Ortt and Ryan Urge Governor to Sign Legislation to Boost Geothermal Energy Use in New York

November 17, 2016

-

ISSUE:

- Green Initiatives

- Green Jobs

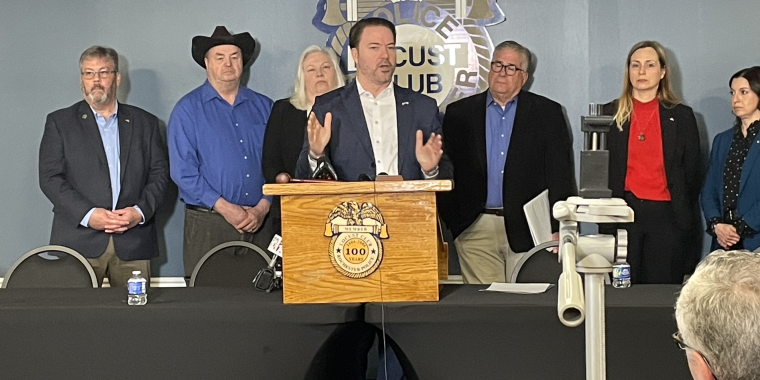

BUFFALO – Today, November 17, 2016, New York State Senator Robert Ortt and New York State Assemblyman Sean Ryan urged Governor Andrew Cuomo to sign legislation they sponsored which would establish a state tax credit for homeowners who install geothermal energy systems for their homes. The tax credit would cover 25% of the cost of designing and installing the systems, up to $5,000. Ortt and Ryan noted that the tax credit would help to boost the installation of geothermal systems across New York, which would help to create good paying green jobs for workers who would be designing, manufacturing, and installing the systems. The bill has arrived on the Governor’s desk and is awaiting his signature or veto. He has until November 28th to act upon the bill.

“The bill is on the Governor’s desk awaiting his signature,” said State Senator Rob Ortt (R,C,I – North Tonawanda). “This legislation is sensible in its approach and will be significant in its impact. Introducing installation incentives and tax credits to the geothermal industry will pay dividends across Western New York. In addition to protecting our environment for future generations, we’re also creating local jobs and helping reduce costs for financially-strapped energy customers.”

Assemblyman Sean Ryan said “We have seen great success with the Solar energy tax credit in New York, and expanding this idea to include geothermal energy systems will help to lower energy costs, protect our environment, and create jobs across Western New York. New York is focused on producing more and more energy from renewable sources, and incentivizing these green industries will be a great benefit to our society, and our energy future. I urge the Governor to sign this legislation to boost green energy production in New York State.”

Bill Nowak, Executive Director of NY-GEO said “Governor Cuomo, New Yorkers deserve an alternative to the price swings that come from heating their homes with fossil fuels like natural gas, propane and fuel oil. With 1,000 home grown New York geothermal jobs at stake, we urge you to sign the tax credit bill and level the playing field for renewable energy sources in New York State.”

There are three primary ways we can use geothermal energy: for electricity production, for direct-use applications, and for heating and cooling buildings with geothermal heat pumps. Electricity production using geothermal energy is based on conventional steam turbine and generator equipment, in which expanding steam powers the turbine/generator to produce electricity. Geothermal energy is tapped by drilling wells into the reservoirs and piping the hot water or steam into a power plant for electricity production. For direct use, hot water from geothermal resources can be used to provide heat for industrial processes, greenhouses, crop drying, heating buildings, or even melting snow on sidewalks and bridges. A well is drilled into a geothermal reservoir to provide a steady stream of hot water. The water is brought up through the well, and a mechanical system—piping and pumps, a heat exchanger, and controls—delivers the heat directly for its intended use. Geothermal heat pumps (GHPs) use the shallow ground—which maintains a nearly constant temperature between 50° and 60°F — as an energy storage device. GHPs transfer heat from a building to the ground during the cooling season, and transfer heat from the ground into a building during the heating season. GHPs can also provide hot water.1

The geothermal tax credit will be an important way to help meet New York’s goal of achieving 50% of our state’s energy production from renewable sources by the year 2030. Increasing the usage of geothermal energy systems would help to decrease our state’s reliance on fossil fuels for energy production. Approximately 45% of our energy in New York is produced by either Natural Gas or Coal.2

Ortt and Ryan noted that the success of a similar solar energy tax credit which was passed in 2012, and provided the model for this legislation. Since New York enacted the solar energy tax credit, the state ranks in the top ten states for annual solar capacity additions. Additionally, the solar energy industry has greatly boosted job growth since the enactment of the solar energy tax credit. A report from The Solar Foundation in February found that the solar industry employed 7,284 New Yorkers at the beginning of 2015, and increase of over 2,100 solar jobs over the previous year. This 40% growth in the number of solar jobs has made New York the 4th largest solar industry employer in the country. Ortt and Ryan are confident the geothermal tax credit will lead to similar growth in New York’s geothermal energy industry.3

1: http://www.nrel.gov/docs/fy05osti/35939.pdf

2: http://www.acore.org/files/pdfs/states/NewYork.pdf

3: http://www.thesolarfoundation.org/press-release-ny-census-2014/