Inflation Reduction Act Individual Benefits Available

Lea Webb

September 7, 2023

Many working-and-middle-class households, as well as small businesses, qualify for up to thousands in tax breaks, rebates, and benefits for making eco-improvements to their properties and vehicles as part of President Biden’s Inflation Reduction Act (IRA), passed last summer. Check the guide below to see if you are eligible for these benefits under the IRA!

Many of these benefits can be attained during the tax filing process. For rebates and reimbursements, please see the Rewiring America calculator and the New York League of Conservation Voters’s guide for eligibility:

https://www.rewiringamerica.org/app/ira-calculator

https://nylcv.org/wp-content/uploads/NYLCV_NY-IRAConsumerGuide_8.5x11_01b.pdf

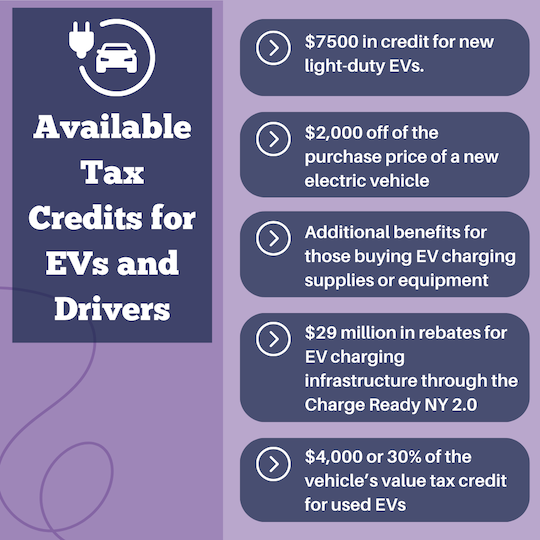

Tax Credits for Electric Vehicles and Drivers: New Yorkers who purchased an electric vehicle, or anyone who invested in renewable charging infrastructure may be eligible for thousands in benefits:

- For those buying a new EV, the IRA provides up to $7500 in credit for light-duty EVs.

- The NYS Drive Clean Rebate adds up to $2,000 off of the purchase price of a new electric vehicle in addition to the federal tax. https://www.nyserda.ny.gov/All-Programs/Drive-Clean-Rebate-For-Electric-Cars-Program

- For used EVs, a tax credit of $4,000 or 30% of the vehicle’s value (whichever is lower).

- Additional benefits for those buying charging supplies or equipment, including the NYSERDA Direct Current Fast Charging (DCFC) Program, the NYS Alternative Fueling Infrastructure Tax Credit, the Utility DCFC Owner Programs, and the Utility Make Ready Program. https://nylcv.org/wp-content/uploads/IRAGuide_EV-infastructure-credits.pdf

- $29 million in rebates for EV charging infrastructure through the Charge Ready NY 2.0 program, with up to $4,000 per charging port installed at a public facility, and $2,000 per charging port installed at a workplace or multi-unit dwelling location. https://www.nyserda.ny.gov/All-Programs/ChargeNY/Charge-Electric/Charging-Station-Programs/Charge-Ready-NY

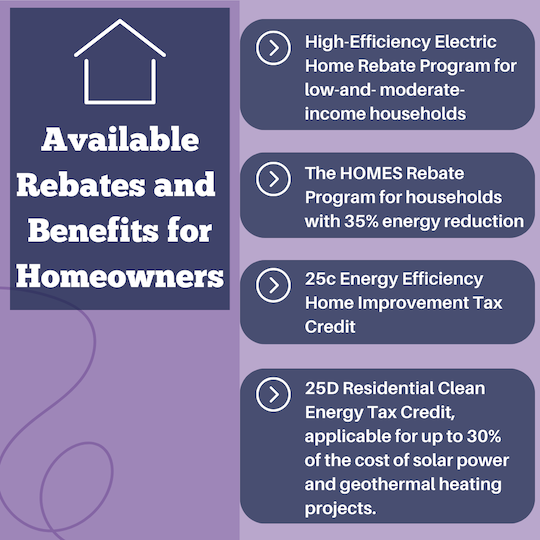

Rebates and Benefits for Homeowners: Homeowners throughout the state who made any energy efficiency improvements to their properties may be eligible for significant tax benefits and rebates:

- High-Efficiency Electric Home Rebate (HEEHR) Program to reduce or eliminate the cost of efficiency and electrification projects or appliances for low-and- moderate-income households. https://www.rewiringamerica.org/policy/high-efficiency-electric-home-rebate-act

- The HOMES Rebate Program provides rebates for households that reduce their energy usage by at least 35%, regardless of income. https://nylcv.org/wp-content/uploads/IRAGuide_HOMES.pdf

- 25c Energy Efficiency Home Improvement Tax Credit, now an annual incentive to offset tax liabilities. https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

- 25D Residential Clean Energy Tax Credit, applicable for up to 30% of the cost of solar power and geothermal heating projects. https://nylcv.org/wp-content/uploads/IRAGuide_Residential-Clean-Energy-Tax-Credit.pdf

Ratepayer Benefits and Reimbursements: Most major energy providers in New York offer extensive benefits for installing energy efficient utilities, including furnaces, heat pumps, thermostats, cooling systems, and more. Check to see if your provider participates in these programs: https://nylcv.org/wp-content/uploads/IRAGuide_Utility-Bennefits.pdf

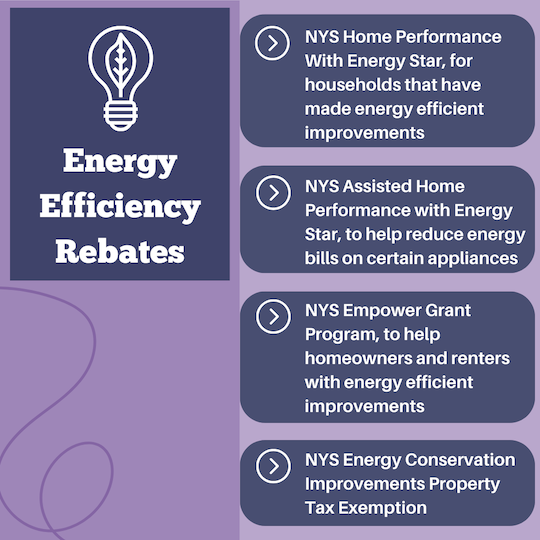

Energy Efficiency Rebates: In addition to numerous rebates for household energy improvements, the IRA provides tax benefits to keep homeowner and renter expenses low while property value increases thanks to energy efficient improvements:

- NYS Home Performance With Energy Star (NYSERDA), for households that have made energy efficient improvements: https://www.nyserda.ny.gov/All-Programs/Residential-Financing-Programs/Assisted-Home-Performance-with-ENERGY-STAR

- NYS Assisted Home Performance with Energy Star (NYSERDA), to help eligible households reduce their energy bills on certain appliances: https://www.nyserda.ny.gov/All-Programs/Assisted-Home-Performance-with-ENERGY-STAR-Program

- NYS Empower Grant Program (NYSERDA), to help income-eligible homeowners and renters with energy efficient improvements: https://www.nyserda.ny.gov/All-Programs/EmPower-New-York-Program

- NYS Energy Conservation Improvements Property Tax Exemption, to prevent property tax increases when certain improvements are made: https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

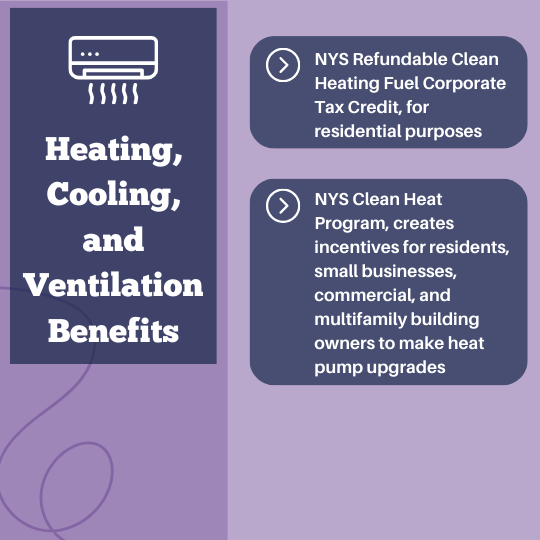

Heating, Cooling, and Ventilation Benefits: The IRA also provides tax credits for residential, multifamily, small business, and commercial entities who make temperature upgrades:

- NYS Refundable Clean Heating Fuel Corporate Tax Credit, for residential purposes: https://programs.dsireusa.org/system/program/detail/3203/refundable-clean-heating-fuel-tax-credit-personal

- NYS Clean Heat Program, creates incentives for residents, small businesses, commercial, and multifamily building owners to make heat pump upgrades: https://cleanheat.ny.gov/

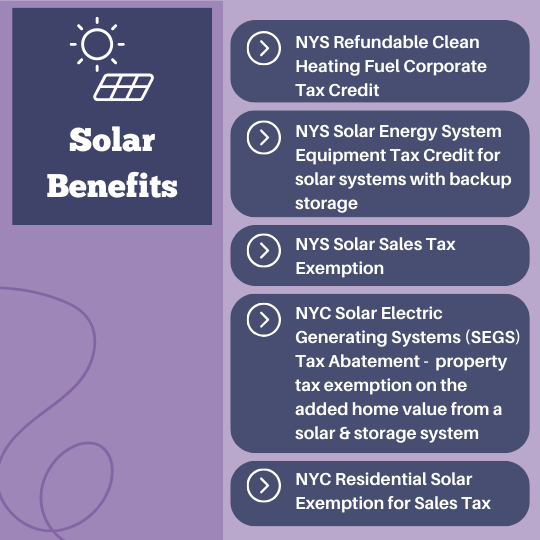

Solar Benefits: For households and businesses that upgrade to solar, the IRA includes several tax credits and exemptions that significantly reduce costs:

- NYS Refundable Clean Heating Fuel Corporate Tax Credit for when solar is installed: https://www.nyserda.ny.gov/all-programs/ny-sun/contractors/dashboards-and-incentives

- NYS Solar Energy System Equipment Tax Credit, for purchased home solar systems with backup storage: https://www.tax.ny.gov/pit/credits/solar_energy_system_equipment_credit.htm

- NYS Solar Sales Tax Exemption: https://www.tax.ny.gov/pdf/publications/sales/pub718cs.pdf

- NYC Solar Electric Generating Systems (SEGS) Tax Abatement, creates a property tax exemption on the added home value from a solar & storage system: https://www.nyc.gov/site/finance/benefits/landlords-solar-roof.page

- NYC Residential Solar Exemption for Sales Tax: https://programs.dsireusa.org/system/program/detail/4703/new-york-city-residential-solar-sales-tax-exemption

Share this Article or Press Release

Newsroom

Go to Newsroom