Senate Majority Passes Permanent Tax Cap To Protect Taxpayers

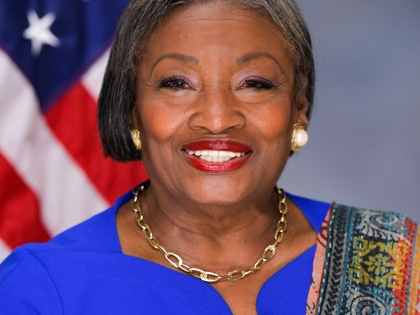

Andrea Stewart-Cousins

January 23, 2019

-

ISSUE:

- Tax Cap

Senate Majority Passes Permanent Tax Cap To Protect Taxpayers

Albany, NY-The New York State Senate Democratic Majority today passed legislation (S.1904) to protect taxpayers by making the property tax cap permanent. Senator Jim Gaughran sponsored the legislation, which is a major victory for his constituents on Long Island and taxpayers across New York State. The property tax cap, passed in 2011 and extended for 4 years in 2015, prevents increases in real property taxes from exceeding 2% of the previous assessment or the rate of inflation.

“Today we made it clear that we will continue to stand up for New Yorkers,” said Senate Majority Leader Andrea Stewart-Cousins. “We made college more affordable, we have made it possible for all teachers to teach without undue burdens, and we passed tax relief for middle class New Yorkers by making the property tax cap permanent.”

Bill Sponsor, Senator Jim Gaughran said, “I ran for State Senate on the promise that I would fight tirelessly for overburdened and overtaxed Long Islanders. Today I took the first step and introduced vital legislation to make the property tax cap permanent. No more temporary extensions. A permanent tax cap for permanent relief.”

“We’re beginning to feel the devastating effects of the federal limit on State and Local Tax deductions. We cannot let Long Islanders be taxed out of their homes. It is critical that New York State takes steps to providing real tax relief to Long Islanders, while the federal government continues its attack on New York taxpayers. The Democratic Senate Majority is going to provide local municipalities and school districts with mandate reform and increase state aid to our region to help lower local tax levies. It’s a new day in Albany and we’re done with the same old games that have cost Long Island for decades. I am proud that my first bill to pass as a State Senator will be legislation to make the tax cap permanent,” Bill Sponsor, Senator Jim Gaughran added.

Senate Deputy Leader Michael Gianaris said, “Families throughout New York struggle with the burden of high property taxes. Making the tax cap permanent will make life in our state more affordable and enable more families to achieve the American Dream.”

Senator Alessandra Biaggi said, “I'm supporting the tax cap, but we need to find a way to carefully balance on the one hand ensuring that people are not driven from their homes by high property taxes and on the other, that schools are properly funded. And it's good to remember that good schools are essential to maintaining property values.”

Senator Brian Benjamin said, “With New Yorkers under assault from the Trump Tax plan, it is imperative that we act on the state level to preserve the well-being of working families and homeowners across New York. I am proud to be voting yes on this bill, and I look forward as Chair of the Revenue & Budget Committee to ensure every New Yorker’s financial future is protected and preserved.”

Senator Neil Breslin said, “New York's property taxpayers have already saved $2.6 billion because of the property tax cap. Making the tax cap permanent and providing certainty to taxpayers going forward will greatly benefit our state's taxpayers and economy alike.”

Senator John Brooks said, “New Yorkers, especially Long Island families and residents, have been overburdened and crushed by high property taxes for too long. New York State citizens deserve to stay in the homes and communities they love, and not be driven out by high property taxes. This legislation provides security of tax relief for Long Islanders and I'm proud to support it.”

Senator Leroy Comrie said, “Making the property tax cap permanent is an important first step in making our state an affordable place to live for all New Yorkers.”

Senator David Carlucci said, “Rockland and Westchester have some of the highest property taxes in the nation. We must ease the burden on hardworking taxpayers, especially in the wake of the federal government's $10,000 cap on state and local tax deductions. The property tax cap offers homeowners relief and stability.”

Senator Pete Harckham said, “No one in my district in Westchester, Putnam, and Dutchess counties or, in any other part of our state, should be taxed out of their home or the town they live in. Making the property tax cap permanent will help reduce the tax burden on New York families and keep our towns more affordable.”

Senator Todd Kaminsky said, “For far too long, hardworking Long Islanders have been overburdened with skyrocketing taxes — a problem that has only been exacerbated by Washington’s decision to nix our SALT deductions. New York’s property tax cap has proven to be vital in reigning in spending and protecting our hard-earned tax dollars. I was proud to have shepherded legislation through the Senate to make the tax cap permanent, and I will continue to fight to ensure that Long Island remains an affordable place to raise a family, build a business and retire — our neighbors deserve no less.”

Senator Anna M. Kaplan said, “With the federal administration declaring war on New York taxpayers by reducing the State and Local Tax (SALT) deduction, it’s becoming harder and harder for Long Island families to make ends meet. New York State’s 2% tax cap has worked to slow the growth of property taxes on Long Island, and I’m proud to co-sponsor legislation to make it permanent so that government continues to live within its means.”

Senator Tim Kennedy said, “For years, the Senate Democratic Conference has worked to ensure New Yorkers see real property tax relief, introducing many proposals to alleviate the overall burden on taxpayers and homeowners statewide. The passage of this legislation will continue to help millions of struggling New Yorkers, many of whom are on fixed incomes, remain in their homes and communities. As a proud co-sponsor of this bill, I was happy to see it pass through the Senate, because I know the impact it will have on hardworking families across Western New York and beyond.”

Senator Shelley Mayer said, “This bill reflects our commitment to property taxpayers throughout the state, but particularly in districts like mine, where high property taxes remain a tremendous burden on our homeowners. Given the federally-imposed limit on the SALT deduction which unfairly targets New York's taxpayers, we must take action this year to protect our residents. At the same time, we must work to shift a greater share of the burden of school funding and municipal services away from local taxpayers and to the State. I believe that as we adopt this measure, we must make the necessary modifications to the tax cap to make it fairer and more predictable. Specifically, I support a hard 2% cap, some limited exceptions to the cap, and full restoration of proposed cuts to AIM for towns and villages. We should increase the State's commitment to our municipal governments by finally increasing AIM overall to our cities, and rectify the unfair reliance on property tax payers for the essential services of government.”

Senator Diane Savino said, “Leader Stewart-Cousins is proving again why she is a champion for the State. As New York City continues to burden homeowners in my district, the property tax cap will surely put homeowners outside of New York City at ease knowing the Senate is moving to ensuring a pragmatic approach to what is one of the most detrimental taxes to their wallet. This is simply another reminder that we must work together to bring equity to Staten Island, Brooklyn, and our New York City neighbors.”

Senator James Skoufis said, “Making the property tax cap permanent is a critical first step towards a more affordable New York. Our families and future generations deserve a livable state to call home and that begins with an enduring lid on sky-high taxes.”

Senator Kevin Thomas said, “New Yorkers pay some of the highest property taxes in the country. The property tax cap is vitally important to protect New Yorkers from the onslaught of the Trump Republican tax plan that raises taxes on working families throughout my district. That is why I support a permanent 2% property tax cap. I pledge to you that I will always fight for Long Island taxpayers, and today is just a step in keeping that promise.”

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom