2012 New Jobs-NY Job Creation Plan

James L. Seward

May 22, 2012

ALBANY, 05/22/12 – State Senator James L. Seward (R/C/I-Oneonta) today announced that the senate will pass legislation next week to implement the 2012 New Jobs-NY Job Creation Plan. The senate’s comprehensive plan will help create thousands of new private sector jobs by delivering tax relief to small businesses and manufacturers, reducing energy costs, and enacting major fiscal reforms to make New York state more economically competitive.

“Fostering private sector job growth in upstate New York is a key to strengthening our communities and helping families improve their quality of life,” Senator Seward said. “The senate jobs plan is a tool that can be used by our small business owners, manufacturers and entrepreneurs who want to grow right here at home. The proposal will also offer incentives for new companies to locate within the Empire State.”

Senate Republicans first approved a small business tax cut plan as part of its budget resolution in early March. However, the tax cuts were not included in the final 2012-13 state budget.

“Over the past two years, we’ve enacted two fiscally responsible state budgets, reduced government spending, held the line on taxes and enacted a historic property tax cap. This tax cut and job creation plan will build on the achievements and take significant steps to further stimulate New York’s economy,” added Seward.

Among the highlights of the Senate Republican’s New Jobs-NY plan, which is supported by statewide business organizations, including the Business Council of New York, Unshackle Upstate and the National Federation of Independent Businesses, are the following:

• Eliminating Taxes on New York Manufacturers: The plan would spur creation of thousands of manufacturing jobs by eliminating income taxes paid by manufacturers over a three year period ($495 million in tax relief).

• 20 percent Corporate Tax Cut for Small Businesses: This cut in the corporate tax rate will save nearly 200,000 small businesses $49 million.

• 10 percent Personal Income Tax Credit for Small Businesses: This tax cut would save 800,000 small businesses $80 million.

• Major Energy Tax Cut: The legislation accelerates the phase-out of the 500 percent energy tax hike Senate Democrats previously approved.

• New Incentives for Each New Job Created: The bill includes new job-creating incentives that would give businesses a tax credit of up to $5,000 for each new job they create; up to an $8,000 credit if the new job goes to someone on unemployment; up to a $10,000 credit if a business hires a returning military veteran.

• Help for New York’s Small Brewers: The plan includes a new production credit and label registration credit for New York’s vibrant craft brewing industry.

• Fiscal Reforms to Improve New York’s Business Climate: The plan includes a two percent state spending cap; a super-majority vote provision to make any future tax increases more difficult; and new regulatory reforms to reduce red tape for businesses.

Heather Briccetti, president and CEO of The Business Council of New York State, Inc. said: "We applaud the Senate Majority's continued focus on reducing the cost of doing business, lowering the state's business burden on business, and reducing the cost of creating jobs. This package focuses on key sectors and emerging industries, and will promote new private sector investments

and critically needed new jobs."

Mike Durant, state director of the National Federation of Independent Business, said:

"The past few weeks have seen continuous discussion in the other house on issues that not only harm small business, but hurt those that seek meaningful employment. This legislation is aimed at real problems and reaffirms the Senate Majority's commitment to revitalizing our economy and helping spur new and innovative economic development opportunities. Simply, this is another step in the right direction for New York."

Brian Sampson, Executive Director of Unshackle Upstate said: “Our organization has consistently called for much-needed tax cuts for the businesses and taxpayers across upstate and we are particularly pleased with the senate’s commitment to reducing taxes on our manufacturers and eliminating the onerous, hidden 18a energy surcharge a year earlier than expected. After weeks and months of endless talk about raising the cost of business in New York, we now call on the assembly to introduce and pass this bill to help boost private sector job growth, get our economy back on track, and demonstrate to the world that we are truly serious about changing the reputation of the state.”

MACNY President Randy Wolken stated, "For years, MACNY has stated the way Albany treats its manufacturing community will have significant impact on the state's overall wellbeing, and I am pleased to see the Senate Majority has listened and acted on our message. Eliminating costly and burdensome taxes including the corporate franchise tax will allow for the state's manufacturing community to invest their dollars in more productive and necessary areas to help foster statewide growth: supporting and adding good paying family supporting jobs, making significant capital investment in their businesses and investing dollars back into their communities. This is a big day for manufacturers statewide, and I applaud the Senate Majority for their leadership on this significant investment in our state's manufacturing community."

-30-

Share this Article or Press Release

Newsroom

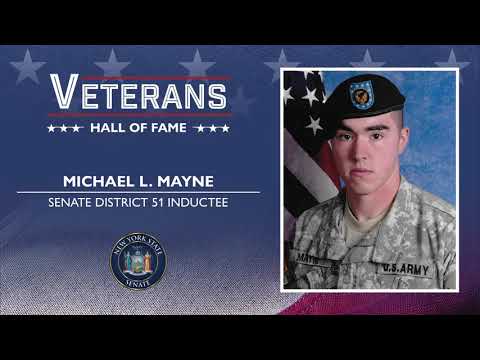

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020