Kennedy: With Elections Committee Approval, Now Is The Time For A Full Senate Vote to Close LLC Loophole

Timothy M. Kennedy

April 27, 2015

-

ISSUE:

- Elections

- Ethics

- Campaign Finance

Legislation Closing the Notorious “LLC Loophole” Approved This Afternoon by State Senate Elections Committee, Prevents Donors from Circumventing Donation Limits

Kennedy Calls Loophole “Big Enough to Drive a Brinks Truck Through”

ALBANY, N.Y. – Senator Tim Kennedy (D-Buffalo) announced today that the New York State Senate Standing Committee on Elections has given its approval to S.60, a bill that closes one of New York election law’s most-abused loopholes: the LLC loophole. Under current law, a single donor who owns multiple Limited Liability Corporations (LLC), is allowed to give the maximum donation from each of his or her LLC’s, circumventing the law and allowing a single person to direct tens, or even hundreds, of thousands of dollars towards a single candidate. The State Board of Elections currently views LLCs as individuals, rather than corporations. The legislation, introduced by Senator Daniel Squadron and co-sponsored by Senator Kennedy, corrects that problem by treating LLCs for what they are: corporations, not people.

According to the New York Public Interest Research Group (NYPIRG), 14% of all donations to state-level candidates and committees came from LLCs in the first six months of 2013, totaling a combined $40 million between 2005 and 2013. S.60 will crack down on this loophole both by treating LLCs as corporations, and lowering their contribution limit to $1000. With approval by the Senate Elections Committee, Kennedy is calling for the Senate leadership to swiftly take up this legislation for a vote on the Senate floor.

“We often speak of loopholes that are big enough to drive a Mack Truck through, but I’d say instead that this loophole is big enough to drive a Brinks Truck through,” said Senator Kennedy. “I came to Albany on a promise to clean up Albany, and that is exactly what this bill does. I strongly urge the Senate leadership to bring this bill to the floor for a vote as quickly as possible. People in Western New York, and throughout the state, are fed up with the culture of money and influence that pervades Albany. Finally closing the LLC loophole will ensure that the public has a strong voice in their government."

"Closing the LLC loophole will be a big step forward for New York state," said Sam Magavern, co-director of the Partnership for the Public Good, which represents 187 community groups in Western New York. "It makes it much harder to advance the public good when private interests can buy such outsized influence in Albany through a loophole in the current system."

Currently, corporate donations are capped at $5000 per year. But because LLCs are not considered corporations, they are subject to the same limits that individuals are, allowing donations of up to $60,800 to a statewide candidate per campaign cycle, and an annual total of $150,000. On top of that, because an individual can create as many LLCs as he or she wishes, they are only limited by the size of their checking account. The loophole was first opened in 1996 with a decision from the State Board of Elections that determined that LLCs ought to be treated as individuals and not corporations.

Having passed the Senate Elections Committee, the legislation was referred to the Senate Standing Committee on Corporations, Authorities and Commissions. Kennedy is strongly urging swift action by the Committee to allow the bill to continue to move forward.

###

Senator Timothy M. Kennedy represents the New York State Senate’s 63rd District, which is comprised of the towns of Cheektowaga, the city of Lackawanna and nearly all of the city of Buffalo. More information is available at http://kennedy.nysenate.gov.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Kennedy Passes Jay-J’s Law through Senate

May 23, 2013

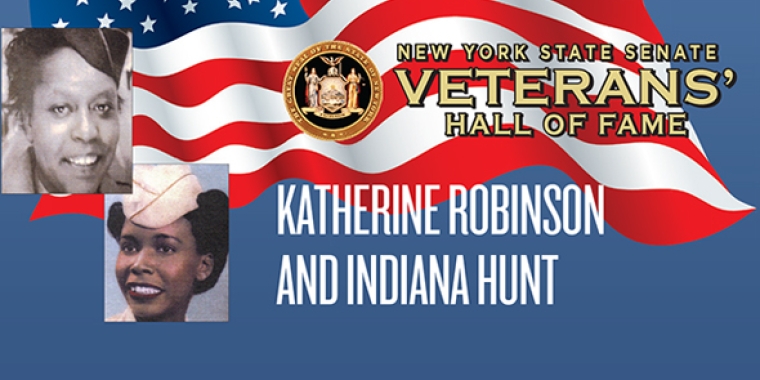

Katherine Robinson and Indiana Hunt

May 20, 2013