From the Desk of Senator Jack M. Martins

Jack M. Martins

April 3, 2012

-

ISSUE:

- Local Government

- Foreclosure

-

COMMITTEE:

- Local Government

Help for Homeowners

It started out simple enough. Since taking office I’ve had a small but steady stream of constituents who seek help with various mortgage and foreclosure problems. I regularly connect them to appropriate state agencies and having heard back about a number of successful resolutions, I decided to host a local seminar for anyone experiencing similar issues. I invited the New York Attorney General’s (AG’s) Office, the state’s Department of Financial Services, and even some of the larger lenders.

I thought booking a large meeting room at the Elmont library was overkill as we had only 25 constituents RSVP, but when I arrived that Saturday morning my jaw dropped. More than 420 people were waiting. Entire families were there, lined up against the walls, waiting in the hall, some even sitting on the floor between rows of chairs. My stomach sank as I looked into what I could see were desperate faces. Not knowing where to start with such a large crowd, we broke off at three tables: the AG’s office at one, Financial Services at another, and my staff at yet another. I canceled all my appointments that morning as I became absorbed in what was a sobering experience.

Let me start by confirming that with few exceptions, most were employed, hard-working couples, with fair to good credit, who were now inexplicably facing a mortgage crisis, or worse, foreclosure. As our offices interviewed, a recurring pattern of unfair lending practices became evident. Truthfully, it’s hard to believe how some lenders scam people with the same, well-worn techniques, time and again. The AG’s office left that day with 300 legitimate cases.

For example, I met a well-employed Latino couple that spent years saving for a down payment and whose credit had been near-perfect. They were now facing foreclosure because of astronomical mortgage payments. I asked how this happened given their fairly decent circumstances. It turns out their lender continuously promised to have a translator available to help with contracts but one never materialized. At their closing, the lender actually had the couple’s grade-school children translate for them! Naturally, their contract was a sham and their mortgage rate eventually ballooned. Not only were they losing their home but their credit rating was being destroyed. Like many immigrants, they spoke English but hardly understood contract legalese. The fact is the lender didn’t want anything translated and sadly, this happens all too often.

We also heard numerous complaints from those who had applied for loan modifications. They came with all their paperwork in order and even produced signed, certified mail documentation as evidence it had been received. Yet repeatedly, these families waited for months on end without any response whatsoever. Written correspondence and phone calls were routinely ignored. One senior citizen even allowed me to listen to a disturbing, taped conversation with her lender in which her agent was downright disrespectful and dismissive.

I could go on but it wouldn’t be helpful. Instead, I want those facing these dire straits to know you don’t have to go it alone. Our state’s Attorney General’s office and our Department of Financial Services have attorneys who can, where appropriate, interface with lenders and facilitate fair resolutions. But you must take the first step so I encourage you to visit “Help for Homeowners” at www.dfs.ny.gov/consumer/mortg.htm and get informed. Then please remember that patience, persistence and preparation are key to sorting through these paper trails and keeping your piece of the American dream.

Instability in our housing market including foreclosures in our own communities actually affects us all. The sooner we are able to restructure our home loans to provide stable and predictable payments, the sooner we can take a huge step to climb out of this economic downturn.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins' Toy Drive 2025

November 10, 2025

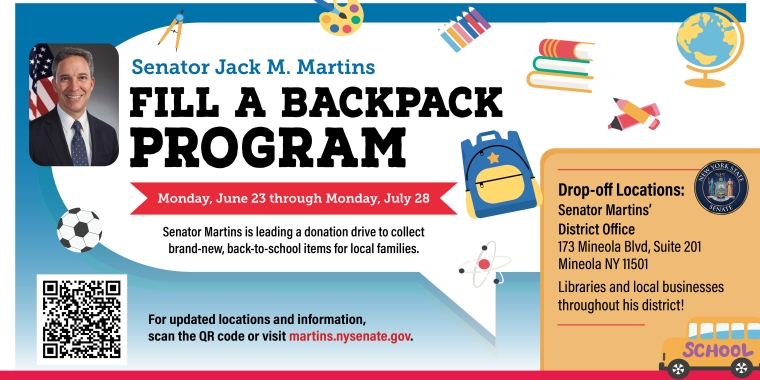

Fill a Backpack Program

June 10, 2025