Senate Approves New Job Creation, Spending Control Plan

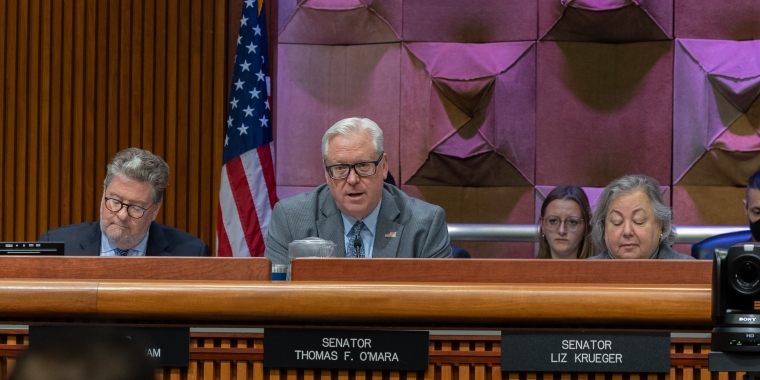

Albany, N.Y., January 19—The New York State Senate approved a legislative package today that will be co-sponsored by Senator Tom O’Mara (R-C,Big Flats) calling for a new, comprehensive job creation, spending control, and tax incentive strategy as a way to help New York climb out of its current economic crisis.

[watch Senator O'Mara's comments on the new Senate plan]

The Senate’s “Job Creation and Taxpayer Protection Act” seeks to encourage overall economic growth, provide targeted tax incentives, and focus on the creation of upstate jobs. The plan also seeks to put the brakes on New York’s reckless tax-and-spend past by making it harder for legislators to approve tax increases and by putting a cap on future state spending.

“We’re determined that Albany takes a new approach to economic growth and fiscal responsibility this year. We have an immediate financial crisis to confront, but we also have to begin putting in place a foundation for long-term fiscal responsibility and sustained, private-sector economic growth,” said O’Mara, beginning his first term representing New York’s 53rd Senate District. “Our plan zeroes in on private-sector job growth, tax incentives, and spending control as the cornerstones of rebuilding a strong-running, private-sector economic engine for upstate New York. We’re making it clear today that less state spending, lower state taxes, and the elimination of job-killing state regulations needs to represent a new way of doing business in New York government.”

[see below for attached copy of news release and additional details on the "Job Creation and Taxpayer Protection Act"]

O’Mara believes the overall strategy being advanced by the plan has been overlooked as a way to help the state climb out of its current fiscal trouble. Among several key initiatives, the legislative package would begin to put in place a permanent cap on future state spending and take other steps to encourage private-sector job growth and improve upstate New York’s business tax climate.

A report last October from the national Tax Foundation ranked New York’s business tax climate as the worst in America. O’Mara said that has to change.

“Potential employers see New York as a state that’s unfriendly to business. That hurts our workers and their families, and it has to change,” said O’Mara. “This plan begins to change it.”

O’Mara highlighted key provisions of the Senate plan, which includes measures to:

-- establish a permanent, Constitutionally mandated cap on state spending that would limit year-to-year increases in state spending to no more than two percent or 120 percent of the consumer price index (CPI), whichever is less, a move that would have saved state taxpayers billions of dollars if it had been in place over the past five years;

-- amend the state Constitution to require a two-thirds “super majority” vote in the Senate and Assembly to enact any new state taxes or fees. Currently it only takes a simple majority vote in each house of the Legislature to approve tax or fee increases, which O’Mara said made it too easy for the Democratic-controlled Legislature to enact upwards of $14 billion in new taxes and fees in 2009 and 2010;

-- establish a new Job Creation Tax Credit offering businesses, manufacturers, and other private-sector employers a refundable tax credit of up to $5,000 for every new job they create. O’Mara said that twenty-four other states currently offer a similar job creation tax credit. Under the plan he’s co-sponsoring, an additional $3,000 credit would be offered for hiring unemployed workers; and

-- enact a five-year moratorium on any new state-imposed business regulations and red tape, together with the creation of state-level commission to identify state rules and regulations that stand in the way of sustained economic growth and job creation. New regulations would require legislative approval under the Senate plan.

You can also share your view through O'Mara's online poll.