Senator Carlucci Proposes "Jobs for Heroes" Legislation to Boost Statewide Economy, Reduce High Unemployment Among Returning Veterans Post 9/11

David Carlucci

February 4, 2013

-

ISSUE:

- Veterans

Tax credits will benefit all employers who hire a post-9/11 war veteran to a new, full-time job

CONGERS, N.Y. – Seeking new and effective ways to spur job creation and address perennially high unemployment rates amongst New York’s returning combat veterans, Senator David Carlucci (D-Rockland/Westchester today introduced legislation to provide major tax credits to private employers hiring veterans discharged after 9/11.

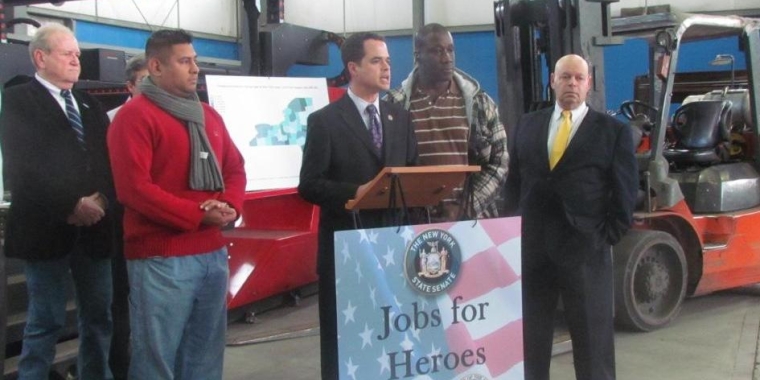

The announcement took place at Rockland-based United Structural Works in Congers, a company that specializes in structural steel fabrication and erection. Young veterans, business leaders, and advocacy organizations joined the Senator in speaking about the benefits of giving economic incentives to jumpstart hiring.

Senator David Carlucci (D-Rockland/Westchester), prime sponsor of the tax credit legislation (S.3043), said: "Jobs for Heroes gives our next generation of brave veterans the assistance they need to get back on their feet and into today's workforce. Our heroes have served our country with courage and valor on the battlefield, and it is only fair that we do everything we can to assist them once they return to the Empire State. Through smart investment and tax relief, this legislation will grant new financial incentives for businesses that decide to hire a veteran as their next standout employee. I am proud to sponsor this bipartisan bill and look forward to working with all stakeholders who have a shared interest in seeing this signed into law."

New York State is home to more than 8,000 unemployed post-9/11 veterans. The unemployment rate among these veterans is a startling 10.7%, according to statistics released today by the Bureau of Labor Statistics. Under the proposal released today, business owners who employ a post-9/11 war veteran to a new, full-time job will receive a state tax credit equal to 10% of the new employee’s gross annual salary. The tax credit can be up to $10,000 for each non service-disabled veteran and up to $15,000 for each newly hired service-disabled veteran. Employers may apply the tax credit towards each and every new veteran that they hire for a qualifying job, without limit.

The legislation, named “Jobs for Heroes,” has the backing of Senate Majority Coalition Co-Leader Jeffrey D. Klein (Bronx/Westchester). It also attracts Republican support from State Senators Mark Grisanti (R-Erie) and Greg Ball (R-Putnam). Senator Carlucci is the prime sponsor of the bill.

Jeff Klare, Chief Executive Officer of Be a Hero-Hire a Hero, said: “These brave men and women have been taught to be great and failure is not an option. They have given of themselves and now it’s time to give back to them. We at Be a Hero-Hire a Hero are in full support of this proposed legislation and the efforts of Senator Carlucci. By making the transition from the military to civilian life easier, by giving business an incentive to hire our American heroes, we can say to our veterans – Welcome Home."

# # #