Senator Lanza Announces Small Business Emergency Loan Fund to Provide Assistance for Businesses Affected by Sandy

Andrew J Lanza

November 14, 2012

Senator Andrew Lanza today announced that the New York Bankers Association (NYBA) and the New York Business Development Corporation (NYBDC) have agreed to establish a $10 million small business emergency loan fund to provide immediate financial assistance for businesses impacted by Storm Sandy. Under the fund, businesses will be able to apply for loans of up to $25,000immediately by going to www.esd.ny.gov or calling 1-855-NYS-SANDY.

The emergency loan program will provide low-interest loans of up to $25,000 to small businesses in an expedited manner to help in the recovery efforts. The New York Business Development Corporation will manage and operate the loan program in coordination with Empire State Development (ESD).

Through the program, small businesses in affected communities will be eligible to receive loans of up to $25,000 that will be interest and payment-free for the first six months and then at one percent interest for the following two years. Eligible businesses can use the funding to cover the costs of replacement and repairs to facilities or equipment or as working capital needed to restart or continue business operations.

The emergency loan program is for independently owned and operated businesses that have fewer than 100 employees and are located in the counties designated as disaster areas: Orange, Putnam, Rockland, Sullivan, Ulster, Westchester, Nassau, Suffolk, and the five boroughs of New York City.

To be eligible to receive funding through the program, companies must have filed 2011 business tax returns and have experienced direct damage or economic hardship as a result of Sandy. Applications will be available within the week and businesses are expected to begin to receive funding five to seven days after submitting a complete application and the required documentation.

Created in 1955, NYBDC is a consortium of banks committed to supporting economic development and job growth opportunities in New York State by providing government guaranteed and conventional loans to small businesses at all stages of development. NYBDC works with its member banks to provide creative, responsive and cost effective financing solutions when a conventional alternative is not available through long-term working capital, equipment, and real estate loans to a variety of businesses located in New York State, either in participation with, or as an adjunct to, the banking industry.

Share this Article or Press Release

Newsroom

Go to Newsroom

Senator Lanza & Assemblyman Cusick Present the Shred Event

August 31, 2021

Senator Lanza & Assemblyman Cusick Host the Veterans BBQ

August 31, 2021

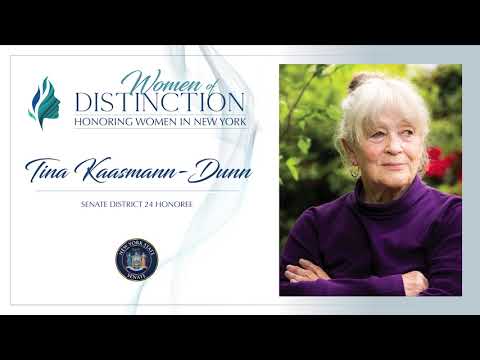

Senator Lanza 2021 Woman of Distinction

August 27, 2021