Legislature Passes Schneiderman Bill to Crack Down on Tax Cheats

Martin J. Golden

June 21, 2011

AG Schneiderman and DA Vance Team Up To Close “Helmsley Loophole” That Let Tax Evaders Off The Hook For Breaking State Laws

Schneiderman: There Must Be One Set Of Rules For Everyone, No More Free Passes For White Collar Criminals

ALBANY – In a major victory in the fight against white collar crime, the state Senate today overwhelmingly passed Attorney General Eric T. Schneiderman’s legislation to close a loophole that let tax evaders off the hook for breaking the law. The Attorney General’s program bill, which was drafted in collaboration with New York County District Attorney Cyrus R. Vance Jr., amends a law that prohibits the state from prosecuting income tax cheats who have been previously prosecuted in federal court for the “same criminal transactions” even if the crimes are distinct. The Assembly passed Schneiderman’s bill on Friday.

“Tax evasion is a crime, but for too long, white collar criminals have benefited from a gaping loophole in state law that has let them off the hook. This legislation unties the hands of state prosecutors so that all tax violations can be prosecuted to the fullest extent of the law,” said Attorney General Schneiderman. “By cracking down on tax violations, there will no longer be one set of rules for the powerful and another for everyone else. The days of giving tax evaders a free pass are over.”

“This legislation protects honest taxpayers by giving state prosecutors the tools we need to hold tax cheats accountable,” said New York County District Attorney Vance. “People who play by the rules and pay their fair share for vital state services will no longer have to foot the bill for tax evaders who escape prosecution as a result of the Helmsley loophole. I’d like to thank Attorney General Schneiderman and the legislative sponsors.”

Endorsed by the District Attorneys Association of the State of New York, Attorney General Schneiderman’s bill (S.5776) eliminates a loophole in the so-called “double jeopardy” provision in the state’s Criminal Procedure Law that prohibited state prosecutors from seeking charges against tax criminals who have already been charged in federal court for separate but related federal tax crimes. The bill was sponsored by Senator Martin J. Golden and Assemblymember Joseph R. Lentol, and awaits the Governor’s signature.

The so-called “Helmsley loophole” first gained attention following the investigation of billionaire hotel operator Leona Helmsley for income tax evasion by federal and state prosecutors. After the federal criminal case went to trial, the State presented its case. Despite the fact that the defendant had evaded taxes in both jurisdictions, the court dismissed the state charges on the grounds that they were based on the "same criminal transaction" as the federal tax charges. The Schneiderman bill simply fixes this flaw that has impeded New York State's ability to prosecute and collect unpaid state taxes.

“Tax cheats who violate our state laws should be held accountable by state authorities - period. You should not get off the hook for breaking state law just because you also broke federal law and were prosecuted for that crime,” said Senator Golden. “I am pleased to sponsor the Attorney General’s legislation, which closes this egregious loophole.”

“The State of New York has had to make tough choices in the last year with regard to taxes and spending, but making sure everyone pays the taxes they owe is a no-brainer,” said Assemblyman Lentol. “New York State can’t afford loopholes that allow tax evaders to escape justice By closing this loophole, the Attorney General’s legislation will help to ensure that everyone pays their fair share of state taxes, and no one is above the law.”

Attorney General Schneiderman has made restoring New Yorkers’ faith in government a top priority of his administration. Last month, he announced a sweeping new initiative that will give the Attorney General's office the authority to investigate and potentially prosecute any wrongdoing involving government spending, including member items, contracts, and pension fraud.

Upon taking office, Schneiderman also established a new Taxpayer Protection Bureau to target corrupt contractors, pension con-artists, and large-scale tax cheats who rip-off New York State government and its taxpayers. The Attorney General bolstered the Medicaid Fraud Control Unit and has already secured tens of millions of dollars in recoveries for New Yorkers. And he is fulfilling his pledge to appoint a public integrity officer to all 13 of the Attorney General’s regional offices so that citizens can feel safe reporting local corruption to an independent prosecutorial authority.

Share this Article or Press Release

Newsroom

Go to Newsroom2018 Civil Service & Pensions Committee Annual Report

December 27, 2018

Golden to Mayor: Time for police negotiations long overdue.

August 6, 2018

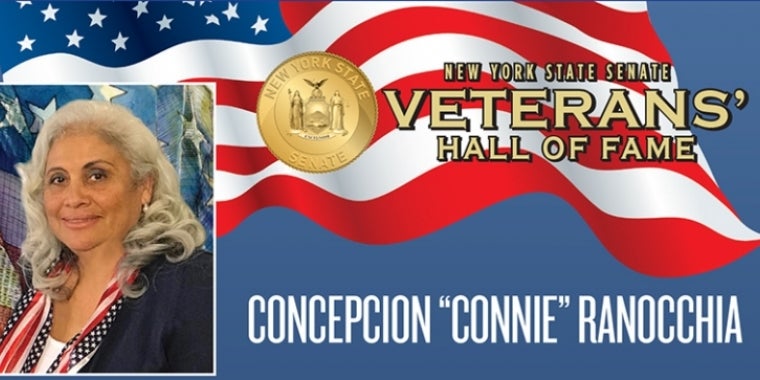

Concepcion "Connie" Ranocchia

May 15, 2018