Senator Seward Renews Call For Measures To Fight Auto Insurance Fraud

James L. Seward

May 8, 2012

-

ISSUE:

- Crime

- Insurance

- Insurance Fraud

New York State Senate Majority Leader Dean G. Skelos, Senate Insurance Committee Chairman Senator James L. Seward and Senator Martin Golden today joined law enforcement, insurance advocates, business groups, and victims to press for the assembly’s passage of three auto insurance fraud prevention bills before the end of this year’s legislative session. Auto insurance fraud costs New Yorkers million of dollars each year and has led to injuries - even death - for innocent victims.

The package of legislation passed by the senate in March would significantly cut down on auto insurance scams by increasing penalties for those who commit or assist in the fraud and gives more flexibility to insurance companies to prevent such criminals from getting policies and continuing to commit auto fraud.

“New Yorkers are paying too a high price, both in auto insurance premiums and their well-being, because of unscrupulous criminals who profit from staging automobile accidents,” Senator Skelos said. “Year after year the senate has passed legislation to stop auto fraud criminals, but we need the assembly to act before another session concludes so that we can help put an end to this dangerous and costly crime.”

“Comprehensive no-fault reform is desperately needed to reduce auto insurance costs, put law-breakers behind bars and protect innocent victims,” Senator Seward (R,C,I- Oneonta) said. “The senate has recognized the need for change for some time and the Governor’s administration is also taking action to crack down on this escalating scourge. The Assembly needs to join the effort so we can put these criminal enterprises out of business for good.”

Senator Marty Golden said: "Insurance fraud is costing every driver in New York from Montauk to Buffalo and from Brooklyn to Ogdensburg. We owe it to every consumer to put the brakes on this fraud now. We must make laws that prove New York is serious about cracking down on auto insurance fraud and that we can no longer tolerate this because of the many devastating effects it is having on our economy, our court system, and on our families."

Senate action on the bills this year came on the ninth anniversary of the tragic death of Alice Ross, a 71-year-old wife and grandmother who was killed as the result of a fraud-related, staged auto accident in Queens. One of the criminals drove into her car, causing her to lose control of her vehicle, strike a tree and die.

In addition to risking the safety of innocent drivers, fraud is a key reason why New Yorkers pay over 50 percent more for auto insurance premiums than drivers in other states. Organized crime rings comprised of doctors, lawyers, patients and others, stage accidents, fake injuries, submit false insurance claims and rip off insurance companies and the state’s Medicaid system to the tune of billions of dollars.

In February, the longest-running auto insurance rip-off scam in history was busted by federal and New York City authorities. Three dozen people, including doctors, lawyers and patients coached to fake injuries, are accused of stealing more than $279 million in accident benefits over five years. The ring allegedly exploited the state’s "no-fault" auto insurance law as their own giant state-sponsored ATM machine. In New York, vehicles registered in the state are required to carry insurance that lets drivers and passengers obtain up to $50,000 for accident injuries, regardless of fault.

A separate auto fraud ring in Brooklyn was recently shut down when 16 people were arrested and charged with intentionally causing a dozen accidents involving unsuspecting motorists between 2009 and 2011. The suspects then submitted fraudulent insurance claims, ripping off insurance companies for $400,000.

The state Department of Financial Services responded to red flags indicating the possibility of even more incidents of auto-fraud when it sent letters to 135 doctors in the metropolitan area after finding their billing practices “raised concerns regarding possible no-fault fraud.” The agency ordered them to provide documents supporting billed treatments or be banned from the no-fault system.

Brooklyn District Attorney Charles J. Hynes said: “The passage of these bills is essential to our ongoing enforcement of auto fraud. They would make it more difficult and costly in terms of sentences upon conviction for people to be repeat auto fraud offenders, stage phony accidents and act as runners enabling rip-off artists to commit crimes. I thank the state Senate for its hard work on these issues and urge the Assembly to pass these bills as well.”

Ellen Melchionni, President of the New York Insurance Association, said: “No-fault auto insurance fraud is a serious public safety issue in New York. Criminals have made fraud a ‘big business’ and are cashing in by threatening the safety of our roadways and stealing money out of the pockets of honest New Yorkers. It is crucial that the Legislature act this year to put measures in place that stop fraud and protect our state’s citizens.”

Kristina Baldwin, Assistant Vice President for Property Casualty Insurers Association of America and Co-Chair of Fraud Costs New York, said: "These important bills will go a long way to give prosecutors the tools they need to combat no-fault auto insurance fraud, which is crippling small businesses and individual drivers alike. I applaud the Senate for its actions and look forward to working with both houses of the Legislature to bring about the reforms we desperately need to protect New York drivers."

In a March 30 editorial, The Buffalo News called the Senate’s legislation “a powerful trio of bills to combat con men.” The legislative package includes:

· Bill (S.1685), sponsored by Senator Seward (R,C,I- Oneonta): makes it a crime to stage a motor vehicle accident with intent to commit insurance fraud. This felony crime would be punishable by up to seven years in prison. (A.6177, sponsored by Assemblyman David Weprin, D-Queens)

· Bill (S.2004), sponsored by Senator Skelos (R, Rockville Centre): makes it illegal to act as a “runner” who steers accident victims towards crooked doctors who bill Medicaid for unnecessary medical treatments. Runners are key members of auto fraud rings. Under this bill, they could get four years in prison. (A.9768, sponsored by Assemblyman J.Gary Pretlow, D-Westchester)

· Bill (S.4507B), sponsored by Senator Golden (R-C, Brooklyn): allows insurance companies to retroactively cancel policies taken out by people who commit auto fraud. These criminals often take out policies and pay for them with bad checks or stolen credit cards just before they stage accidents. Under current law, insurance companies cannot cancel the policy and policyholders wind up paying for it through higher premiums. This bill would take that burden off honest consumers. (A.6346A, sponsored by Assemblyman Carl Heastie, D-Bronx)

Richard Savino, President of The Professional Insurance Agents of New York State Inc. said: “PIANY supports the Senate Majority Conference's efforts to address automobile insurance no-fault fraud and applauds this most recent action. It is critically important that action is taken immediately, because if nothing is done to contain runaway no-fault claim costs it is a virtual certainty that costs and premiums will continue to rise indefinitely and that someday soon New York will hold the dubious distinction of the state with the most expensive auto insurance in America.”

All three bills are pending in the assembly.

-30-

Share this Article or Press Release

Newsroom

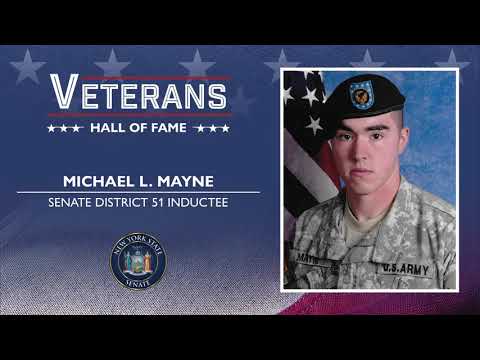

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020