Senator Robach joins colleagues to pass Senate Budget Resolution

March 20, 2017

-

ISSUE:

- Senator Robach

- Budget Resolution

Last week, Senator Joe Robach joined with his Senate Majority colleagues to pass a Senate budget resolution that creates economic opportunity for New York State, invests in infrastructure, education and families without new taxes on hardworking New Yorkers. Our Senate budget resolution rejected fee increases proposed by the Governor, protected the STAR program and makes the property tax cap permanent ensuring that New York can be a state where people want to live, work and raise a family. As the Senate continue down the path of a timely and transparent budget on April 1st and as the process heads to individual committees, Sen. Robach will continue to update his consituents on the progress of the budget

The recently passed Senate budget resolution included various measures that help New Yorkers and their families. Finding affordable childcare is an issue that many working families struggle with. The Senate budget resolution increased the ability of low and moderate-income families to find affordable, safe childcare. Additionally, to help keep New York’s seniors save money and stay in their homes during retirement, the Senate budget resolution increased the private pension and retirement income exclusion to $40,000 for single taxpayers and $80,000 for married taxpayers over three years. This would be the first increase since 1981 and would save New York retirees approximately $315 million.

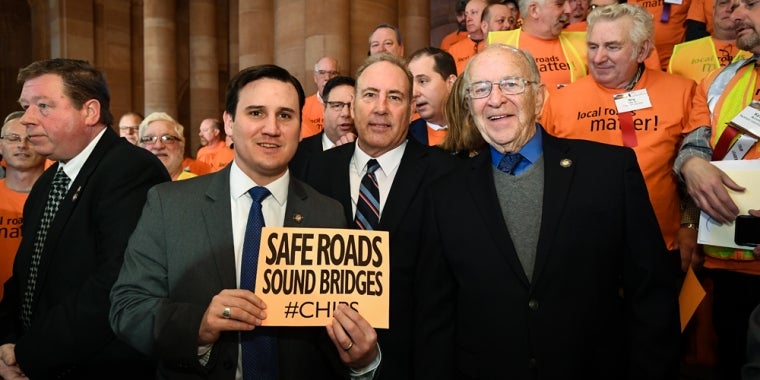

As Senate Transportation Chairman, Sen. Robach was proud that our recently passed Senate Budget resolution continued the commitment to parity for Upstate roads and Bridges with New York City. In the Senate budget resolution, the measure brought the total of non-MTA capital to $175.5 million, $513 million in funding for the Consolidated Local Street and Highway Program, and $150 million for the Local BRIDGE NY program as well as increasing funding for public transportation across Upstate and increasing the ability for cities to maintain State highways.

Ensuring that college is affordable and that access to higher education was improved was a focal point of the Senate budget resolution. Sen. Robach was proud to support measures that make more middle-class families eligible for more financial aid. The Senate majority increased access and the amount of available funds for TAP and introduced a new E-TAP initiative. The Senate budget resolution also creates the New York State Tax Advantage Student Loan Repayment program that acts like a 401k for student, enabling employees to put up to $2,500 pre-tax each year into an account specifically set by an employer to help pay student loan debt. Additionally, the resolution establishes a new Task Force on College Affordability.

Share this Article or Press Release

Newsroom

Go to NewsroomFrank X. Allkofer

November 11, 2020

Senator Robach Rallies for Transportation Funding

March 4, 2020