONSOR: KAPLAN

TITLE OF BILL:

An act to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the compen-

sating use tax

PURPOSE:

This legislation creates a sales tax exemption for PPE Equipment.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1 adds a new paragraph 46 to Subdivision (a) of section 1115 of

the tax law. Specifically this section adds to a current enumerated list

of products that are exempted from sales and compensating use taxes, to

include personal protective clothing and equipment worn for protection

against illness from infectious diseases, or that helps prevent or

reduce the spread of infectious diseases Personal protective clothing

2021-S31 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

31

2021-2022 Regular Sessions

I N S E N A T E

(PREFILED)

January 6, 2021

___________

Introduced by Sens. KAPLAN, GAUGHRAN, HARCKHAM, HOYLMAN -- read twice

and ordered printed, and when printed to be committed to the Committee

on Budget and Revenue

AN ACT to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the

compensating use tax

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision (a) of section 1115 of the tax law is amended

by adding a new paragraph 46 to read as follows:

(46) PERSONAL PROTECTIVE CLOTHING AND EQUIPMENT WORN FOR PROTECTION

AGAINST ILLNESS FROM INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT

OR REDUCE THE SPREAD OF INFECTIOUS DISEASE OR ILLNESS. PERSONAL PROTEC-

TIVE CLOTHING AND EQUIPMENT SHALL INCLUDE, BUT NOT BE LIMITED TO,

ISOLATION GOWNS AND COVERALLS, GLOVES, FACEMASKS, FACE SHIELDS, GOGGLES,

AND ANY OTHER CLOTHING OR EQUIPMENT DETERMINED BY THE COMMISSIONER OF

HEALTH TO BE EFFECTIVE IN PROTECTING THE WEARER AGAINST ILLNESS FROM

INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT OR REDUCE THE SPREAD

OF INFECTIOUS DISEASE OR ILLNESS.

§ 2. This act shall take effect on the first day of the sales tax

quarterly period commencing after this act shall have become a law, and

shall apply to sales made and uses occurring on and after such date in

accordance with applicable transitional provisions of sections 1106 and

1217 of the tax law.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD03340-01-1

co-Sponsors

(D) Senate District

(D, WF) 40th Senate District

(D, WF) 47th Senate District

(R, C, IP, RFM) Senate District

2021-S31A - Details

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §§1115, 210-B & 606, Tax L

- Versions Introduced in 2019-2020 Legislative Session:

-

S8394

2021-S31A - Sponsor Memo

BILL NUMBER: S31A

SPONSOR: KAPLAN

TITLE OF BILL:

An act to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the compen-

sating use tax, exempting from sales and compensating use taxes any

equipment or product purchased by restaurant or food service establish-

ment for use in outdoor dining during the novel coronavirus (COVID-19)

and exempting from sales and compensating use taxes any equipment or

product purchased by a small business that is used to comply with a

COVID-19 health and safety plan

PURPOSE:

This legislation creates a sales tax exemption for PPE equipment or

product purchased by a restaurant or food service establishment, or

small businesses for use in outdoor dining to comply with health and

safety plan during the COVID-19 pandemic.

2021-S31A - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

31--A

2021-2022 Regular Sessions

I N S E N A T E

(PREFILED)

January 6, 2021

___________

Introduced by Sens. KAPLAN, GAUGHRAN, HARCKHAM, HOYLMAN, JORDAN -- read

twice and ordered printed, and when printed to be committed to the

Committee on Budget and Revenue -- committee discharged, bill amended,

ordered reprinted as amended and recommitted to said committee

AN ACT to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the

compensating use tax, exempting from sales and compensating use taxes

any equipment or product purchased by restaurant or food service

establishment for use in outdoor dining during the novel coronavirus

(COVID-19) and exempting from sales and compensating use taxes any

equipment or product purchased by a small business that is used to

comply with a COVID-19 health and safety plan

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision (a) of section 1115 of the tax law is amended

by adding three new paragraphs 46, 47 and 48 to read as follows:

(46) PERSONAL PROTECTIVE CLOTHING AND EQUIPMENT WORN FOR PROTECTION

AGAINST ILLNESS FROM INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT

OR REDUCE THE SPREAD OF INFECTIOUS DISEASE OR ILLNESS. PERSONAL PROTEC-

TIVE CLOTHING AND EQUIPMENT SHALL INCLUDE, BUT NOT BE LIMITED TO,

ISOLATION GOWNS AND COVERALLS, GLOVES, FACEMASKS, FACE SHIELDS, GOGGLES,

AND ANY OTHER CLOTHING OR EQUIPMENT DETERMINED BY THE COMMISSIONER OF

HEALTH TO BE EFFECTIVE IN PROTECTING THE WEARER AGAINST ILLNESS FROM

INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT OR REDUCE THE SPREAD

OF INFECTIOUS DISEASE OR ILLNESS.

(47) ANY EQUIPMENT OR PRODUCT PURCHASED BY ANY RESTAURANT OR FOOD

SERVICE ESTABLISHMENT FOR THE USE IN OUTDOOR DINING DURING THE NOVEL

CORONAVIRUS (COVID-19) PANDEMIC.

(48) ANY EQUIPMENT OR PRODUCT, INCLUDING MATERIALS USED IN THE

CONSTRUCTION OF PHYSICAL BARRIERS, INCLUDING BUT NOT LIMITED TO PLASTIC

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

co-Sponsors

(D) Senate District

(D, WF) 40th Senate District

(D, WF) 47th Senate District

(R, C, IP, RFM) Senate District

2021-S31B (ACTIVE) - Details

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §§1115, 210-B & 606, Tax L

- Versions Introduced in 2019-2020 Legislative Session:

-

S8394

2021-S31B (ACTIVE) - Sponsor Memo

BILL NUMBER: S31B

SPONSOR: KAPLAN

TITLE OF BILL:

An act to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the compen-

sating use tax

PURPOSE:

This legislation creates a sales tax exemption for PPE Equipment.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1 adds a new paragraph 47 to Subdivision (a) of section 1115 of

the tax law. Specifically this section adds to a current enumerated list

of products that are exempted from sales and compensating use taxes, to

include personal protective clothing and equipment worn for protection

against illness from infectious diseases, or that helps prevent or

reduce the spread of infectious diseases Personal protective clothing

and equipment shall include but is not limited to isolation gowns and

2021-S31B (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

31--B

2021-2022 Regular Sessions

I N S E N A T E

(PREFILED)

January 6, 2021

___________

Introduced by Sens. KAPLAN, GAUGHRAN, HARCKHAM, HOYLMAN, JORDAN -- read

twice and ordered printed, and when printed to be committed to the

Committee on Budget and Revenue -- committee discharged, bill amended,

ordered reprinted as amended and recommitted to said committee

AN ACT to amend the tax law, in relation to exempting certain personal

protective clothing and equipment from the tax on sales and the

compensating use tax

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision (a) of section 1115 of the tax law is amended

by adding a new paragraph 47 to read as follows:

(47) PERSONAL PROTECTIVE CLOTHING AND EQUIPMENT WORN FOR PROTECTION

AGAINST ILLNESS FROM INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT

OR REDUCE THE SPREAD OF INFECTIOUS DISEASE OR ILLNESS. PERSONAL PROTEC-

TIVE CLOTHING AND EQUIPMENT SHALL INCLUDE, BUT NOT BE LIMITED TO,

ISOLATION GOWNS AND COVERALLS, GLOVES, FACEMASKS, FACE SHIELDS, GOGGLES,

AND ANY OTHER CLOTHING OR EQUIPMENT DETERMINED BY THE COMMISSIONER OF

HEALTH TO BE EFFECTIVE IN PROTECTING THE WEARER AGAINST ILLNESS FROM

INFECTIOUS DISEASE OR MATERIALS OR TO HELP PREVENT OR REDUCE THE SPREAD

OF INFECTIOUS DISEASE OR ILLNESS.

§ 2. This act shall take effect on the first day of the sales tax

quarterly period commencing after this act shall have become a law, and

shall apply to sales made and uses occurring on and after such date in

accordance with applicable transitional provisions of sections 1106 and

1217 of the tax law.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD03340-06-1

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.