Senator Ritchie Reminds Seniors to Apply for “Enhanced” Star

Patty Ritchie

February 1, 2012

“Doubles Your Tax Savings” But Applications are Due March 1

State Senator Patty Ritchie is reminding senior citizens who are turning 65 this year—and own their homes—that they could be eligible for additional property tax savings through the state’s “Enhanced STAR” program.

“I have been working hard as your State Senator to hold the line on taxes—and even reduce them,” Senator Ritchie said. “I voted to cut taxes and spending at the state level, and I’ve been working with your local representatives to help lower the cost of government to provide relief to hardworking taxpayers. But if you’re turning 65 anytime during this year, you should know there is something you can do to reduce your property tax bill right now.”

“Enhanced STAR can double your tax savings over Basic STAR, which is available to most homeowners—but you must apply for this important property tax benefit,” Senator Ritchie said.

The deadline to apply is March 1. In the City of Watertown, the deadline to apply is November 1.

Senior homeowners who live in their primary residence, and earned $79,050 or less (based on 2010 income tax returns) can apply through your local Assessor, or by downloading the form below.

Enrolling in the optional Income Verification Program eliminates the need to reapply for Enhanced STAR each year.

Share this Article or Press Release

Newsroom

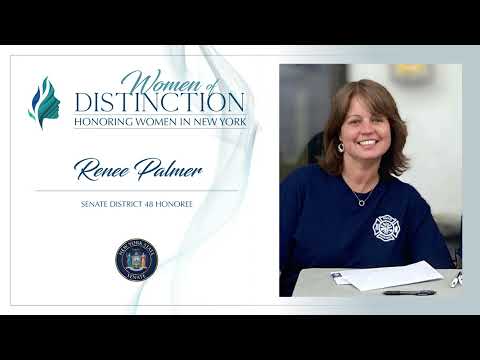

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022