Terminate New Taxes

James L. Seward

January 22, 2010

-

ISSUE:

- Economic Development

- Budget

- Taxes

Governor Paterson recently unveiled his 2010 – 2011 budget proposal and while some ideas merit further examination others must be dismissed entirely if we are to promote economic development and job growth in upstate New York.

As expected, the governor’s budget proposal includes spending reductions in some areas. No doubt, state spending must be curtailed; we cannot continue to spend money the state does not have. Unfortunately, even with deep spending cuts in some areas of the budget, the governor is calling for an overall spending increase of at least $2 billion.

So how does the governor plan to pay for these spending increases? Tax hikes. At this point the tax increases stand at $1 billion, although there is no guarantee that additional taxes won’t be injected later. Remember, last year the governor talked tough, but in the end he put his stamp of approval on a state budget loaded with billions of dollars in new taxes and fees that cost upstate families an estimated extra $2,400 per year.

At this point, the tax increases focus on two areas: cigarettes and sweetened beverages. The governor claims these taxes are meant to help improve our health. I am concerned that they simply continue what has become a disturbing and damaging pattern of overtaxing.

Quite frankly, New York has an image problem. Those who live and work here know far too well the recent history in regard to state taxes. The fees, assessments and whatever other name you attach to them have grown considerably, intruding on every aspect of our lives. In fact, according to the Tax Foundation, between 1977 and 2008, New York has ranked first or second in the country for its state-local tax burden compared to the U.S. average.

As this taxing obsession has grown, people are no longer simply voicing their frustration, they are taking action. Families are pulling up stakes and moving to more wallet friendly states. Long standing businesses are also shutting their doors and taking their jobs elsewhere. Moreover, it has become increasingly difficult to attract new companies to open their doors within our tax infested borders.

A few items proposed by the governor may be helpful:

-Innovation economy matching grants program. An investment of up to $100 million in state funds over a five-year period for research awards financed through the American Recovery and Reinvestment Act (ARRA);

-Small business revolving loan fund. A total of $25 million for loans to support the growth of small businesses specifically targeting businesses owned by minorities, women and others who have difficulty accessing regular credit markets;

-New technology seed fund. A total of $25 million would be made available to assist university-based entrepreneurs transition from research to a marketable product.

I view these proposals as conversation starters. They are a step in the right direction but are not enough to substantially jump start our economy.

The governor has also touted a replacement for the Empire Zone program that he is calling the Excelsior Jobs program. This offering, again, is a start but is not a thorough substitute for the current program which is set to expire later this year. The governor’s proposal focuses on a selected group of industries and calls for the creation of at least fifty new jobs for five years. Many smaller businesses, the backbone of the upstate economy, would fall through the cracks. Certainly I am eager to attract large manufacturers, bio-tech startups and the like, but we also need to be mindful of the small businessman with an idea who needs a helping hand.

I stand ready to work with the governor and my colleagues in fine tuning the 2010-2011 budget, but I can not endorse any proposal that adds new taxes to our already over-burdened property owners and businesses. Instead, I will continue to support reforms that will improve our state’s economy, put people back to work and help us lead the nation toward recovery.

Share this Article or Press Release

Newsroom

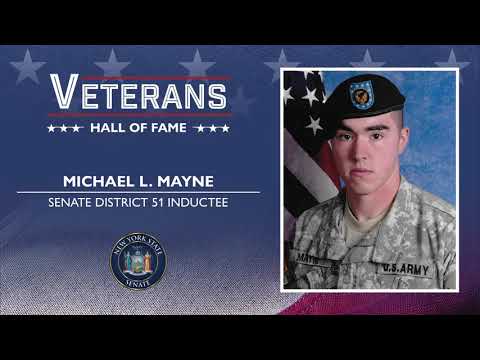

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020