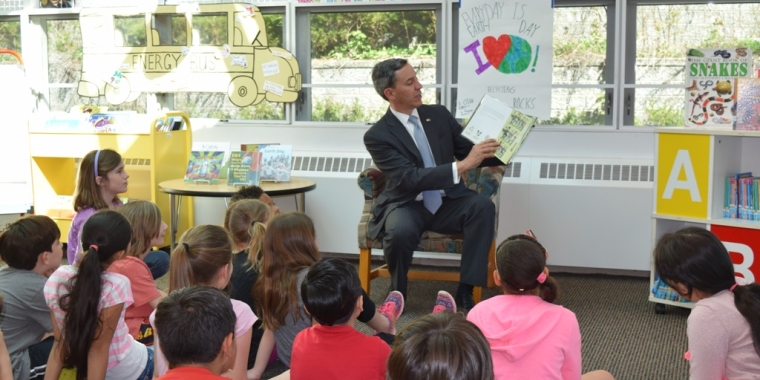

Senator Martins Announces Passage of Legislation That Provides $3.1 Billion in New Property Tax Relief, Extends the Tax Cap, and Implements Significant Education Reforms

Jack M. Martins

June 26, 2015

-

ISSUE:

- Government Operations

Senator Jack M. Martins (R-7th Senate District) announced that the New York State Senate has passed legislation that will bring $3.1 billion in new tax relief to property owners, extend the existing property tax cap to deliver additional savings and create new jobs, improve affordable housing statewide, and continue the Senate’s ongoing commitment to ensuring that every child has access to a quality education. The legislation has also been passed by the Assembly and signed into law by Governor Andrew Cuomo.

"We acted on legislation that will deliver on key priorities for residents throughout the state. Passing this legislation will provide billions of dollars in tax relief to homeowners, extend the property tax cap, and make significant changes to the education system which will benefit students and teachers alike. Each of these measures will make a positive difference for Long Islanders and New Yorkers in every region of the state. I am pleased to support them," said Senator Martins.

STAR-eligible homeowners throughout the state will be eligible for $3.1 billion in new property tax rebates over the next four years, starting in 2016. When the new rebate amounts are combined with the existing tax freeze check planned for next year, a total of $900 million in property tax relief checks will be sent – an average of approximately $350 per eligible homeowner statewide. In 2019-2020, this new tax relief will be fully phased in and a total of $1.3 billion will be issued to taxpayers.

The legislation also extends the highly effective property tax cap that has already saved taxpayers $7.6 billion over the past four years. The cap had been set to expire in 2016-2017 but will now be extended to 2019-2020, bringing certainty to taxpayers and businesses.

Significant education reforms were also adopted to provide greater transparency and accountability, ensure that standardized tests are more age and grade-level appropriate, and that the tests are actually used to enhance learning rather than just gather data. The reforms were based off of concerns raised by both parents and teachers. Measures include:

• Empowering both parents and teachers by directing the State Education Department (SED) to release test questions and the corresponding correct answers back to teachers in their respective classrooms by June 1st of each year. This will ensure greater accountability and transparency in testing, while also ensuring that tests are used as real teaching tools;

• Eliminating the “gag” order that had prevented teachers from discussing tests with their students;

• Helping students by enacting new measures to ensure that state exams in grades 3 through 8 are grade-appropriate and time-appropriate;

• Establishing a content review committee to review exam questions to ensure that they are aligned with the standards and are age and grade-level appropriate; and

• Protecting teachers by establishing in the education law a requirement that SED must consider student characteristics (such as English language learners, students with disabilities, students in poverty, and a student’s prior academic history) as factors in the calculation of a teacher’s student growth scores.

These reforms build upon the $1.4 billion school aid increase in this year’s state budget- an increase of hundreds of millions of dollars above what the Governor originally proposed in his Executive Budget proposal – for a total state education aid investment of $23.5 billion. This funding increase also helps reduce the pressure to raise local taxes by giving school districts additional resources to ensure children are college and career ready. The budget also included significant funding restorations to local school districts that were cut as part of the harmful Gap Elimination Adjustment, which was implemented before Senator Martins took office.

Share this Article or Press Release

Newsroom

Go to Newsroom

Senator Martins to Hold “Shed the Meds” Program on May 14th

April 22, 2016

Track Your Income Tax Refund Status

April 21, 2016