Putnam and Dutchess communities homeowners suffer millions in losses after foreclosed and ‘zombie’ properties are left in disrepair

May 2, 2016

Report details over $6 million loss in property value resulting from neglect of abandoned homes

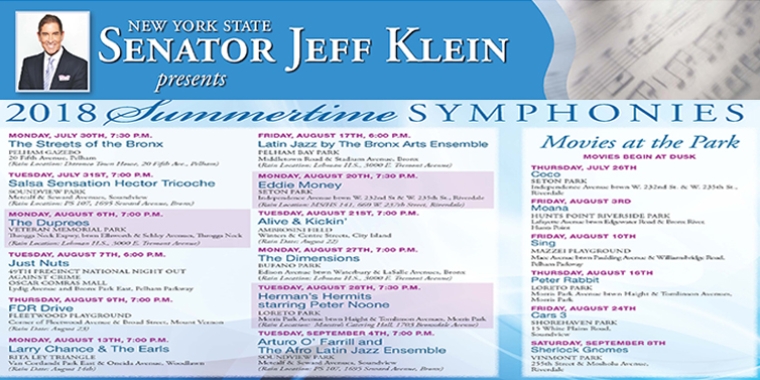

Carmel, NY— Senators Jeff Klein (D-Bronx Westchester) and Terrence Murphy (R-Westchester/Putnam/

Standing in front of a deteriorating home, Senators Klein and Murphy called for new legislation to monitor bank-owned homes, require banks to maintain zombie properties, expedite the foreclosure process, give communities more powers to repair and maintain zombie properties, and create a community reinvestment fund to rid communities of blight.

“The fallout of the subprime mortgage crisis hurts taxpaying homeowners the most. Banks, who own properties through foreclosure, let homes languish in awful states of disrepair that devalue surrounding homes even though they must by law maintain these properties. Worse, zombie properties that are in the legal limbo of foreclosure rot in communities throughout the state negatively impacting property values. This is a problem across New York State affecting homeowners’ greatest assets and we must hold banks accountable,”said Senator Klein.

“Residents of the 40th Senate District live within some of the most expensive areas in the nation and yet are under attack by neighboring zombie properties. These zombie homes not only prove to be an eyesore in our communities but pose real dangers to our neighbors and children. It is not unreasonable to hold big banks accountable to properly care for and maintain the properties under their ownership in the Hudson Valley. I thank Senator Klein for his leadership on this issue and look forward to our continued bipartisan partnership to protect our local neighborhoods from the modern day zombie attacks,” said Senator Murphy.

In the 40th senate district, which includes sections of Westchester, Putnam and Dutchess, bank-owned homes resulted in $846,003 in property depreciation, while zombie properties, or properties where homeowners have walked away, accounted for $1.38 million in property value depreciation.

Studies show that homes within a 300-foot radius of a bank-owned or zombie home depreciate by 1.3 percent, an average $5,000.

Wells Fargo is in the process of foreclosing on the majority of zombie properties in the 40th senate district.

In Dutchess County, 247 zombie properties impacted 781 surrounding homes. Most of the zombie properties are awaiting foreclosure by Wells Fargo. The abandoned homes cost homeowners in this county $2.59 million in lost property value.

In Putnam County, 114 zombie homes negatively affect 289 neighboring homes. Wells Fargo is in the process of foreclosing on the majority of the vacant properties in Putnam. The impact of zombie properties in Putnam totals $1.23 million in property value depreciation.

To combat community blight and protect property values Senators Klein and Murphy called for a multi-part solution: legislation that would to hold banks more accountable for properties they own, expedite the foreclosure process so that these homes are no longer in legal limbo, give communities more tools to help maintain and repair zombie properties, and require banks to maintain zombie properties; and to create a community reinvestment program.

The bank-owned property bill would increase transparency by creating a registry of foreclosed, vacant and abandoned properties in the state for the disposal of municipalities and the Office of the Attorney General, and grant the Attorney General the right to impose fines and initiate legal proceedings against financial institutions violating of the law.

Legislation is also proposed to expedite the foreclosure process when a property is found to be vacant or abandoned. The longer an abandoned home stays in foreclosure, the greater the chances of blight, resulting in deterioration in value to the property itself and the neighborhood at large. The Department of Financial Services noted in a May 2015 report that, “Approximately 31% of homes in the foreclosure process Upstate started out vacant or became vacant at some point during foreclosure, compared with approximately 8% Downstate.”

The zombie property legislation would require mortgagees and their loan servicing agents to maintain vacant properties from the point they are discovered to be abandoned, create a statewide registry of vacant and abandoned properties, and require the attorney general to set up a toll-free hotline for neighbors and community residents to report properties that they believe to be vacant and abandoned, report problems, as well as to find out information regarding the foreclosure status of these properties.

Municipalities are often at the forefront of dealing with this crisis. The cities, towns and villages are often hampered by antiquated laws that make it difficult for them to discern the true owner of a zombie property. Legislation must be passed that would give these localities the ability to protect their citizens from these nuisance and public health risks.

The community reinvestment program would create a council of housing experts to disperse funds to help refinance homes, or help communities create affordable housing, middle-class homes or demolish dangerous structures. The program empowers communities to eliminate blight and take ownership of deteriorating parcels.