Senate Passes Mta Payroll Tax Repeal

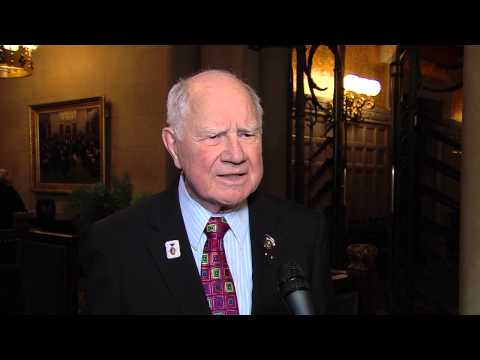

William J. Larkin Jr.

June 15, 2011

Removing Payroll Tax Burden Will Help Businesses Create Jobs

The New York State Senate today passed legislation (S.5596A/ A.8193A) to repeal the MTA Payroll Tax, easing an enormous financial burden that has caused job losses and hurt businesses across the downstate region. The bill, which has strong support from business organizations including the Business Council of New York State and the National Federation of Independent Businesses, is sponsored by Senator Lee M. Zeldin (R, C, I- Shirley), Senator Bill Larkin (R,C - Cornwall-on-Hudson) and other Senators representing the 12-county MTA region.

"This legislation is long overdue," said Senator Bill Larkin (R-C, Cornwall-on-Hudson). "The economy of the Hudson Valley has been strangled by this onerous and burdensome tax and phasing it out is the first step towards encouraging economic development and job growth. We must provide businesses with the means to expand in New York, not give them reasons to leave. I applaud Senator Zeldin for his work on this issue and look forward to the Governor signing the bill into law."

Senator Zeldin and his co-sponsors Senator Martins, Senator Martin Golden (R-C, Brooklyn), Senator Greg Ball (R-C, Pawling), Senator John Bonacic (R-C-I, Mt. Hope), Senator Owen Johnson (R-C, Babylon), Senator William Larkin (R-C, Cornwall-on-Hudson), Senator Ken LaValle (R-C- I, Port Jefferson), Senator Stephen Saland (R-Poughkeepsie), Senator Charles Fuschillo (R, Merrick), Senator John Flanagan (R-C-I, East Northport), Senator Andrew Lanza (R-I, Staten Island), Senator Kemp Hannon (R-C-I, Garden City), Senator Carl Marcellino (R, Syosset) and Senate Majority Leader Dean G. Skelos (R, Rockville Centre), introduced this legislation to repeal the job killing MTA Payroll Tax after hearing from countless constituents about how the tax has harmed businesses and how repealing it could help businesses invest, expand and create new jobs.

The phase-out would begin on January 1, 2012, by exempting small businesses of 25 employees or less, as well as public and non-public schools. The tax would be fully phased out by January 1, 2014 for the seven suburban counties outside of New York City. Within the five boroughs of New York City, the tax would be phased down to .21 percent and would remain at that level. The bill includes several provisions to provide the MTA with $465 million in revenues by 2014 to significantly offset revenues lost due to the significant reduction and repeal of the payroll tax, leaving $375 million, or about three percent of the overall MTA budget, for the MTA to absorb.

The legislation is supported by the National Federation of Independent Businesses, The Business Council of New York State, Inc., The Long Island Business News, New York Farm Bureau, GrowPAC, The Empire State Chapter of the Associated Builders and Contractors, Long Island Cares, Inc., The Long Island Business Council, New York State Catholic Conference, the Nassau-Suffolk Hospital Council, Tax Relief Now, the Hauppauge Industrial Association, and several Chambers of Commerce.

The bill is sponsored in the Assembly by Assemblyman George Latimer (D-Rye).

Summary of Legislation

Small businesses with 25 employees or less, as well as public and non-public schools throughout the entire Metropolitan Commuter Transportation District (MCTD), would be completely exempted from the payroll tax as of January 1, 2012.

The payroll tax, for the seven suburban counties within the MCTD, beginning on January 1, 2012, will have tax rates reduced to 0.23 percent. The tax will be further reduced to 0.12 percent for 2013 and fully repealed as of January 1, 2014. These counties include Suffolk, Nassau, Westchester, Rockland, Orange, Putnam and Dutchess.

Within New York City’s five boroughs, the tax would be reduced to 0.28 percent on January 1, 2013 and 0.21 percent beginning on January 1, 2014. The payroll tax would remain in effect at the 0.21 percent rate for New York City’s five boroughs.

This legislation also includes several measures to mitigate the immediate fiscal impact of the PMT phase-out on the MTA’s operating budget and in order to provide the MTA with the opportunity to implement greater operating efficiencies. These mitigation measures will result in the MTA having to absorb only $375.6 million in foregone PMT revenue by 2014, a tiny 2.4 percent of the expected $15 billion MTA operating budget.

These measures include:

*Direct up to $100 million Regional Greenhouse Gas Initiative (RGGI) funds collected within the MCTD to the MTA.

*Eliminate the PMT for public and non-public schools and state savings from the PMT reduction.

*Prohibit the use of transit funds for state General Fund relief and other purposes.

*Restore a portion of the New York City revenue sharing in SFY 2014-15 and have it dedicated to the MTA for New York City transit purposes.

*Dedicate a portion of the state sales tax on gasoline to transportation including transit and the Dedicated Highway and Bridge Trust Fund, which supports Department of Transportation capital spending.

Share this Article or Press Release

Newsroom

Go to NewsroomNY Jobs For Heroes Program Press Conference

January 14, 2014

Senate Report: Cut Red Tape to Create Jobs in New York State

January 13, 2014

State of the State Remarks

January 9, 2014