Senator Phillips Joins Local Officials To Call For Property Tax Parity

July 10, 2018

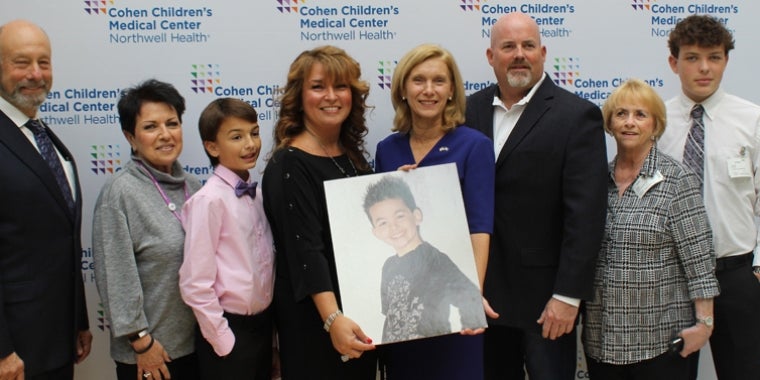

Senator Elaine Phillips today joined with Floral Park senior citizens and local elected officials in support of state legislation that would provide property tax parity for senior citizens and persons with disabilities in Nassau County.

“The cost of living on Long Island is expensive, especially for seniors and those with disabilities who are on a fixed income,” Senator Phillips said. “Equity is imperative and it’s time we help Nassau’s seniors and individuals with disabilities by boosting income eligibility levels for the Senior Citizen Property Tax Exemption. I am proud to announce that I will sponsor legislation to remedy this inequity in the State Senate.”

Senator Phillips, joined by Hempstead Receiver of Taxes Don Clavin and Nassau County Legislature Presiding Officer Richard Nicolello demanded that Nassau homeowners be granted the same income eligibility levels for senior citizen property tax exemptions as the Governor has recently signed into law for homeowners in New York City.

In fact, the newly approved law boosts income eligibility levels for New York City seniors and persons with disabilities who seek an exemption by as much as 72.4 percent. For example, the pre-existing income ceiling of $29,000 for a full 50 percent exemption (the highest exemption level) is raised to $50,000 under the law. In addition, the maximum income level that a New York City senior may achieve and still be eligible for an exemption has been increased to $58,399 from $37,399.

Prior to the newly minted legislation that boosted income limits for NYC’s seniors, the City’s income eligibility limits were identical to those that are applicable to Long Island property owners. The law (Chapter 131 of the RPTL), which was signed into effect by the Governor on July 25, 2017, provides for the City of New York to “opt in.” Before the passage of the new law, the Senior Citizen Property Tax Exemption income eligibility limits for New York City included a maximum adjusted gross income of $37,399, which provided a 5 percent exemption. Those with an adjusted gross income of $29,000 or less qualified for a 50 percent exemption. And, the law provided for eight incremental income levels between the base and the maximum eligibility amounts, each carrying a graduated exemption percentage based on income.

The following table details the previous income/exemption amounts for New York City homeowners (these amounts remain in force for Long Island and the rest of New York State):

|

Income |

Exemption |

|

$29,000 or LESS |

50 percent |

|

$29,001 to $29,999 |

45 percent |

|

$30,000 to $30,999 |

40 percent |

|

$31,000 to $31,999 |

35 percent |

|

$32,000 to $32,899 |

30 percent |

|

$32,900 to $33,799 |

25 percent |

|

$33,800 to $34,699 |

20 percent |

|

$34,700 to $35,599 |

15 percent |

|

$35,600 to $36,499 |

10 percent |

|

$36,500 to $37,399 |

5 percent |

New York City’s income/exemption amounts under the newly adopted state legislation have risen to the following levels:

|

Income |

Exemption |

|

$50,000 or LESS |

50 percent |

|

$50,001 to $50,999 |

45 percent |

|

$51,000 to $51,999 |

40 percent |

|

$52,000 to $52,999 |

35 percent |

|

$53,000 to $53,899 |

30 percent |

|

$53,900 to $54,799 |

25 percent |

|

$54,800 to $55,699 |

20 percent |

|

$55,700 to $56,599 |

15 percent |

|

$56,600 to $57,499 |

10 percent |

|

$57,500 to $58,399 |

5 percent |

The officials called the current income limits unrealistic and said they have not kept pace with the cost of living on Long Island. In fact, federal HUD guidelines term a household income of $56,700 as “low income” on Long Island. The last time the income eligibility limits were raised was in 2009. Prior to that, income limits were raised in three successive years (2007, 2008, 2009). Further, the representatives noted that any new legislation could include “opt in” provisions for local governments and empower municipalities with the authority to adjust income levels or exemption levels within maximum cap amounts in order to address the budgetary constraints of individual local governments.

Share this Article or Press Release

Newsroom

Go to Newsroom