State Budget Disappoints

James L. Seward

August 5, 2010

-

ISSUE:

- Budget

Finally, after long last, a state budget has received approval in Albany. The spending plan was adopted 125 days late but all of that extra time did nothing to help generate a budget that New Yorkers can be proud of.

For the second year in a row, Albany leaders thumbed their noses at the concept of transparency. In direct violation of the 2007 Budget Reform Law, the governor, and leaders in the assembly and senate huddled behind closed doors to fabricate the $136 billion plan. Instead of convening open, bi-partisan conference committees to negotiate spending in full view of the public, three men from New York City decided they knew best.

Even worse, the governor took it upon himself to force his proposals for the entire fiscal year into emergency spending bills intended to cover only a short period of time. The unprecedented maneuver removed the whole legislature from the budget making process taking the dysfunction to a new level.

Along the way I voted against each of the piecemeal budget bills. But more than just say “NO”, I also joined in supporting a number of budget amendments and alternative proposals designed to cut state spending, reduce property taxes and create jobs. Those proposals included:

• A state spending cap;

• A ban on unfunded mandates for local school districts and local governments;

• Medicaid reforms to reduce spending on optional services and prevent fraud and abuse;

• Consolidation of state agencies and a reduction of some unnecessary high priced deputy and assistant commissioner jobs;

• Targeted tax credits to help upstate businesses create jobs.

Many of these proposals were never brought to the senate floor for consideration. The items that did emerge as amendments were defeated, almost entirely along party lines.

One item I did vote in favor of was senate bill 67005 which would clear the way for a property tax cap. New York homeowners pay property taxes that are 79 percent above the national average. Senior citizens, young families just starting out, and everyone in between has been hard hit by escalating property tax bills.

While I am a strong supporter of a property tax cap, it is only a first step. We have to get serious about snuffing out the root of the problem in New York state – unfunded mandates. School administrators and local government officials can only do so much to cut property taxes because state and federal mandates drive costs up. Offering schools and local governments the tools to keep costs down and make more effective use of state aid dollars will improve service and reduce property tax bills.

I also voted to extend the “Power for Jobs” program, a real lifeline for many struggling upstate businesses. The program is a proven success that has provided low cost electricity to businesses, institutions and non-profit organizations across the state in return for capital investment and job commitments.

Ideally, a permanent replacement for “Power for Jobs” that would provide businesses with long term stability is needed. With my support, the state senate overwhelmingly approved legislation creating a new program known as “Energize New York.” It would create a sustainable economic development program and would provide businesses with certainty through seven year contracts. Unfortunately, the assembly never took up the bill.

Overall, I am extremely disappointed with the final budget. Over the last two years, 124 new/increased taxes and fees have been enacted to help fuel more than $14 billion in new spending. This year’s plan raises taxes by $2.2 billion, through new income taxes, business taxes and reinstatement of the sales tax on clothing. The STAR rebate checks have been eliminated, costing hardworking families in the 51st senate district a total of $59.6 million over two years. The budget sends the wrong message to families struggling to get by and businesses cutting costs to stay afloat and will make it that much more difficult for many to live and prosper in New York state.

#####

Share this Article or Press Release

Newsroom

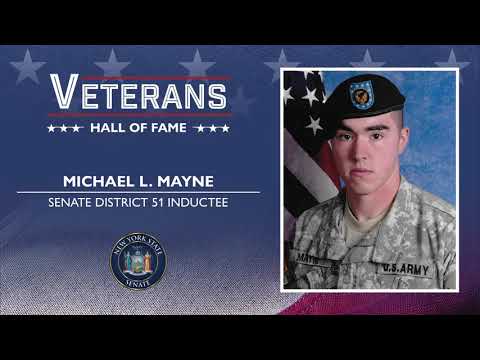

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020