Seward Warns of Looming Clothing Tax

James L. Seward

August 30, 2010

ONEONTA, 08/30/10 – State Senator James L. Seward (R/C/I-Oneonta) is advising families to do their back-to-school shopping as soon as possible in order to avoid a sales tax on clothing that will take another bite out of their finances after it goes into effect on October 1.

“In the past two years, the Democrat-led legislature has approved over $10 billion in new taxes and fees to fuel out of control state spending,” said Senator Seward. “Now, out of touch lawmakers are again reaching into the wallets and pocket books of middle-class New Yorkers by implementing a regressive tax on clothing and footwear that will force consumers to pay even more at the checkout counter starting October 1.”

On October 1st, New York State will begin collecting 4 percent sales tax on clothing and footwear costing $110 or less as part of the 2010-2011 state budget opposed by Senator Seward. The sales tax reinstatement is expected to cost New Yorkers $330 million. It was included in $2.2 billion in new/increased taxes and fees approved this year to fuel the downstate leaders’ 11 percent hike in state spending.

Items that were formerly exempt that will now be subject to the 4 percent state sales tax include: dresses, uniforms, sleepwear, coats, hats, scout uniforms, socks and even diapers.

Senator Seward won approval for the state sales tax exemption on clothing and footwear purchases in 2006 to help hardworking New York families better afford life’s necessities. That action has helped some families save hundreds of dollars on back-to-school purchases each year.

“Middle-class families across the state are still fighting their way out of the worst recession in a generation. Instead of easing the tax burden, Albany has added an unnecessary cost to the essential clothing purchases parents make each year. I opposed the billions of dollars in Democrat approved tax hikes because New Yorkers simply cannot afford them,” Seward concluded.

In the past two years, the Democrat-led legislature has hiked personal income taxes, raised business taxes, eliminated the STAR property tax relief checks, and increased fees on everything from motor vehicle registrations to state park passes to hunting and fishing licenses.

A complete list of the 124 new/increased taxes and fees can be found by CLICKING HERE.

-30-

Share this Article or Press Release

Newsroom

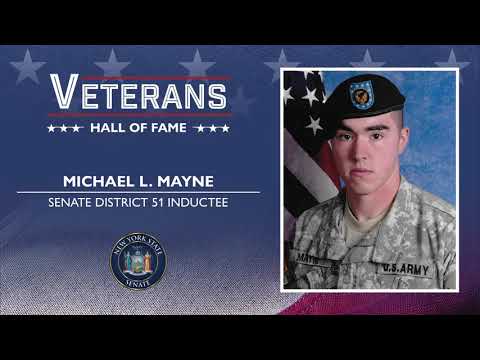

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020