Senator Golden Announces Legislation That Provides Protection for Renters and Homeowners

Martin J. Golden

June 26, 2015

Brooklyn – State Senator Martin J. Golden (R-C-I, Brooklyn) today is announcing that the New York State Senate concluded the 2015 legislative session by voting to bring much needed protection for the renters and homeowners of his district.

Senator Martin J. Golden stated, “The Senate continues to fight to protect renters from unscrupulous landlords and alleviate financial burdens for homeowners. We must continue our efforts to ensure that all New Yorkers have access to quality affordable housing and provide real tax relief for homeowners.”

Senator Marty Golden joined his colleagues in the State Senate in supporting legislation that included the following protections for homeowners and renters in New York City:

Property Tax Cap- The Senate also succeeded in extending the highly effective property tax cap that has already saved taxpayers $7.6 billion over the past four years. The cap had been set to expire in 2016-2017 but will now be extended to 2019-2020, bringing certainty to taxpayers and businesses.

STAR- Eligible homeowners throughout the State will be eligible for $3.1 billion in new property tax rebates over the next four years, starting in 2016. When the new rebate amounts are combined with the existing tax freeze check planned for next year, a total of $900 million in property tax relief checks will be sent – an average of approximately $350 per eligible homeowner statewide. In 2019-2020, this new tax relief will be fully phased in and a total of $1.3 billion will be issued to taxpayers.

Emergency Tenant Protection Act – In addition to extending the lapsed Rent Control Laws until June 2019, the Tenant Protection Act will also expand the current law to further protect renters from unfair treatment or abuse.

Enhanced Real Property Credit for NYC – This allows for a personal income tax for homeowners or renters who reside in New York City and whose real property taxes or rent equivalent to real property taxes exceed a certain amount of their household income. The Enhanced Real Property Tax Circuit Breaker Credit for NYC tax is extended to 2020.

NYC Partial Abatement for Condominiums/Co-Op Units – This program, which reduces a portion of taxes for residents who live in condominiums and Co-Op units, has been extended for four years.

The bill passed the Assembly and is expected to be signed by the Governor.

Share this Article or Press Release

Newsroom

Go to NewsroomBROOKLYN’S 7th ANNUAL SENIOR IDOL FINALISTS ANNOUNCED

October 4, 2013

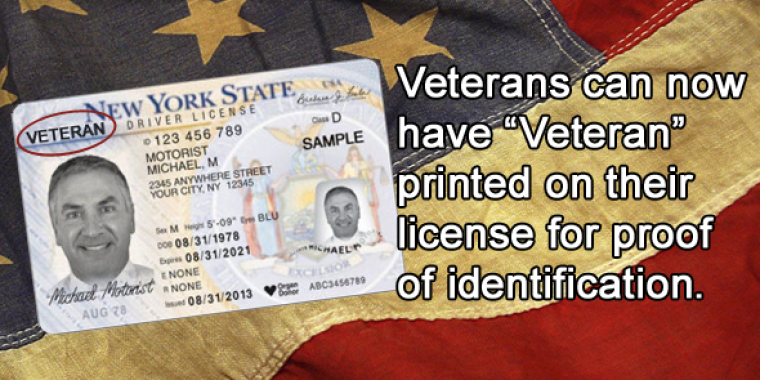

NYS Drivers’ Licenses Now Carry VETERAN Status

October 4, 2013

New York Rising Community Reconstruction Program Meetings

October 3, 2013