Senator Robach Calls on Governor Paterson to Repeal Plan to Increase Gas Taxes

Joseph E. Robach

April 5, 2009

Eliminating State Sales Tax Cap on Gasoline & Raising Fees on Other Driving Expenses Will Further Burden Consumers

Senator Joseph Robach today called on Governor Paterson to eliminate his proposal to raise gas taxes and increase fees for other driving related expenses such as obtaining a driver license, registering a car, and getting license plates.

Senator Robach stated, "With gas prices expected to rise again in the Spring, Governor Paterson's proposed tax increases will further burden consumers by raising prices at the pump. In addition, making other driving related needs more expensive will raise costs for individuals and businesses. With so many families and small businesses struggling, now is not the time to increase taxes."

Mike Elmendorf, New York State Director National Federation of Independent Business (NFIB) added, "New York State has the nation's second highest cost of doing business--second only to Hawaii. This harms not only businesses, but also families and consumers because it means a higher cost of living. Our oppressive tax burden is a major driver of these costs and the proposals contained in the Executive Budget to raise gas taxes and fees on driver licenses, license plates and registrations are just another example of policies that are driving jobs and people from our state. These proposals would increase costs on businesses, increase the expense of transporting goods and hit consumers and families as well. That's why NFIB opposes these proposals and urges their rejection as part of a final budget agreement. We should be lowering New York's tax burden, cost of doing business and cost of living, not making them worse."

As part of his budget proposal, Governor Paterson proposed eliminating the state sales tax cap on a gallon of gasoline. Currently, only the first $2 per gallon of gas is subject to state sales tax. Removing this cap means that drivers will pay more in sales taxes as the price per gallon increases. Estimates are that this would cost drivers $90 million statewide this fiscal year. Some experts predict that the price will be rising by 30 to 50 cents per gallon this Spring.

In addition to removing the sales tax cap on gasoline, Governor Paterson has also proposed a 25% increase in the fees for driver's licenses and vehicle registrations. Governor Paterson is also seeking to raise fees for vehicle license plates just one year before new state license plates will start being phased in. Drivers will be required to purchase these new plates when they register their vehicles.

Share this Article or Press Release

Newsroom

Go to NewsroomFrank X. Allkofer

November 11, 2020

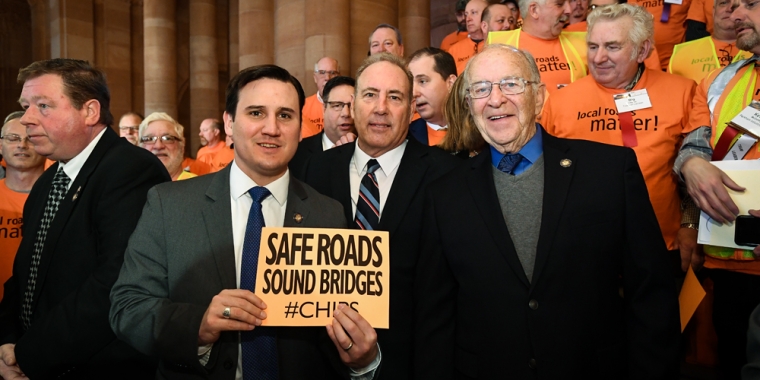

Senator Robach Rallies for Transportation Funding

March 4, 2020