Senate Okays Spending Cap

James L. Seward

The past two state budgets have increased state spending dramatically, and last year the governor's proposed budget offered one of the largest increases in state spending in history. In addition, the governor's budget -- which we still have to work from, in spite of his resignation -- has proposed massive tax increases on hardworking New Yorkers to pay for spending hikes. To make matters worse, the assembly majority has recommended a $1.5 billion tax increase.

That’s why, as part of our budget plan, my senate majority colleagues and I will propose to cap state spending -- because we don’t need more spending and taxes! We need more accountability in Albany.

Given the state of our economy, it's exactly the wrong time for the state to go on a spending spree. Important areas of concern -- schools, health care, transportation, local governments -- all need a bump in aid so they can keep up with inflation. But the state's budget shouldn't take more out of the economy as businesses struggle to pay their employees and health insurance costs.With that in mind, the state senate has just approved legislation to enact a constitutional spending cap that would prevent the executive branch of state government from submitting a budget that increases spending by more than four percent over the previous year’s budget. The measure would force both houses of the legislature to live within reasonable spending limits.

Under the senate proposal, year-to-year state spending increases would be limited to 120 percent of the Consumer Price Index (CPI) or 4 percent, whichever is less. In any given year, fifty percent of tax revenue that exceeded the cap would be placed in a reserve fund and fifty percent would be returned to taxpayers in the form of direct tax rebates.

In addition, the amendment would force the governor to resubmit a balanced budget to address any shortfalls in revenue that occur after the submission of his executive budget, and make any necessary spending revisions to reflect the declining revenue.

The cap would slam the door on massive increases in state spending and hold a governor accountable for maintaining a balanced budget. The family budget is more important than the state budget, and we have to stand up to protect taxpayers from being taxed out of their homes.

If a constitutional amendment had been in place the last five years, state taxpayers would have saved $13.1 billion, half of which would have been returned to taxpayers and the other half placed in a rainy day reserve fund.

State government must lead by example and do more at the state level to control spending and taxes. A constitutional amendment is the only guarantee against excessive and wasteful spending and higher taxes to pay for that spending.

In addition to the spending cap, the senate just voted to reject nearly $1.7 billion in tax and fee increases recommended in the governor's budget. The assembly majority has also proposed to increase the state’s personal income tax (PIT) by $1.5 billion, which has been unilaterally rejected by the senate, and that will save taxpayers at least $3.2 billion this year. In addition, the state’s Democrat-allied Working Families Party has called for cancelling $16 billion in tax cuts!

The senate's plan for a constitutional spending cap proposal would give the governor the authority to exceed the cap in the event of a fiscal emergency or other extraordinary circumstances, however, the comptroller would be required to independently certify the financial crisis.

According to a 2007 report by the National Conference of State Legislatures, thirty states have enacted statutory or constitutional tax or spending limits. New York continues to rank at or near the top in combined state and local tax burden, further illustrating the need to enact a spending cap.

Share this Article or Press Release

Newsroom

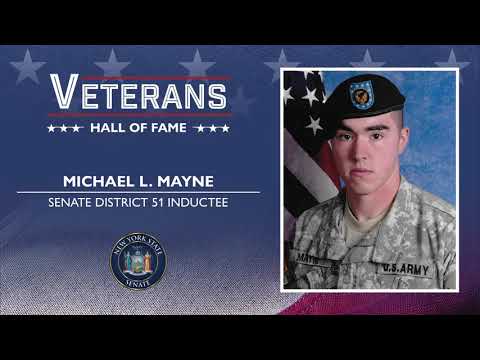

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020