Senate Democrats Fight To Release Trump Tax Returns

May 2, 2017

-

ISSUE:

- Elections

Albany, NY - The Senate Democrats will force legislation to the Senate floor that if passed would give New Yorkers, and all Americans, the opportunity to review Presidential candidates’ tax returns. This legislation will provide greater transparency and ensure that to appear on a New York ballot for President of the United States, candidates must provide the public with their tax returns.

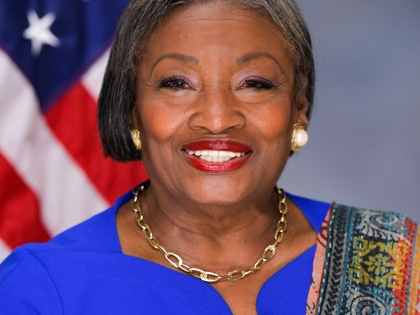

“Leaders should play by the same rules as the citizens they seek to represent, and this bill simply helps New Yorkers see if their Presidential candidates pay taxes like the rest of us,” Senate Democratic Leader Andrea Stewart-Cousins said. “The Senate Democrats have led the fight to increase government transparency and this action continues our push to make elected officials more accountable to the people they serve. New Yorkers overwhelmingly support the release of Presidential candidates’ tax returns, and I urge the Senate Republican/IDC Coalition to listen to the public and support this legislation.”

Senator Brad Hoylman said, “Trump’s refusal to release his taxes continues to raise deep questions over whether public policy is furthering private gain. The American public has been left in the dark on how Trump’s massive tax cuts may benefit him personally or even the details of his foreign entanglements. New York has an obligation to shed light on these issues. I’m proud to join with Leader Andrea Stewart-Cousins and the entire Democratic Conference in calling on the State Senate to defend the public interest by bringing my tax disclosure bills to a vote this session, as is happening in 28 other state houses across the nation.”

Senator Leroy Comrie, Ranking Member of the Senate Elections Committee, said, “As ranking member on the Committee for Elections, I am committed to passing reforms that protect the integrity of our electoral system at every level. New York voters cannot be left in the dark when it comes to the conflicts of interest of presidential candidates. I commend Senator Hoylman and Conference Leader Stewart-Cousins for their leadership on this issue.”

Senate Democratic Policy Group Chair Daniel Squadron said, “New York has the opportunity to act on transparency where the President has chosen to evade. The release of presidential tax returns is a cornerstone of ensuring the press and public have important information about conflicts -- it’s urgent the Senate act on common-sense, nonpartisan measures I’m pushing, along with Senator Hoylman, to preserve this basic disclosure. Thank you to Senator Hoylman, Leader Stewart-Cousins, and my colleagues pushing for transparency in government.”

The Tax Returns Uniformly Made Public (TRUMP) Act, S.26, will ensure all candidates for President release five years of tax returns to the New York State Board of Elections which would then provide them to the public. Any candidate who fails to comply would be barred from appearing on New York State ballots, and would be blocked from receiving any support from New York’s electors in the Electoral College.

For over 40 years, all major party Presidential candidates have released their tax returns. The legislation advanced by Senate Democrats was introduced in response to the unprecedented refusal by then-candidate Donald Trump to releases his tax returns for public review. With the majority of New Yorkers and Americans demanding to have President Trump release his tax returns, this legislation should not be controversial and the Senate Republican/IDC Coalition should join Senate Democrats in supporting it.

Senator Neil Breslin said, “Up until this past presidential election it has become the norm for candidates to release their tax returns. Because presidents are largely exempt from conflicts-of-interest laws, it is critical that the public know what/if any potential conflicts may or may not exist. It should be incumbent upon a president or presidential candidate to provide the public with as much personal financial information as possible. However, if he or she is unwilling to voluntarily make these disclosures they should be compelled by law to do so.”

Senator John Brooks said, “I support this legislation because I believe that taxpayers deserve transparency from their elected officials. Taxes are too high for hard working Long Islanders -- we must be committed to lowering them which is why it’s critical to know that are elected officials are playing by the rules. I’m committed to ensuring fairness and transparency in our state.”

Senator Martin Malavé Dilan said, “A tax return has long been the first gesture to build trust between the voting public and presidential candidates. Voters have come to expect and demand tax records. This past election proved that voters cannot rely on the common decency of candidates to release their returns. If that is to be the new norm, then it is well within New York’s right to demand a basic standard of candidates that appear on its ballots.”

Senator Todd Kaminsky said, “Transparency is key to holding our elected officials accountable. Voters especially need to know whether the leader of our country has any conflicts of interest or would financially benefit from any new legislation or regulatory changes. I will continue to advocate for measures at all levels of government that keep New York representatives honest and working for their constituents.”

Senator Tim Kennedy said, “For more than 40 years, candidates for President of the United States have willingly released tax returns as a way of emphasizing transparency and disclosing potential conflicts of interest to the American public. Unfortunately, our current President decided to break that tradition, and continues to make excuse after excuse about why his ambiguity and irresponsibility is acceptable. Enough is enough. It’s time New York sets an example and takes a stand against any candidate unwilling to be open and honest with voters. I fully support this legislation, and I encourage all of my colleagues in both houses to do the same.”

Senator Gustavo Rivera said, “A candidate’s tax returns provides voters with basic insight into the financial dealings and ties of someone looking to represent them. During the last election cycle, it was made clear that not every candidate thinks they are accountable to the voters. These bills would ensure that no future candidate is able to cheat New Yorkers or the American people out of being able to make an informed decision about their vote.”

Share this Article or Press Release

Newsroom

Go to NewsroomElmsford Little League Opening Day

April 16, 2016

Earth Day 2016 Poster Contest: District 35

April 14, 2016

UAW Region 9A Local 2325 Rally

April 8, 2016