Stec urges unemployment insurance improvements

May 4, 2021

-

ISSUE:

- Unemployment Insurance

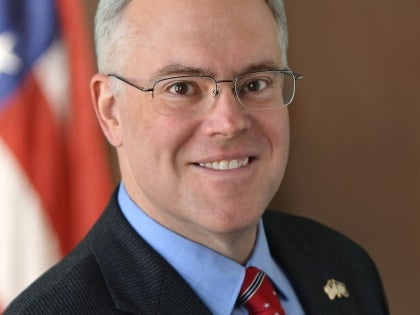

Senator Dan Stec and his Senate Republican colleagues are calling on the Legislature and Cuomo administration to address issues that have plagued the state’s unemployment insurance (UI) system since the beginning of the COVID-19 pandemic.

“We were inundated with calls and emails last year from exasperated constituents who couldn’t get through to the Department of Labor for weeks and then months,” said Stec. “Problems persist as we continue to learn on an almost daily basis. Before the legislative session ends next month, we’re urging all lawmakers and the Cuomo administration to focus on this problem and to take steps to fix the system.”

At a news conference in Albany today, Stec and his colleagues called for a forensic audit of the state’s IT systems to identify failures and weaknesses, and to strengthen the digital infrastructure to avoid future catastrophic failures. They also said an assessment of potential fraud, and efforts to recoup funds, is needed. The state’s unemployment insurance fund is facing a $10 billion deficit.

In addition to improving the administration of UI, the Republican lawmakers want to see a state tax break of up to $10,200 on unemployment benefits collected during the pandemic last year. The federal government waived federal taxes on up to $10,200 of 2020 unemployment benefits for households earning up to $150,000. New York and ten other states have declined to offer the same waiver on state income taxes.

Stec is one of 38 senate sponsors of legislation (S5125a) introduced in both houses of the State Legislature that would create this income tax break.

Additionally, Stec said the state should consider a one-time forgiveness for recipients of unemployment overpayments due to improper administration by the Department of Labor.

-30-