Senate Eyes Crackdown On Medicaid Fraud

Senator John J. Flanagan (R,C-East Northport) joined Members of the Senate Republican Conference to call for a comprehensive overhaul of the state’s Medicaid fraud detection effort with the goal of dramatically reducing corruption and waste, and increasing the amounts of money returned to taxpayers.

Senate legislation restructures the detection, investigation and prosecution of Medicaid fraud in New York by strengthening and streamlining the roles of the Health Department and Attorney General, and creates a new Medicaid Inspector General to help uncover fraud, waste and abuse.

"There is no excuse for tolerating fraud," said Senator John J. Flanagan (R,C-East Northport). "This legislation attempts to restore accountability and integrity to the Medicaid program, and ensure that tax dollars are being used only as they are intended."

The U.S. General Accounting Office estimates that a minimum 10 percent of Medicaid expenses -- and as much as 30 percent -- are diverted through fraud, an amount equal to billions of dollars each year in New York’s $44 billion Medicaid program. But New York’s anti-fraud efforts have recouped only a fraction of that amount, and have lagged those of other states.

"With estimates that Medicaid fraud may cost taxpayers billions of dollars each year, we are taking extraordinary steps to bring the program under control, to better coordinate our fraud-fighting effort and to employ the latest technology to return those savings back to taxpayers," said Senator Flanagan.

Key to the success of the Senate’s proposal is the creation of a state-of-the-art computer fraud detection system.

Fighting fraud is considered so important to the integrity of the Medicaid system that the federal government contributes 75 percent of the cost of fraud-fighting units in each state, while states fund the balance.

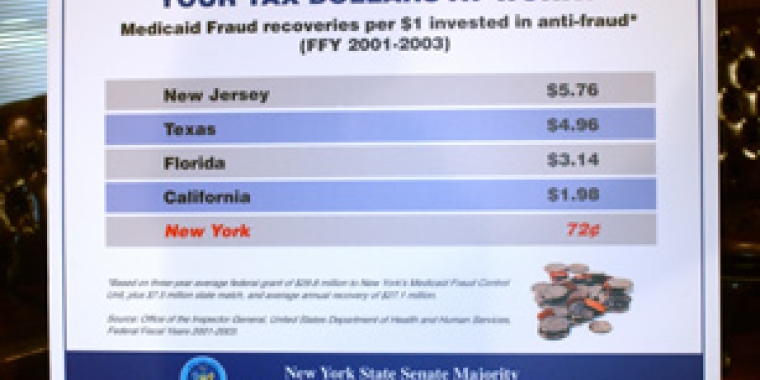

Nonetheless, New York ranks alone among the nation’s 10 most populous states in spending more on anti-fraud efforts than it recovers, according to the most recent reports filed by states with the federal government.

In Federal Fiscal Years from 2001 to 2003, New York’s Medicaid Fraud Control Unit, which prosecutes fraud and recovers illicit gains, posted 72 cents in recoveries for every dollar spent by state and local governments on fraud recovery, according to a review of filings with the Inspector general of the federal Department of Health and Human Services. By contrast, Texas recouped five times its anti-fraud spending; New Jersey regained six times its investment.

The Senate plan would mean additional savings to county and state taxpayers since savings under the program are automatically returned to local governments who paid the bill in the first place.

Under the Senate plan, New York would continue to qualify for federal anti-fraud funding to defray the cost of the new program. Another of the Senate proposal’s components, modeled on the anti-crime Operation IMPACT initiative, would provide funding and personnel to local district attorneys to help prosecute fraud cases not handled by the Attorney General.

Increasing anti-fraud efforts to control Medicaid cost growth was a key Senate goal during negotiations over the new state budget, but that effort was rebuffed by the Assembly. Nonetheless, the Senate secured $1 million in the budget to initiate creation of such an office.

"This legislation is about protecting the taxpayers and the Medicaid system to make sure the money is actually going to help people who need and rely on it," concluded Flanagan.