Senator Phillips’ Legislation Restoring Nassau County’s Senior Tax Abatement Program Receives Final Legislative Approval

March 21, 2017

-

ISSUE:

- Seniors

- Property Tax Exemptions

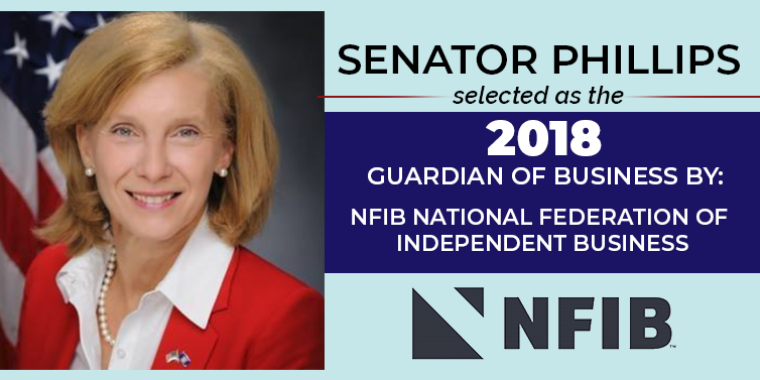

Senator Elaine Phillips (R-Manhasset) announced that both the Senate and Assembly passed legislation she sponsored to restore Nassau County’s senior citizen property tax abatement program. The program, which helps eligible seniors save money on their property taxes, expired at the end of 2016.

“Nassau’s senior citizens need the tax relief provided by this County program. Seniors on fixed incomes already depend on every dollar to make ends meet and cannot afford to have their taxes go up by hundreds of dollars a year. Enabling Nassau County to bring back this important tax relief program will restore these important savings and help seniors stay in their homes and the communities they helped build. Governor Cuomo should sign this legislation when it reaches his desk,” said Senator Phillips.

In 2002, Nassau County increased county property taxes by more than 19 percent. To mitigate some of the impacts to seniors on fixed incomes, the County created a tax abatement program which provided tax savings. State approval was necessary to implement the program, which the County received. The abatement was scheduled to last until the end of 2016. The program’s expiration resulted in substantial property tax increases for seniors, many of whom were unaware that the program was ending.

The legislation sponsored by Senator Phillips (S3142A/A2382B) would allow Nassau County to retroactively restore and continue the county program, ensuring that seniors do not lose out on valuable property tax savings. The Nassau County Legislature passed a home rule message requesting the state authorization.

The legislation will be sent to Governor Andrew Cuomo for consideration.

Share this Article or Press Release

Newsroom

Go to Newsroom