From the Desk of Senator Jack M. Martins

Jack M. Martins

June 18, 2012

-

COMMITTEE:

- Local Government

The Triple-Crown of Tax Relief

There certainly must have been a lot of disappointment in the days leading up to the Belmont Stakes as thoroughbred racehorse and Triple-Crown favorite, “I’ll Have Another,” showed signs of tendonitis and was scratched. I imagine it must have wreaked a fair amount of havoc on the sport, but I think most notable was the widespread, collective let-down that people experienced. Maybe we fall victim to so much press hype but I think it has something more to do with human nature. People love a winner, especially one that overcomes the odds, indisputably, three times over.

I feel that same sense of “triple-crown” anticipation in the New York Senate as we passed a bill last week that would restore the STAR Property Tax Rebate checks. The bill (S.7447) that I co-sponsored would mean $202 million back in the pockets of senior citizens in the 2012-13 school year and $1.2 billion back to middle- class families starting in 2013-14.

The STAR rebates were originally designed to give some relief to overtaxed property owners and frankly, people came to rely on them, especially seniors in over-taxed areas like Long Island and Westchester. Unfortunately, it was repealed in 2009 under then Governor Paterson and the NYC-based Senate Democratic Majority.

Now, we’re fighting to get it back for you. If we can make it happen, I would consider it the triple-crown of tax relief. First, we passed a 2 percent property tax cap, which saved property taxpayers an estimated $456 million. Then we changed the state’s tax code and lowered income taxes for more than 4 million middle-class New Yorkers to the lowest levels in over 50 years. Now we’re working towards restoring the STAR rebate.

Why this continued focus on taxes? Because getting them under control will start New York on the road to being affordable again. Make New York affordable again, and business returns, bringing with it jobs and a better way of life.

Consider that the median property tax paid nationally is $1,917, while we New Yorkers pay $3,755. That’s a whopping 96 percent more. We pay the highest local taxes in the country as a percentage of personal income, almost 80 percent above the national average. And within New York, Nassau County property owners have it even worse - a median property tax of more than $8,200 per year! Needless to say, there is no other issue as core to New Yorkers and their quality of life as taxes, especially on Long Island. They’re always in the back of everyone’s minds and on the tips of some very angry tongues, and rightly so.

The state has now passed two fiscally responsible budgets that have remained within the 2 percent spending cap for two years running and we believe those savings should be going to homeowners via the STAR rebate checks. But we know Rome wasn’t built in a day. That’s why our bill includes a gradual increase in the rebate amounts through 2017. Just in case there are years when the budget doesn’t allow for rebates, we’ve even included a provision that would let taxpayers claim a property tax credit, equivalent to their rebate check, against their personal income taxes.

The bill is a well-thought out attempt to keep the trend of tax relief in motion. Now all we need is Governor Cuomo and the Assembly to get behind the STAR Rebates and approve the bill.

We have high hopes and, who knows, maybe New York’s tax payers will be treated to a triple-crown this year after all.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins' Toy Drive 2025

November 10, 2025

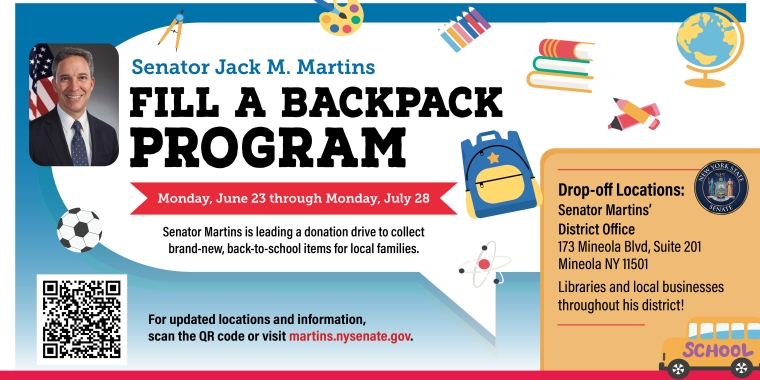

Fill a Backpack Program

June 10, 2025