Ritchie Bill To Provide Tax Credit For Adoptions Of "Special Needs" Children Passes Senate

June 7, 2017

State Senator Patty Ritchie is announcing her bill to help increase the number of special needs adoptions by providing parents with a $10,000 annual tax deduction has passed the Senate.

“Across our state, there are thousands of children with special needs who are waiting to be placed in homes with caring parents,” said Senator Ritchie.

“This bill will help eliminate worries potential parents might have over the increased cost of raising a child with unique needs. I encourage my colleagues in the Assembly to pass this measure which will help connect children with stable and loving homes.”

The IRS allows adoptive parents to claim tax credits and some deductions for adoption-related expenses, and the tax benefits are more generous for special needs adoption. At least 16 other states provide additional tax credits and deductions beyond the IRS benefits to encourage adoptions, including five with special tax incentives for “special needs” children.

Under Senator Ritchie’s bill, the state Office for Children and Family Services would make the determination of which potential adoptees would be considered “special needs.” The term special needs can be used to describe children with a host of physical, medical or emotional disabilities including with autism, Down syndrome, dyslexia, blindness, ADHD or cystic fibrosis, for example. The benefit would extend until the child’s 21st birthday.

It is estimated that New York State spends $33,000 annually for each child in foster care, or about $759 million. Under Senator Ritchie’s plan, the state would see substantial savings by moving children from foster care into loving homes.

According to the federal Administration for Children and Families, a branch of the Department of Health and Human Services, New York ranked 6th in 2014 for adoption placements, well behind other large states like California, Florida and Texas; but also behind much smaller states like Arizona and Michigan. Two of those states provide tax incentives for adoptions.

The measure was sent to the Assembly, where the legislation has been approved in years past.

Share this Article or Press Release

Newsroom

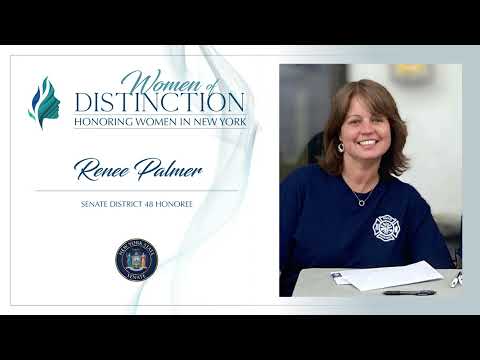

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022