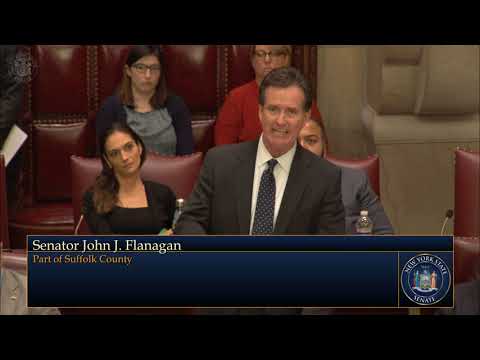

Senator Flanagan Proposes Mandate Relief in State Budget

John J. Flanagan

April 5, 2009

During the recently concluded New York State budget negotiations, Senator John Flanagan (2nd Senate District) introduced an amendment to the state budget that would reign in runaway school spending, increase transparency within local school districts and protect taxpayers from having to pick up the additional costs for unfunded mandates.

“It is impossible to control the overwhelming property tax burden without reigning in school district spending. But in talking to school leaders across my district, they continually point to mandates as a main reason for increased costs and our state has a responsibility to help control these costs for the good of our property taxpayers. This amendment proposes several realistic relief measures that will help our school districts now and protect our homeowners,” said Senator John Flanagan, ranking member of the Senate Education Committee.

The amendment introduced by the Senate Republicans includes the following proposals:

· A ban on unfunded mandates to prevent the Legislature from imposing a mandate whose fiscal implications are greater than $10,000 to a municipality, or in excess of $1 million when combined statewide;

· A ban on mandates to school districts that have fiscal implications, in order to allow for proper budgeting and planning;

· A “paperwork reduction act” to eliminate duplicate and burdensome reports;

· Assistance of up to 65 percent reimbursement for energy audits that will help schools save operating money. If they choose not to implement the recommendations, they will be required to hold a public hearing to explain to the taxpayers why they have opted out of the recommendations;

· Increased building aid for the construction of “green” buildings;

· Incentives for districts that consolidate central maintenance and municipal services, including but not limited to lawn mowing, heating, venting, and air conditioning, and repair, maintenance, or trash collection;

· Enhanced consolidation incentives for districts;

· School superintendent sharing for smaller school districts with an enrollment of less than 1,000 students;

· $100 million in relief for pension costs in excess of four percent outside of New York City. Up to 40 percent of this program will be used to pay for New York City pension costs in excess of four percent;

· Authorization for districts to construct joint facilities with other schools and municipalities;

· Allow schools to use transportation consumer price index (CPI) for two years in order to decrease contractual costs; and

· The creation of a Blue Ribbon Commission on Mandates in order to determine costs associated with mandates, establish alternative solutions to costly mandates, identify duplicate mandates that could be consolidated, and determine true savings from mandate relief.

Senate Democrats voted to defeat the amendment.

“Rising school taxes are the single biggest burden facing homeowners throughout the state and it is important to use any measure possible to provide relief. While this measure was defeated along party lines, it is imperative that we work together in the coming months to reach an agreement on school mandate relief to protect our residents,” concluded Senator Flanagan.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Flanagan Fights For Public Safety

January 9, 2020

Statement from Senator John Flanagan Regarding NRSP Legislation

December 23, 2019