IDA reform measures pushed in Albany (Niagara Gazette)

Advocates for reforming New York’s system of handing out tax breaks to support business growth and job development took their case to Albany on Wednesday, arguing that abatements authorized by local industrial development agencies harm local schools and education.

Representatives from two dozen major unions, education associations, school funding advocates and government watchdog groups, including Reinvent Albany, rallied at the state capitol for passage of reform legislation aimed at stopping IDAs from diverting tax revenue that they say would otherwise go to schools.

Their argument is based largely on an analysis by the watchdog group Good Jobs First that found New York’s public schools, including those in Niagara County, shared in the loss of at least $1.8 billion in local tax revenue in 2021 due to tax abatements granted by local IDAs.

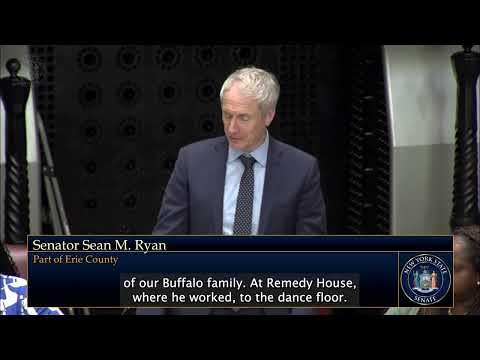

While in Albany, the advocacy groups pushed for the passage of bills introduced by state Sen. Sean Ryan, D-Buffalo, and Assemblyman Harry Bronson, D-Rochester, that would prohibit IDAs from abating the school share of property taxes.

“Preventing IDAs from abating taxes that should be going to schools would be a game-changer for public education in New York,” Ryan said. “Every year at budget time, we are faced with a choice – we can either accept that our schools will be underfunded, or we can use taxpayer dollars to fill the budget gaps created by these corporate handouts. It’s time we recognize that school funding is too important to be used as a bargaining chip. We need to stop this endless game of budgetary Whac-A-Mole and tell IDAs that everyone needs to pay their fair share from now on.”

In its analysis, Good Jobs First, a Washington-D.C. non-profit group that promotes corporate and government accountability in economic development, found New York state public schools lost at least $1.8 billion in revenue to tax abatements in fiscal year 2021.

According to the analysis, the figure combines $430 million in self-reported losses by 318 school districts with $1.4 billion in estimated losses for schools in the state’s five largest cities — New York City, Buffalo, Rochester, Yonkers and Syracuse — where education-specific tax abatement disclosures are not available as those districts’ finances are not separate from the cities where they operate.

The Good Jobs First analysis concluded that in 2021 Niagara County school districts lost between $5 million and $10 million in “foregone school revenues.” According to the analysis, that included $548,000, or $133 per pupil, in “net foregone revenues” for the Lockport City School District, $1.42 million, or $203 per pupil, in the Niagara Falls City School District, and $240,304, or $74 per pupil, in the North Tonawanda City School District.

“IDAs should not be allowed to nullify taxes, that’s something legislatures do, let alone waste $1.8 billion a year that should be going to schools,” said John Kaehny, executive director of Reinvent Albany, a non-profit group that advocates for more transparent and accountable government in New York. “There are zero independent economic development experts in the United States who believe an IDA subsidy is a better use of tax dollars than funding public schools.”

In addition to making the trip to Albany, the organizations supporting IDA reform sent a letter to state lawmakers, encouraging them to support the effort. The list of groups signing on to the letter included several prominent labor unions, including the NYS AFL-CIO, NYSUT, CSEA and AFSCME, as well as the state Council of School Superintendents, state Parent Teacher Association and state School Board Association. Reinvent Albany and Good Jobs First were among a half dozen good government advocacy groups that also signed on in support of the passage of the legislation.

“These tax breaks allow for private companies to come in and create demands on our school systems while avoiding the financial responsibility of supporting our students and educators,” said NYSUT President Melinda Person. “Our students deserve everything they’ve been promised, including the $1.8 billion per year that these tax abatements are currently taking from them.”

To view the full tax abatement analysis completed by Good Jobs First, visit https://goodjobsfirst.org/corporate-subsidies-versus-public-education-how-tax-abatements-cost-new-york-public-schools/?mc_cid=2a5471cb28&mc_eid=8ea39f7ea2.