Ritchie Bill Offering Tax Break for Military Reservists Passes Senate

Patty Ritchie

June 13, 2011

-

ISSUE:

- Military Affairs

- Military

- Troops

- Veterans

A bill sponsored by Senator Patty Ritchie (R-C, Heuvelton) that could let military reservists cut their property tax bill was passed Monday by the Senate.

The measure, S.5231, gives local counties, cities, towns and villages an option to offer reservists the same property tax benefit that is currently available to other veterans who served their nation during specific periods of conflict.

“The changing nature of threats to our nation has also changed the demands that we put on the men and women of our military reserves, who are increasingly called upon to serve side by side with active duty military to defend our freedom and way of life,” Senator Ritchie said.

“These are our ‘citizen soldiers’ who often times interrupt their careers and spend long stretches away from the families, communities and friends—just like those in the active duty service—but aren’t entitled to the same benefits back home. This bill shows our gratitude and respect for all that they do for us.”

Under current law, reservists are only eligible for the tax breaks if they previously served in active duty forces, but not if their military careers were spent exclusively in the reserves.

If enacted, local governments will have the option of extending the benefit to reservists, as well as active duty military veterans.

The veterans’ property tax benefit can reduce county, city, town and village tax bills by 15percent with additional benefits for disabled veterans.

Senator Ritchie said the idea for her bill came from a career military reservist who lives in her district.

The bill was sent to the Assembly, where it is sponsored by US Army veteran Felix Ortiz of Brooklyn.

Share this Article or Press Release

Newsroom

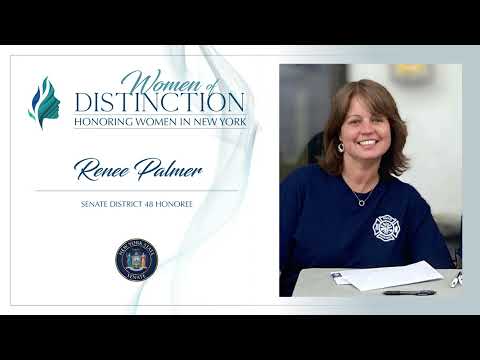

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022