| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 05, 2022 |

referred to budget and revenue |

| Feb 05, 2021 |

referred to budget and revenue |

Senate Bill S4482

2021-2022 Legislative Session

Sponsored By

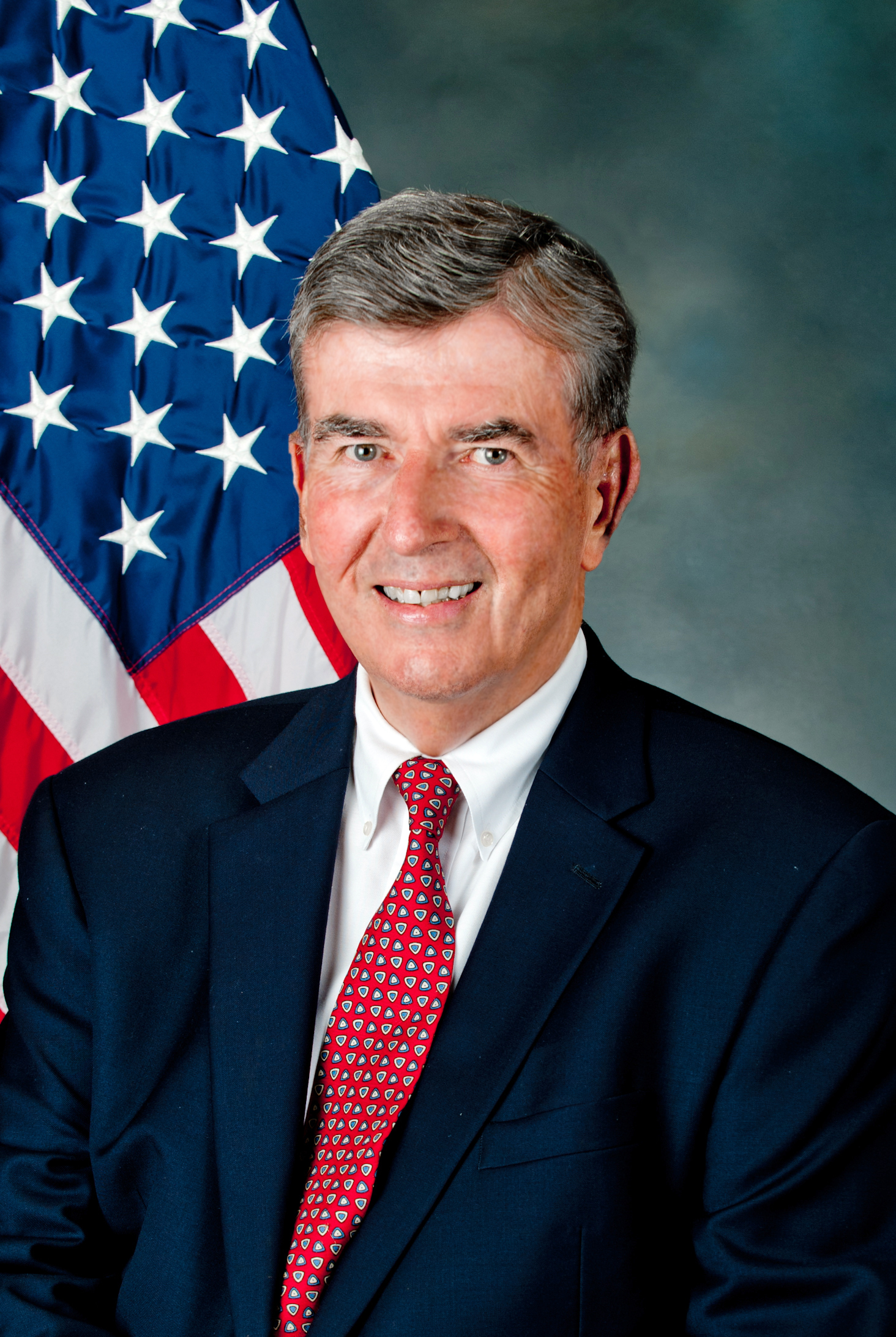

(D, WF) 13th Senate District

Archive: Last Bill Status - In Senate Committee Budget And Revenue Committee

Actions

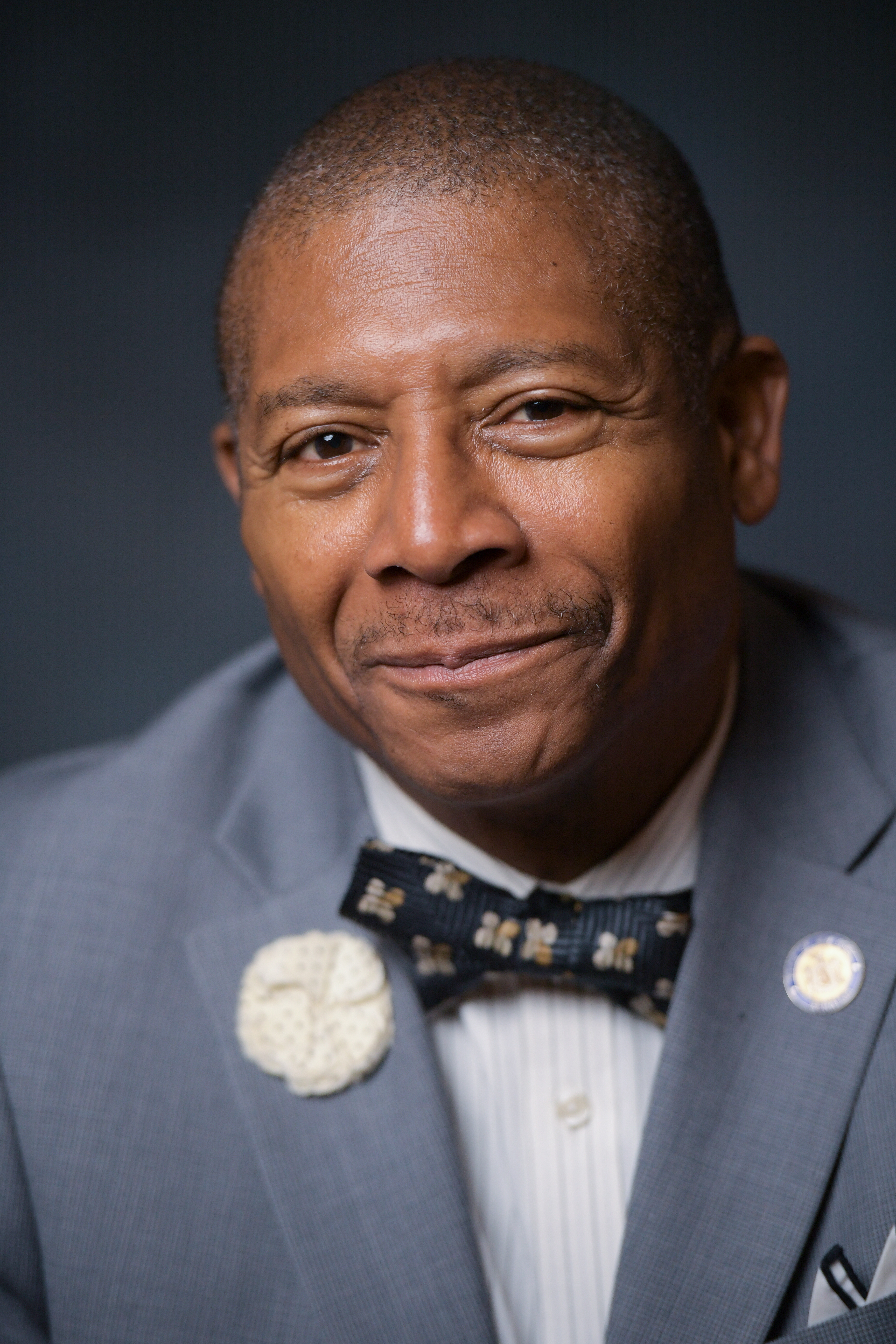

co-Sponsors

(D) Senate District

(D, WF) Senate District

(D, WF) Senate District

(D, WF) 25th Senate District

2021-S4482 (ACTIVE) - Details

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Add §612-a, Tax L

- Versions Introduced in Other Legislative Sessions:

-

2023-2024:

S1570

2025-2026: S165

2021-S4482 (ACTIVE) - Sponsor Memo

BILL NUMBER: S4482

SPONSOR: RAMOS

TITLE OF BILL:

An act to establish the "billionaire mark to market tax act"; and to

amend the tax law, in relation to establishing a mark to market tax

SUMMARY OF PROVISIONS:

Section 1. Establishes the act to be cited as the "billionaire mark to

market tax act".

Section 2. Amends the tax law by adding a new section 612-a, which

treats residential billionaires capital gains on their net assets as

annual income, furthermore, taxing billionaires yearly unrealized capi-

tal gains. Year one taxes all built in gains on assets owned by billio-

naires before 2020 with an option to pay in ten installments. Year two

onward, taxes the yearly gains of assets unrealized.

Section 3. This act shall take effect immediately.

2021-S4482 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4482

2021-2022 Regular Sessions

I N S E N A T E

February 5, 2021

___________

Introduced by Sen. RAMOS -- read twice and ordered printed, and when

printed to be committed to the Committee on Budget and Revenue

AN ACT to establish the "billionaire mark to market tax act"; and to

amend the tax law, in relation to establishing a mark to market tax

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. This act shall be known and may be cited as the "billio-

naire mark to market tax act".

§ 2. The tax law is amended by adding a new section 612-a to read as

follows:

§ 612-A. BILLIONAIRE MARK TO MARKET TAXATION. (A)(1) NOTWITHSTANDING

ANY OTHER PROVISION OF LAW TO THE CONTRARY, RESIDENT INDIVIDUAL TAXPAY-

ERS WITH NET ASSETS WORTH ONE BILLION DOLLARS OR MORE ON THE DATE OF

DECEMBER THIRTY-FIRST, TWO THOUSAND TWENTY, SHALL RECOGNIZE GAIN OR LOSS

AS IF EACH ASSET OWNED BY THE INDIVIDUAL TAXPAYER WERE SOLD FOR ITS FAIR

MARKET VALUE ON THAT DATE. ANY RESULTING NET GAINS FROM THESE DEEMED

SALES, UP TO THE PHASE-IN CAP AMOUNT, SHALL BE INCLUDED IN THE TAXPAY-

ER'S INCOME FOR THE TWO THOUSAND TWENTY-ONE TAX YEAR. PROPER ADJUSTMENT

SHALL BE MADE IN THE AMOUNT OF ANY GAIN OR LOSS SUBSEQUENTLY REALIZED

FOR GAIN OR LOSS TAKEN INTO ACCOUNT UNDER THE PRECEDING SENTENCE. AT THE

TAXPAYER'S OPTION, ANY ADDITIONAL TAX PAYABLE AS A RESULT OF THIS

SUBSECTION SHALL EITHER BE PAYABLE ALONG WITH ANY OTHER TAX OWED FOR THE

TWO THOUSAND TWENTY-ONE TAX YEAR OR ELSE SHALL BE PAYABLE ANNUALLY IN

TEN EQUAL INSTALLMENTS BEGINNING IN THE YEAR OF THE EFFECTIVE DATE OF

THIS SECTION AND WITH ALL SUCH INSTALLMENT PAYMENTS COMMENCING AFTER THE

INITIAL INSTALLMENT PAYMENT ALSO BEING SUBJECT TO AN ANNUAL NONDEDUCT-

IBLE DEFERRAL CHARGE. THE ANNUAL NONDEDUCTIBLE DEFERRAL CHARGE SHALL BE

SET BY THE STATE COMPTROLLER AT A RATE THAT THE COMPTROLLER ESTIMATES IS

EQUAL TO THE UNSECURED BORROWING RATE OF THE TAXPAYER FOR A LOAN REPAID

OVER A TEN-YEAR TERM IN EQUAL ANNUAL INSTALLMENTS. THE COMPTROLLER MAY

ESTIMATE A SINGLE RATE FOR ALL TAXPAYERS SUBJECT TO THE DEFERRAL CHARGE.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.