State Legislators Call for Funding for Student Loan Consumer Assistance Program

March 4, 2019

ALBANY, NY - Today a group of New York State lawmakers, led by the respective chairs of the Senate and Assembly Banks Committees, and the chair of the Senate Consumer Protection Committee, cited findings from of a recent U.S. Department of Education Inspector General report in calling for the creation of an independent, statewide student loan consumer assistance program, including a toll-free “Help Line,” to assist borrowers in New York fight back against deceptive student loan industry practices.

Under the Trump Administration, protections for student borrowers have been steadily eroded. Last year, the student loan ombudsman at the federal Consumer Financial Protection Bureau resigned to protest sweeping changes at the Bureau that he said protected “the interests of the biggest financial companies in America” to the detriment of borrowers.

As the federal government has retreated from its oversight and enforcement responsibilities, states have had to step in with legal action against loan servicers who mislead borrowers, illegally drive up repayment costs and make serious errors in the processing of student loans. Only a few months ago, a lawsuit filed by the New York Attorney General resulted in a $9 million settlement against Conduent Education Services for misleading borrowers in New York State.

The Inspector General’s report is just the latest example of the failure of the Trump Administration to protect borrowers and rein in the nation’s $1.5 trillion loan servicing industry. The report, released earlier this month, examined the practices of the nine private companies authorized to service federal student loans. It found that the Office of Federal Student Aid (FSA) had failed to exert oversight over the loan servicer sector, putting millions of borrowers at risk. That includes nearly 2.4 million New Yorkers with outstanding student loans.

As lawmakers, we are calling for the Legislature to appropriate $1 million this year to launch an independent, unbiased, statewide student loan consumer assistance program. The program would feature a statewide, live answer professionally staffed toll-free “Help Line,” with trained counselors ready to assist borrowers gain financial stability managing their student loans as well as a network of community-based organizations providing services to consumers, free of charge. Along with measures advanced in the Legislature and by Governor Cuomo to license and regulate student loan servicers and student debt consultants, these two initiatives would give consumers some assurance that the state is acting in their interest.

“Ensuring loan servicers are providing honest information to borrowers and complying with standard codes of conduct as fiduciaries is the responsibility of the USDOE. We now know that the USDOE has not done its job, and as a result, these firms are operating without oversight, imperiling the financial health millions of consumers,” said State Sen. James Sanders Jr. (D-Queens), Chair of Committee on Banks. “Regulating and licensing student loan servicers operating in New York is critically-important, but so is giving New Yorkers with student loan debt access to resources, counseling and unbiased financial advice to help them effectively manage their debt and avoid outcomes that could worsen their financial situation.”

“Crushing student loan debt has unfortunately become the new normal for many New Yorkers. Amid this crisis, it has become alarmingly clear that the federal government is not appropriately protecting borrowers, even putting them at risk,” said Assembly Member Kenneth Zebrowski (D-Rockland County), Chair of Committee on Banks. “Now more than ever, it is our responsibility to ensure that consumers have access to resources and all the tools necessary to assist in what often feels like an uphill battle. This funding is critically important, and we will continue to fight for additional oversight as well as regulating student loan servicers in NYS.”

“As chair of the consumer protection committee and a former legal aide attorney I know the corrupt and intentionally complicated hurdles students face when applying for student loans. We must ensure a simple and transparent process and provide students the resources they need to come to an informed decision,” said Senator Kevin Thomas (D-Hempstead), Chair of Committee on Consumer Protection.

“Just as New York has been a leader in making college more affordable and extending financial aid to its neediest students, it can help lead the way out of our student loan debt crisis,” said David R. Jones, President and CEO of the Community Service Society, which has proposed the student loan “Help Line” under consideration. “By funding an independent advocate who can take on individual student loan cases, advocate on their behalf from start to finish, New York will protect vulnerable New Yorkers who are being targeted by unscrupulous loan servicers and predatory lenders.”

"Navigating loan repayment can be stressful and challenging for graduates; this is particularly true when loan servicers fail to provide complete and honest information to borrowers," said Austin Ostro, Vice President of the State University of New York Student Assembly. "It is essential that borrowers be given the information they need to make wise financial decisions, which is why the Student Assembly strongly supports the creation of a statewide student loan consumer assistance program."

“Many of our fellow New Yorkers, who owe over $30 billion in student loan debt, are in desperate need of relief and can’t count on the Trump Administration for help,” said DC 37 Executive Director Henry Garrido. “As a result, some lenders have used deceptive tactics to victimize them. There needs to be a statewide student loan consumer assistance program to help protect vulnerable New Yorkers from being targeted by unscrupulous loan servicers and predatory lenders.”

“Empowering the Department of Financial Services to license and examine student loan servicers will help safeguard New York borrowers from receiving inaccurate, false, and misleading information. Coupling this with expert counseling from reliable nonprofits will further enable New Yorkers to protect their rights and make better decisions about their student loans,” said Evan Denerstein, Senior Staff Attorney with Mobilization for Justice, Inc.

Share this Article or Press Release

Newsroom

Go to Newsroom

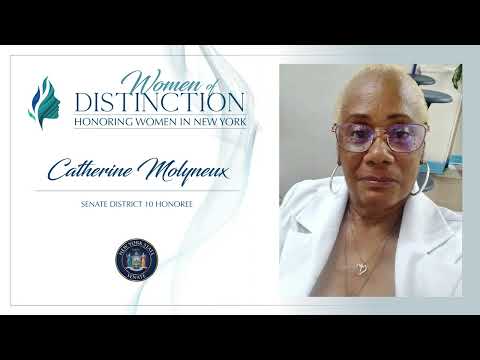

Senator Sanders 2022 Woman of Distinction

August 26, 2022

2022 Queens Carnival Promo Video

August 9, 2022