Senator Valesky Opposes Governor's Plan to Delay Income Tax Returns

David J. Valesky

February 24, 2010

-

ISSUE:

- Finance

- Legislature

- Executive

- Taxes

- Income Tax

ALBANY, N.Y.--If New Yorkers have to pay their taxes on time, the state should provide its refunds on time, Senator David J. Valesky (D-Oneida) and Senate Majority Democrats told Governor Paterson today. Passing a resolution with broad bi-partisan support, the Senate formally opposed the Governor’s scheme to delay more than $500 million in refunds to individuals and $200 in refunds to businesses.

"In these times of great economic difficulty, New Yorkers need their government to ease the pressure, not add to it," Senator Valesky said. "The Governor’s proposal would only punish New Yorkers who pay their taxes on time and in full, and just want the return they deserve. There is a big difference between making tough decisions and bad decisions—this proposal is just plain wrong."

Under the Governor’s plan, the state’s current cap on income-tax refunds paid out before March 31st would be lowered from $1.75 billion to just $1.25 billion, resulting in a nearly two-month delay for thousands of taxpayers awaiting lawful refunds. Additionally, taxpayers will not be paid interest on their funds until June 1 while businesses would be denied any interest until the second half of March.

Full text of the resolution:

----------------------------------------

LEGISLATIVE RESOLUTION calling upon Governor David A. Paterson to immediately abandon his intention to delay the refunding of individual and business income tax overpayments and refund those tax overpayments with all deliberate speed

WHEREAS, Governor David A. Paterson announced, as recently as February 16, 2010, his intention to delay payment of approximately $500 million in personal income tax refunds owed to New York State taxpayers; and

WHEREAS, The hard economic times in which hard-working individuals and families across the State presently find themselves make it critically important for the State to remit personal income tax refunds as expeditiously as possible, in order to meet the dire needs of taxpayers struggling to make necessary purchases and meet their financial obligations; and

WHEREAS, Governor Paterson has also announced his intention to delay payment of approximately $200 million in business tax refunds; and

WHEREAS, Many small and large businesses depend upon the timely receipt of their tax refunds to support the ongoing economic and market- place activity driving their local and regional economies; and

WHEREAS, The residents, businesses and taxpayers generally in the State have already shared the sacrifices imposed upon them by recent cuts in vital programs; now, therefore, be it

RESOLVED, That this Legislative Body pause in its deliberations to call upon Governor David A. Paterson to immediately abandon his intention to delay the refunding of individual and business income tax overpayments and refund those tax overpayments with all deliberate speed; and be it further

RESOLVED, That a copy of this Resolution, suitably engrossed, be transmitted to The Honorable David A. Paterson, Governor of the State of New York.

###

Share this Article or Press Release

Newsroom

Go to NewsroomSen. Valesky’s Sixth Annual Free Senior Fair is October 19 in Madison County

September 25, 2018

Harmful Algal Blooms: What to Know, How to Report

June 29, 2018

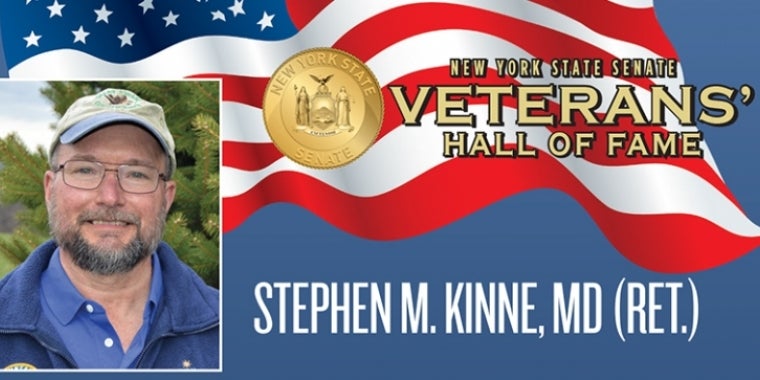

Stephen M. Kinne, MD (Ret.)

May 15, 2018