The Senate Minority Tackles Sub-Prime Loan Foreclosure Crisis

Malcolm A. Smith

May 6, 2007

More than 20 percent of the sub-prime mortgage loans originated in 2005 will end in foreclosure, jeopardizing the homes of more than 28,000 New York families, according to a report unveiled today by the State Senate Democratic Conference.

Alarmed by the growing number of foreclosures across New York State, and stunned by the accounts of New Yorkers who are on the verge of losing their homes, Senate Democrats announced the Predatory Lending Mitigation Program which will help families that have been victimized by predatory lenders.

Senate Democratic Leader Malcolm A. Smith (D-Queens) said "if we don't work together to find a solution today, the foreclosure crisis will have a devastating effect on our communities and families as well as the banking industry itself." Smith said the measures proposed are part of the Senate Democrats' "9 to 5 Agenda" designed to aid and protect the working families of New York State.

The Democrats' report, prepared by Senator Jeff Klein (D-Bronx/Westchester) clearly illustrates the problem, showing that while New York had a relatively low sub-prime foreclosure rate as recently as 2001, the State last year had the fifth highest sub-prime foreclosure rate in the nation.

"This crisis has exploded in the last few years," Klein said. "And it is a significant problem in every region of the State."

The Democratic Senators proposed several measures that will protect consumers from predatory lending practices. And, in an effort to help borrowers who have already been victimized by questionable, and perhaps unethical, lending practices, the Senators called for an immediate voluntary six-month moratorium on foreclosures of sub-prime loans in New York.

Senator Liz Krueger (D-Manhattan) said the moratorium, combined with a planned series of public hearings, "would allow an opportunity to hear from the banking industry and from victims of predatory lending and hopefully provide sufficient time to devise a solution that helps victims without hurting ethical lenders."

The public hearings will be chaired by Senator Martin Connor, ranking Democrat on the Senate's Banking Committee. Connor said he would be holding hearings in each region of the State in order to gauge the full magnitude of the problem. "The more information we have available, the greater our chances of addressing and solving this crisis."

Senate Democrats also proposed measures to help consumers avoid the pitfalls of predatory loans. One bill, sponsored by Senator Smith, would bar the State from doing business with banks that partake in predatory lending practices.

"Predatory loans are unethical. Targeting people who are naïve in order to rob them of their dreams is unconscionable, and New York State should not be doing business with banks that engage in such practices," Smith said.

A measure proposed by Senator John Sampson (D-Brooklyn) would provide training and assistance to borrowers seeking a loan. "My intent is to ensure that all consumers fully understand the intricacies of the loan process and are aware of the terms and conditions of their loan. Unfortunately, there have been too many instances of people being coerced into a loan that is not in their best interests," Sampson said.

The Senators were joined by David Collymore, vice president of Amalgamated Bank, who said, "Our bank has provided free financial literacy programs to our customers and the communities we serve for many years. Recently, we expanded our efforts by joining with Assemblywoman Catherine Nolan and LaGuardia Community College to offer more financial literacy classes in our branches, community centers and other locations throughout the N.Y. metro area."

Collymore praised Assemblyman Darryl C. Towns for supporting the bank's program, which has brought money management information to 1,000 families in just six months. "My belief is that improving a person's financial literacy is a key step on the journey to successful homeownership," Towns said.

Bruce Beaudette, president and CEO of Sunmark Federal Credit Union, also joined the Senate Democrats to describe a program established by the New York Credit Union League. Beaudette said "New York's 505 not-for-profit credit unions are the anti-predatory lender. We educate our members and communities on avoiding unfavorable debt spirals, and we offer solutions via low cost loans, refinancing of existing high cost debt and financial education and counseling. We applaud the Senators for addressing the problems of predatory sub-prime lending in our state, because we have found that those who can least afford to pay exorbitant rates and fess on mortgage debt are

the very people being targeted. These people need education and legislative relief."

Klein's report shows that sub-prime foreclosure rates in Nassau-Suffolk County (22 percent) and the New York City-White Plains area (21.7 percent) would place both metropolitan areas among the top 20 cities in the United States.

But, Klein said, this is not just a downstate problem, with double-digit foreclosure rates in cities and areas like Ithaca (17.8 percent), Buffalo-Niagara Falls (15.6 percent) and the Capital Region (17.4 percent).

"This problem is not limited to one portion of the State. Indeed it is a statewide and nationwide crisis," Senator Klein said. "This report shows just how broad these predatory practices have spread."

The study also showed that African-American and Latino borrowers are far more likely to pay more for their mortgages than other borrowers. "Clearly, there have been numerous instances of minority borrowers with good credit histories who should qualify for regular loans instead being steered into sub-prime loans," Klein said. "These victims will spend tens of thousands of dollars more than they should for a mortgage. The lenders that use these deceptive practices should be held accountable and punished."

Sub-prime loans are loans offered to individuals whose credit history prevents them from securing a low-rate loan. A typical sub-prime borrower has a low credit score and a history of late payments, charge-offs or bankruptcies. Since they are considered at high risk of default, they receive less-than-favorable terms, including higher interest rates, regular fees or an upfront charge.

In some cases, sub-prime borrowers are drawn in by a low introductory rate, which then sharply increases within a few years, making it difficult if not impossible to keep up with monthly payments. Unless they can refinance their loan or sell the house, the borrower can lose their home.

Not all sub-prime lenders engage in predatory practices, and some sub-prime lenders provide a valuable service to people who would not otherwise be able to qualify for a mortgage loan.

Share this Article or Press Release

Newsroom

Go to NewsroomTHANKSGIVING ESSAYS AND CONTRIBUTIONS

December 2, 2014

Cycle With the Senator Saturdays in August

August 5, 2014

“Woman of Distinction" 2014 Honoree Adjoa Gzifa

July 11, 2014

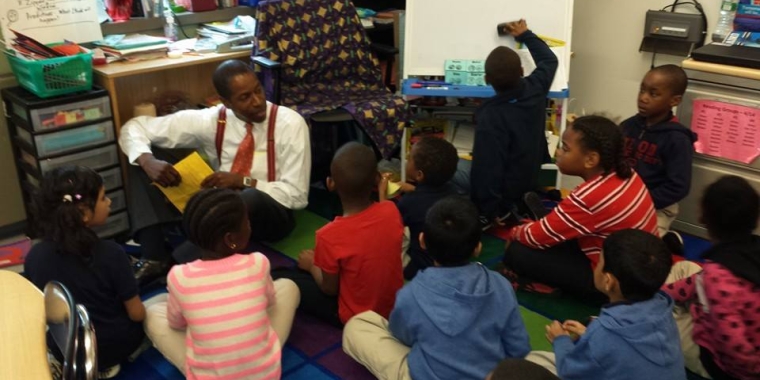

Career Day at PS 48 in Jamaica

July 11, 2014