Golden, Malliotakis Join Rep. Grimm’s Call to Fix Policy that Will Keep Sandy Survivors from Recovery Funds

Martin J. Golden

May 6, 2013

Residents who applied for and turned down SBA loans

may not be eligible for CDBG recovery grants distributed by NYC

NEW YORK, NY – Today, Rep. Michael G. Grimm (R,C-SI/Brooklyn) was joined by State Senator Marty Golden (R-Brooklyn) and Assemblywoman Nicole Malliotakis (R,C,I-Brooklyn/SI) in calling for a change to a federal policy that, if left unchanged, will limit available grant funding to Sandy survivors who turned down SBA loans to avoid going deeper into debt. This morning, Rep. Grimm sent a letter to HUD Secretary Shaun Donovan asking him to waive the policy or implement a viable alternative solution. The call is quickly gaining support from state and local officials.

“Those impacted by Sandy have already suffered tremendous loss and accrued significant amounts of debt. Now many may lose access to grant funding for making a responsible decision to turn down a loan they simply cannot afford to pay back. It is simply unfair to punish those who have played by the rules. That is why I am calling for a viable solution that puts all Sandy survivors on a more equal playing field, and I am pleased to receive growing support for this effort from other leaders in Staten Island and Brooklyn,” said Rep. Grimm.

"It has now been more than six months since Sandy, and the people of Gerritsen Beach, Sheepshead Bay and Manhattan Beach, are still looking for assistance in order to get their lives back on track. Many families lost everything and had to start over, rebuilding their homes, buying their cars, and so much more. To deny this funding is both absurd and wrong, and I would ask that Secretary Donovan, who knows New York City well, realize both the great needs and expenses still facing Sandy survivors,” said Senator Golden.

"As survivors fight to recover from Sandy's destruction, economic realities have placed limits on what options they can afford. Many couldn't accept an SBA loan because they were simply unable to take on more debt. The current CDBG action plan would in essence force these people into a loan program that they aren't comfortable with, a red flag in any responsible lender-borrower relationship. Classifying declined SBA loans as 'unclaimed benefits' would be unfair and it is our hope that HUD will step in to rectify this,” said Assemblywoman Malliotakis.

###

The text of Rep. Grimm’s letter can be found below:

May 6, 2013

The Honorable Shaun Donovan

Secretary

U.S. Department of Housing and Urban Development

451 Seventh Street, SW

Washington, DC 20410-1000

Dear Secretary Donovan:

New York City’s Community Development Block Grant (CDBG) - Disaster Recovery Plan is currently under review by the Department of Housing and Urban Development (HUD), and is expected to be approved in the near future. I have heard growing concerns regarding unclaimed Small Business Administration (SBA) loans that will count against the benefits that will be made available to homeowners recovering in the aftermath of Superstorm Sandy. In order to help those impacted by the storm recover, I am asking you to use your waiver authority as Secretary of HUD, or an alternative method, to exclude unclaimed SBA loans from being classified as “received benefits” that will ultimately count against, and reduce, a homeowner’s recovery grant.

It is my understanding that the guidelines put forth in the November 16, 2011 Federal Register Vol. 76, No. 221 are the basis for determining the amount of CDBG funds distributed by the City of New York to those eligible for recovery grants. The formula accounts for need minus benefits “received” (such as FEMA, insurance claims, and SBA loans) as well as benefits “available.” Available benefits include SBA loans applied for but not claimed. In contrast, these guidelines exclude private loans. I am asking that “available” SBA loans be treated like private loans, and thus be excluded from consideration when determining the value of the grant awarded.

I am aware that the intent of the guidelines is to eliminate “fraud, abuse of funds, and duplication of benefits.” I agree wholeheartedly that we should be doing all we can to ensure that every dollar is used to meet the unmet needs of those impacted. My constituents, however, are not looking to scam the system; they are simply looking for assistance after they have lost everything in this devastating storm.

Many impacted by the storm did exactly as they were told by officials. They registered for FEMA aid, filed claims with their insurance companies, and applied for SBA loans. As the recovery process moved forward, many found themselves deep in debt – paying a mortgage on a home they could no longer live in, while paying rent to keep a roof over their heads. Others drained their savings to pay for repairs. Some qualified for SBA loans, but refused them, to avoid going even deeper into debt.

By counting these unclaimed SBA loans as a received benefit, we are creating a circumstance where people who played by the rules and maintained good credit will be punished with additional debt, while others remain eligible for a grant. Those who chose not to accept the SBA loan because they knew they could not afford it, acted prudently and responsibly by refusing to take on debt they could not pay back. That decision will now keep them from receiving aid that will be available to those who never applied for loans in the first place. This is simply unfair, which is why I am requesting your assistance to level the playing field for all who were impacted by the storm.

Once again, I am respectfully requesting that you explore any options to exclude available SBA loans from being categorized as assistance received by homeowners. Should a simple waiver not be a viable option, I look forward to working with you on an alternative solution. Thank you again for your attention to this matter. I look forward to your prompt reply.

Sincerely,

MICHAEL G. GRIMM

Member of Congress

Share this Article or Press Release

Newsroom

Go to Newsroom2018 Civil Service & Pensions Committee Annual Report

December 27, 2018

Golden to Mayor: Time for police negotiations long overdue.

August 6, 2018

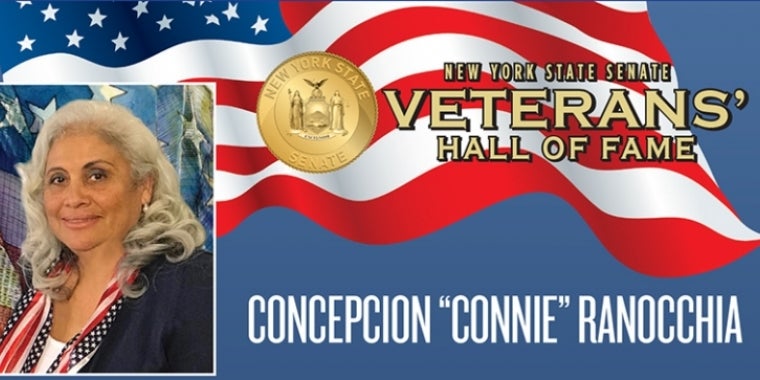

Concepcion "Connie" Ranocchia

May 15, 2018