What's In Your Mailbox?

James L. Seward

October 2, 2009

CLICK HERE to join the fight.

Over the past few years, at about this time, I have reminded homeowners to check their mailbox for their STAR rebate check. Unfortunately, this year, no such reminder is needed. Thanks to the governor and his Democrat colleagues, that check is not in the mail.

In 2006, when I helped start the STAR rebate check program, the idea was to return homeowners some of their hard earned money each fall to help meet their pressing needs. The rebate checks arrived at just about the same time as school tax notices or that first bill of the heating season. Granted the STAR rebate probably didn’t cover these costs completely, but at least it softened the blow. This year though, thanks to the state’s new leadership, no such relief exists.

The mailbox definitely isn’t empty though. The STAR rebate check has been methodically replaced with a host of new bills arriving on a regular basis. Some of these bills have come in disguise, and at first glance, you may not even realize you are being taken; for example, a two percent tax on utility bills or the doubling of the state fee on auto insurance. These increases are tacked on to bills you already receive and while they are small amounts they add up over time, costing those who are already stretched to the breaking point.

Other increases hit you right over the head, like the higher cost to register your motor vehicle or renew your driver’s license. This increase is especially egregious because it hits at the heart of upstate New York. Moms and Dads need to drive to get to work, take their children to the doctor or shop for groceries. Public transportation is limited in many of our rural areas so a personal vehicle is not a luxury, it is a lifeline. Now that lifeline is much more difficult to afford.

While these fees hit everyone personally, just think of the businessmen and women who depend on transportation. Companies are now paying much more to insure and register their vehicles, a large expense for many upstate employers. These added expenses may force small businesses to cut benefits, or in extreme cases, let employees go.

New York state sportsmen are the latest group to be subjected to higher fees. The cost of resident and non-resident licenses and all lifetime hunting and fishing licenses increased between 25 percent and 63 percent on October 1. Once again, upstate will feel the most pain.

For many upstate individuals and families, these outdoor sporting activities are a time honored tradition, handed down from generation to generation. They are a recreational pursuit as well as a way to provide food and sustenance.

Hunting and fishing have a major impact on the upstate economy as well, especially in rural areas that depend on tourist dollars. The license fee increases are projected to take an additional $22 million out of the pockets of hunters and fishermen that could have been spent at small bait shops or on local guides. Maybe the higher fees mean visiting sportsmen cut their trip short, depriving hotels and restaurants of much needed revenue.

All of these higher fees are in addition to new and higher taxes consumers are paying on a daily basis for on-line purchases, beer and wine, car rentals and more. By now the cost is starting to add up. Families across New York are paying an additional $2,400 in new and higher taxes and fees to support record state spending totaling almost $132 billion.

In the past a trip to the mailbox for a STAR rebate check could have provided some relief. This year though, the mailbox is only filled with more painful reminders of the sorry state of affairs in Albany and the latest gimmicks cooked up by New York City Democrats to cover the rising cost of living in the Empire State.

Share this Article or Press Release

Newsroom

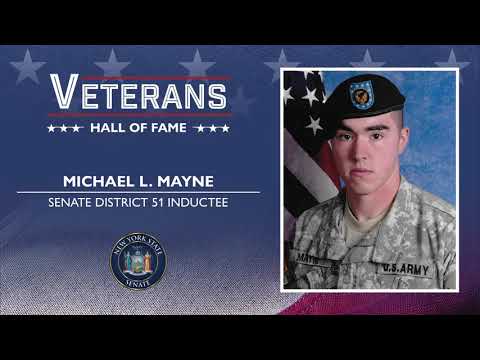

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020