Senate Passes Ritchie Bills to Support State’s Craft Breweries

Patty Ritchie

June 18, 2012

Includes Measures to Increase Demand for Locally Grown Farm Products

State Senator Patty Ritchie has announced Senate approval of a package of bills to boost the farming industry and help expand the state’s growing craft beer industry.

The legislation is designed to support New York’s breweries and wineries, increase demand for locally grown farm products and to foster both economic and development and tourism in the areas of New York State where breweries and wineries exist.

“Here in New York State, the craft brewing industry consists of more than 90 breweries, employs thousands of people and is responsible for more than $200 million of economic activity every year,” said Senator Ritchie.

“This legislation provides opportunities not only for that industry to continue to grow, but also for our state’s farmers to benefit from the success of craft breweries.”

The legislation includes the following provisions, that will benefit craft breweries and farmers:

The protection of a vital tax benefit for New York State breweries: Under the bill, S.7728, any brewery producing 60 million or less gallons of beer in New York would qualify for a refundable tax credit applied against New York State personal income and businesses taxes.

An exemption for small breweries from paying annual state liquor authority fee: Under S.7728, small breweries producing brands of 1,500 barrels or less annually would be exempt from the $150 annual brand label fee.

The creation of a “Farm Brewery” license to promote growth of craft breweries: The “Farm Brewery license would allow craft brewers using products grown in New York State to operate in a fashion similar to the state’s Farm Wineries.

Under the Senator Ritchie sponsored bill, S.7727, Farm Breweries would be allowed to do the following: sell New York State labeled beer, wine and liquor at their retail outlets for off-premises consumption, open restaurants, conduct tastings of New York State produced beer and wine at their facilities and sell beer making equipment, supplies, food complementing beer tastings, souvenir items and other products similar to those under the Farm Winery statute. Under S.7019, Farm Wineries and Distilleries, as well as Farm Breweries would also be exempt from burdensome tax filing requirements.

In order to qualify for a Farm Brewery license, beer must be made primarily from locally grown products. Until the end of 2018, at least 20 percent of the hops and 20 percent of all ingredients must be grown or produced in New York State. From January 1, 2018 to December 31, 2023, no less than 60 percent of the hops and 60 percent of all other ingredients must be grown or produced in New York State. After January 1, 2024, no less than 90 percent of the hops and 90 percent of all other ingredients must be grown or produced in New York State.

The legislation is modeled after the 1976 “Farm Winery,” act, which helped New York become a world leader in locally produced wines and helped to create 249 Farm Wineries; tripling the number of wineries in New York State.

“Back in the late 19th century, New York State grew nearly 90 percent of our nation’s hops; the crop was a huge part of the economy,” said Senator Ritchie.

“The creation of a Farm Brewery license will be a win-win for New York State. Requiring craft breweries to use locally grown products will not only result in great tasting beer—but will also provide a big boost to our state’s agricultural industry.”

The bills are expected to pass the Assembly.

Share this Article or Press Release

Newsroom

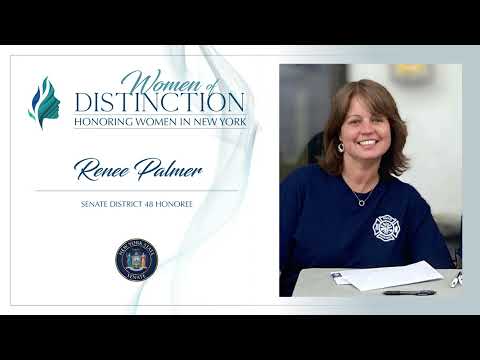

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022