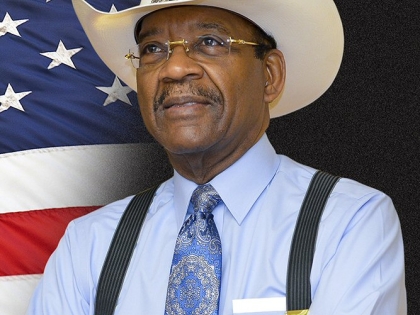

New York Senator Rev. Ruben Diaz Proposes Legislation To Amend State Tax Law To Add Needed Funds To The New York State Budget

New York State Senator Rev. Ruben Diaz (D-Bronx) has proposed legislation to amend the New York State Tax Law and require credit card companies to remit the State’s portion of sales tax amounts from receipts of retail sale of taxable foods and services directly to the State Department of Taxation and Finance - and not back to the businesses and retail establishments for their estimates of amounts due. This more direct and more certain mechanism will ensure that New York State will promptly receive all of the sales tax revenues to which they are entitled, and is expected to add from $300 - $500 million dollars in revenue to the State’s Budget.

"As credit card companies continue to charge sales tax from credit card purchases, businesses should not be permitted to submit an estimate of taxes owed so that the State loses money. My legislation will ensure that this revenue stream of taxes will give the State exactly what it deserves, and go directly to the State Department of Taxation and Finance," stated Senator Reverend Diaz, a Member of the Senate Banking Committee. "When this requirement goes into effect, it will improve the State’s financial condition and allow us to better provide and fund much needed services to our constituents."

For additional information, please contact Senator Rev. Diaz at 718/496-4793.