From the Desk of Senator Jack M. Martins

Jack M. Martins

March 20, 2013

-

ISSUE:

- Local Government

- Taxes

-

COMMITTEE:

- Local Government

The Smaller Picture

I wish I could remind all the folks in Washington D.C. and Albany that if they look beyond the special interest agendas that consume them, they would find most of us still waiting on what counts: the economy.

For all the media hoopla that highlights and exploits our disagreements, most people want exactly the same things: they want to work and make a decent living at a job that’s secure; they want to raise their families in peace; they want a good education for their kids and maybe a few of the finer things in life like a vacation or a new car once in a while. I don’t think that’s too much to ask. At one time all of these were taken as a given.

A lot of people in government are so concerned with the “big” issues that they often seem to miss that simple message. Sometimes our leaders need to see the smaller picture too, because that’s where most of us live.

That’s why I am trying to get some common sense reforms passed in Albany. The first is the Family Tax Relief Act. Most New Yorkers don’t realize that some of our state tax breaks haven’t been adjusted to keep up with increased costs in more than 25 years. We have 1987 tax breaks for a 2013 life and that’s unacceptable. Our houses don’t cost what they did in 1987, nor do our cars, nor does a college education. A dozen eggs were 78 cents and gas was only 89 cents per gallon! So, while the cost of living has skyrocketed, the state has treated our income exactly as it did when things cost much less, making our tax breaks progressively worth less and less each year. When enacted, these credits were worth more than $2,000 per family. Today, they’re worth an anemic $800.

To fix this, we propose a number of adjustments, first being the restoration of the STAR rebate checks that were eliminated in 2009. This relief is especially important to us on Long Island, paying some of the highest property taxes in the country. The re-instated rebate would average $445 per property, $460 for seniors, and would put $1.3 billion back in your pockets and back into the economy.

Second, an increase to the Dependent Exemption (the amount you can subtract from your gross income for each dependent), is also long overdue. It’s still the same $1,000 it was in 1987 so we’ve proposed increasing it to over $2,000 per dependent. This would go hand-in-hand with an increase to the Dependent Care Credit, which helps cover the costs of raising a child.

Third is to increase the maximum Child Tax Credit from $330 to $375 to adjust for today’s higher costs. This credit applies to married-joint filers with combined income of less than $130,000, who have a child between 4 and 16. In addition, we are proposing an additional $500 Child Tax Credit for all New York families, to help cope with the escalating costs of raising a family.

These are not radical budget-busting changes but simple, common-sense adjustments that are fair and long-overdue. They would not be possible had we not been able to balance the state budget these last two years. But with that accomplished, it’s time to rebuild our local economy. I still believe that starts by increasing the spending and savings power of all New Yorkers and that means keeping their hard-earned money in their own hands.

Let’s keep our eye on the smaller picture – it’s the one that matters most.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins' Toy Drive 2025

November 10, 2025

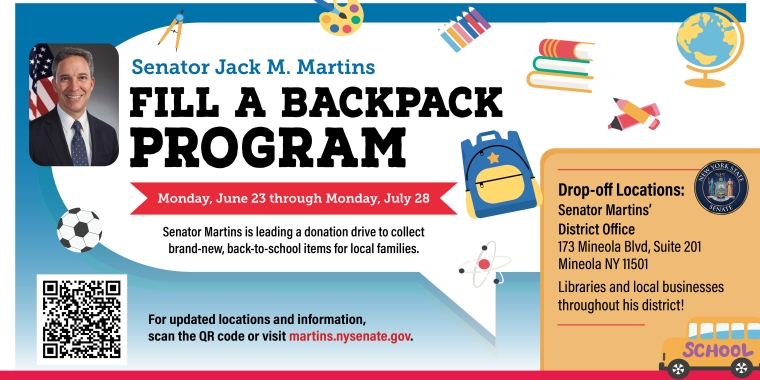

Fill a Backpack Program

June 10, 2025