Ortt, Senate Republican Majority Unveil Sweeping Tax Cut Plan

Antoinette DelBel

March 9, 2016

-

ISSUE:

- Middle Class

- Small Business

- Farmers

- Seniors

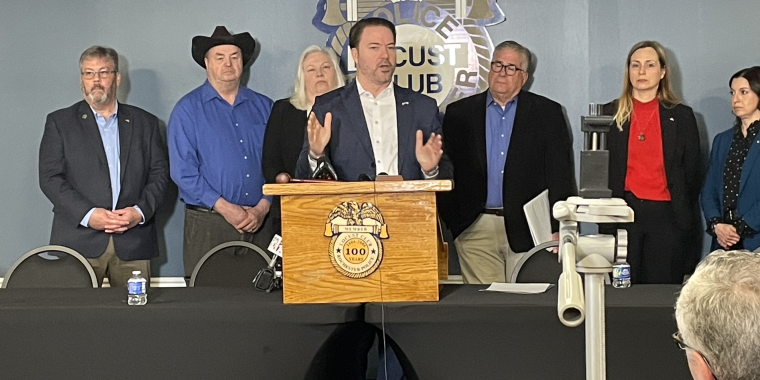

ALBANY – Senator Rob Ortt (R,C,I – North Tonawanda) and dozens of other lawmakers in the Senate Republican Majority held a press conference today at the Capitol Building to announce the first proposal of their one-house budget. The Senate Majority unveiled an all-encompassing tax cut plan to provide billions of dollars in tax relief to the middle class, seniors and small business owners.

A video of Senator Ortt’s statement on the budget resolution can be found here.

“This billion-dollar tax relief package represents my priorities and that of my conference to provide much-needed and long-overdue tax relief to middle class families, seniors, small businesses, and family farms,” said Senator Ortt. “This plan serves as our template as we negotiate with the Assembly and Governor, and I’m hopeful that its many benefits to Western New Yorkers will find its way into our adopted state budget. We need to enact policies that will keep New Yorkers here in New York and make our state an attractive place to live, work, and raise a family.”

Cutting Middle Class Taxes

The Senate Majority’s tax cut proposal would reduce current taxes for eligible middle-class taxpayers starting in 2019 after existing middle-class tax cuts expire in the 2018 tax year. The Middle Class Income Tax Relief Program would create a new 25 percent tax rate reduction that would be phased in from 2019 to 2025. When fully implemented in 2025, middle class New Yorkers will pay a 5.14 percent tax rate, saving a total of $3.5 billion in taxes each year. More than 770,000 small business owners who file under the Personal Income Tax would also see savings under this plan. This Middle Class Income Tax Relief Program establishes the lowest middle class tax rate in more than 70 years.

Creating More Financial Security For Senior Citizens

The Senate Majority is proposing new income tax relief to help more seniors save money and stay in New York during retirement. The tax cut would provide the first increase to the exempt amount of private pensions and retirement income since 1981, saving approximately $275 million every year when fully phased in. In 2017, the exclusion amount would increase to $27,000 from the current $20,000. The following year, it would increase to $34,000 and then to $40,000 by 2019.

Cutting Taxes for Small Business Owners and Farmers

The Senate’s tax cut plan would provide even more tax relief to small businesses and small farms to help them grow and create jobs. The plan expands on the 2013 Personal Income Tax (PIT) exemption for small businesses and small farms, increasing the exemption from 5 percent to 20 percent for farm income and from 5 percent to 15 percent for net business income of small business. When enacted in fiscal year 2018, small businesses and small farms would save $200 million annually and save $494 million by 2020.

Fully Eliminate the 18-a Utility Tax Surcharge

The Senate’s budget proposal would fully eliminate the 18-a assessment surcharge by the end of 2016 – one year ahead of the current phase-out plan scheduled to be completed by 2017. The 18-a surcharge, imposed by Democrats in 2009, is a surcharge residents and businesses are forced to pay on utility bills charged by the State’s publicly owned utilities. The move to eliminate the 18-a surcharge this year would save taxpayers $125 million in fiscal year 2017.

Estate Tax Changes for Small Businesses and Farms

The Senate is proposing to accelerate the full phase-in of the estate tax reform enacted in 2014 in order to encourage small businesses and farms to pass down their business from one generation to the next. This would allow estates of farm operations or small business property to have a tax exclusion amount equal to the federal exclusion amount starting April 1, 2016. The exclusion would be increased to $5.45 million from $4,187,500 in FY 2016, resulting in an annual savings of $70 million annually. By 2020, there would be a cumulative savings of $210 million.

The state budget is due March 31.

Share this Article or Press Release

Newsroom

Go to Newsroom