|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 05, 2022 |

referred to local government |

| May 24, 2021 |

print number 6326a |

| May 24, 2021 |

amend and recommit to local government |

| Apr 21, 2021 |

referred to local government |

Senate Bill S6326A

2021-2022 Legislative Session

Sponsored By

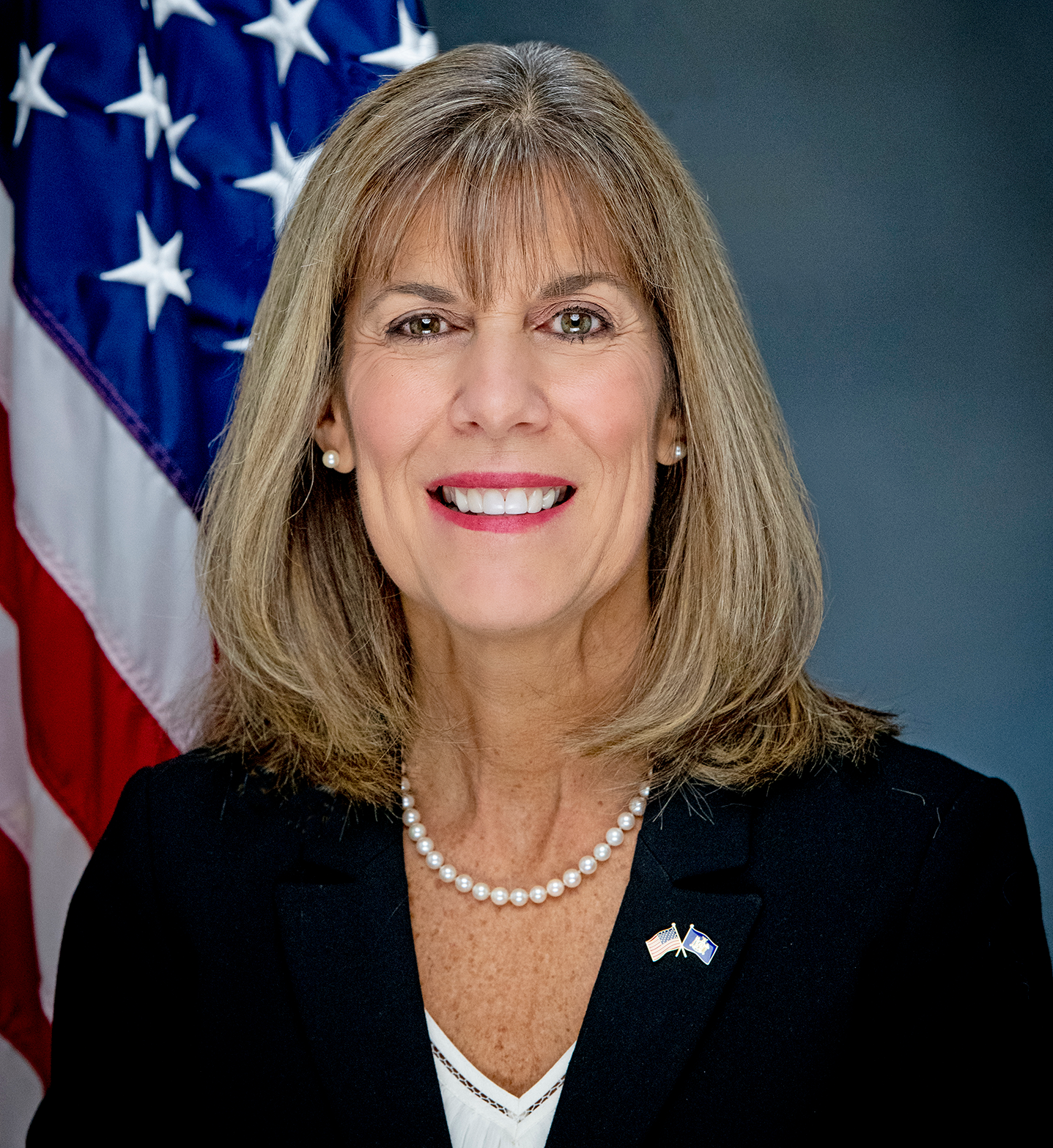

(D, WF) 55th Senate District

Archive: Last Bill Status - In Senate Committee Local Government Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Bill Amendments

co-Sponsors

(D) 27th Senate District

2021-S6326 - Details

- See Assembly Version of this Bill:

- A7930

- Current Committee:

- Senate Local Government

- Law Section:

- Real Property Tax Law

- Laws Affected:

- Amd §§420-a & 422, RPT L

- Versions Introduced in Other Legislative Sessions:

-

2017-2018:

S8526

2019-2020: S3469

2023-2024: A1894

2021-S6326 - Sponsor Memo

BILL NUMBER: S6326

SPONSOR: BROUK

TITLE OF BILL:

An act to amend the real property tax law, in relation to tax exemptions

for community land trusts and income-restricted homeownership properties

PURPOSE:

This bill adds a new subsection 420-A (17) to the Real Property Tax Law

to permit land that is owned by a Community Land Trust to qualify for

real property tax exemption as well as a new subsection 422(3) to the

Real Property Tax Law to require a partial real property tax exemption

for certain income-restricted homeownership property, including improve-

ments that are erected on a Community Land Trust, for purposes of deter-

mining property taxes. The purpose of both new sections of law are to

ensure that income-restricted homeownership property, including improve-

ments that are erected on land which is owned by a Community Land Trust,

are not property tax burdened in a way that could impact the affordabil-

ity of such permanently affordable homeownership housing. This bill

shall provide property tax relief to a Community Land Trust and owners

of improvements.

2021-S6326 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6326

2021-2022 Regular Sessions

I N S E N A T E

April 21, 2021

___________

Introduced by Sen. BROUK -- read twice and ordered printed, and when

printed to be committed to the Committee on Local Government

AN ACT to amend the real property tax law, in relation to tax exemptions

for community land trusts and income-restricted homeownership proper-

ties

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Section 420-a of the real property tax law is amended by

adding a new subdivision 17 to read as follows:

17. (A) FOR THE PURPOSES OF THIS SUBDIVISION, "COMMUNITY LAND TRUST"

SHALL MEAN A NONPROFIT CORPORATION ORGANIZED PURSUANT TO SECTION

501(C)(3) OF THE U.S. INTERNAL REVENUE CODE THAT SATISFIES THE FOLLOWING

CRITERIA:

(I) SUCH NONPROFIT CORPORATION'S PRIMARY PURPOSE IS THE CREATION AND

MAINTENANCE OF PERMANENTLY AFFORDABLE SINGLE-FAMILY OR MULTI-FAMILY

RESIDENCES;

(II) ALL DWELLINGS AND UNITS LOCATED ON LAND OWNED BY SUCH NONPROFIT

CORPORATION IS SOLD TO A QUALIFIED OWNER TO BE OCCUPIED AS THE QUALIFIED

OWNER'S PRIMARY RESIDENCE OR RENTED TO PERSONS OR FAMILIES OF LOW INCOME

AS DEFINED IN SUBDIVISION TEN OF SECTION TWELVE OF THE PRIVATE HOUSING

FINANCE LAW; AND

(III) THE LAND OWNED BY THE NONPROFIT CORPORATION, ON WHICH A DWELLING

OR UNIT SOLD TO A QUALIFIED OWNER IS SITUATED, IS LEASED BY SUCH CORPO-

RATION TO THE QUALIFIED OWNER FOR THE CONVENIENT OCCUPATION AND USE OF

SUCH DWELLING OR UNIT FOR A RENEWABLE TERM OF NINETY-NINE YEARS.

(B) ANY LAND OWNED BY A COMMUNITY LAND TRUST AS DEFINED IN PARAGRAPH

(A) OF THIS SUBDIVISION AND SEPARATELY ASSESSED IMPROVEMENTS OWNED BY

THE RESIDENTS THEREOF, SHALL BE EXEMPT FROM TAXATION AND EXEMPT FROM

SPECIAL AD VALOREM LEVIES AND SPECIAL ASSESSMENTS TO THE EXTENT PROVIDED

IN SECTION FOUR HUNDRED NINETY OF THIS ARTICLE. THE SUPERVISING AGENCY

MAY REQUIRE THE COMMUNITY LAND TRUST TO ENTER INTO A REGULATORY AGREE-

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

co-Sponsors

(R, C, IP, RFM) Senate District

(D) 27th Senate District

2021-S6326A (ACTIVE) - Details

- See Assembly Version of this Bill:

- A7930

- Current Committee:

- Senate Local Government

- Law Section:

- Real Property Tax Law

- Laws Affected:

- Amd §§420-a & 422, RPT L

- Versions Introduced in Other Legislative Sessions:

-

2017-2018:

S8526

2019-2020: S3469

2023-2024: A1894

2021-S6326A (ACTIVE) - Sponsor Memo

BILL NUMBER: S6326A

SPONSOR: BROUK

TITLE OF BILL:

An act to amend the real property tax law, in relation to tax exemptions

for community land trusts and income-restricted homeownership properties

PURPOSE:

This bill adds a new subsection 420-A (17) to the Real Property Tax Law

to permit land that is owned by a Community Land Trust to qualify for

real property tax exemption as well as a new subsection 422(3) to the

Real Property Tax Law to require a partial real property tax exemption

for certain income-restricted homeownership property, including improve-

ments that are erected on a Community Land Trust, for purposes of deter-

mining property taxes. The purpose of both new sections of law are to

ensure that income-restricted homeownership property, including improve-

ments that are erected on land which is owned by a Community Land Trust,

are not property tax burdened in a way that could impact the affordabil-

ity of such permanently affordable homeownership housing. This bill

shall provide property tax relief to a Community Land Trust and owners

2021-S6326A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6326--A

2021-2022 Regular Sessions

I N S E N A T E

April 21, 2021

___________

Introduced by Sens. BROUK, KAVANAGH -- read twice and ordered printed,

and when printed to be committed to the Committee on Local Government

-- committee discharged, bill amended, ordered reprinted as amended

and recommitted to said committee

AN ACT to amend the real property tax law, in relation to tax exemptions

for community land trusts and income-restricted homeownership proper-

ties

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Section 420-a of the real property tax law is amended by

adding a new subdivision 17 to read as follows:

17. OTHER THAN IN A CITY HAVING A POPULATION OF ONE MILLION OR MORE,

ANY LAND OWNED BY A COMMUNITY LAND TRUST AND SEPARATELY ASSESSED

IMPROVEMENTS OWNED BY THE RESIDENTS THEREOF, SHALL BE EXEMPT FROM LOCAL

REAL PROPERTY TAXATION AND EXEMPT FROM SPECIAL AD VALOREM LEVIES AND

SPECIAL ASSESSMENTS TO THE EXTENT PROVIDED IN SECTION FOUR HUNDRED NINE-

TY OF THIS ARTICLE.

(A) FOR THE PURPOSES OF THIS SUBDIVISION, "COMMUNITY LAND TRUST" SHALL

MEAN A CORPORATION ORGANIZED PURSUANT TO THE NOT-FOR-PROFIT CORPORATION

LAW AND EXEMPT FROM TAXATION PURSUANT TO SECTION 501(C)(3) OF THE INTER-

NAL REVENUE CODE THAT SATISFIES THE FOLLOWING CRITERIA:

(I) SUCH NONPROFIT CORPORATION'S PURPOSE IS THE CREATION AND MAINTE-

NANCE OF PERMANENTLY AFFORDABLE SINGLE-FAMILY OR MULTI-FAMILY RESI-

DENCES;

(II) ALL DWELLINGS AND UNITS LOCATED ON LAND OWNED BY SUCH NONPROFIT

CORPORATION IS SOLD TO A QUALIFIED OWNER TO BE OCCUPIED AS THE QUALIFIED

OWNER'S PRIMARY RESIDENCE OR RENTED TO PERSONS OR FAMILIES OF LOW

INCOME; AND

(III) ANY LEASE WITH THE OWNER OF A SINGLE-FAMILY HOME OR MULTI-FAMILY

RESIDENCE SHALL BE FOR AN INITIAL TERM OF NINETY-NINE YEARS WITH RENEWAL

RIGHTS UNDER THE SAME INITIAL TERMS AND CONDITIONS.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.