Harckham Acclaims 2021-2022 State Budget for Investments in Hudson Valley Recovery

April 7, 2021

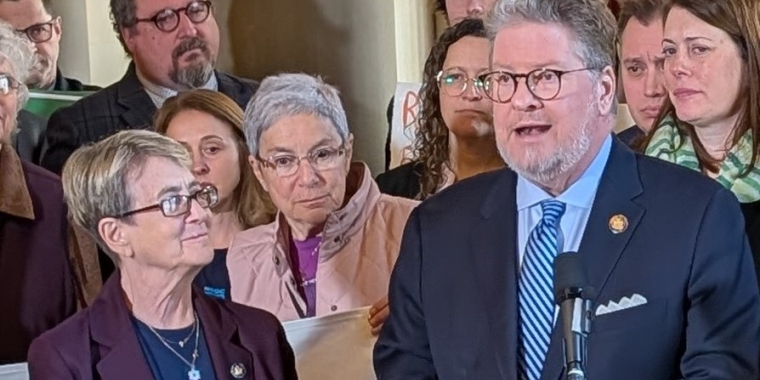

Albany, NY – New York State Senator Pete Harckham, along with his colleagues in the Senate Majority, passed the 2021-2022 State Budget, which he acclaimed as a “significant investment in the economic recovery of the Hudson Valley,” a region still reeling from the financial devastation caused by the coronavirus pandemic.

The total spending for the 2021-2022 State Budget is roughly $212 billion; last year state lawmakers approved a $194.6 billion budget. This year’s record investments are meant to benefit middle-class taxpayers, students, small businesses, workers and local municipalities.

“With this new budget the state is making significant commitments to improve education, small businesses, healthcare and infrastructure while also continuing to provide support for struggling small businesses and workers,” said Harckham. “This has been a year like no other, and it required a comprehensive response in a budget that would strengthen our communities and help our residents regain stability. Altogether, this is a significant investment in the economic recovery of the Hudson Valley.”

Many of the initiatives in the FY2022 State Budget will have a strong and positive impact on the 40th Senate District, Harckham noted, particularly in areas such as support for education, help for small businesses and taxes.

EDUCATION

- $1.4 billion increase Foundation Aid to school districts, plus a three-year phase-in of Foundation owed to districts.

- Every single school district in the 40th Senate District received an increase in school aid.

- Three-year commitment to fully phase-in Universal Pre-Kindergarten (UPK) outside of New York City, with 210 school districts being able to benefit this year. School districts in 40th Senate District gaining UPK slots are: Arlington; Pawling; Brewster; Carmel; Mahopac; Croton-Harmon; Hendrick Hudson; Lakeland; Mount Pleasant Central; Pleasantville; Somers; Valhalla; and Yorktown. Total UPK slots: 854.

- Additional $87 million in the Tuition Assistance program (TAP), increasing the per student award by $500.

- The Electric Generation Facility Cessation Mitigation Program fully funded at $140 million, which will benefit residents of the Hendrick Hudson School District, Village of Buchanan and Town of Cortlandt during the Indian Point Energy Center closing.

- Holding the parent-share cap for child care costs at 10%.

“These budget investments reflect an unprecedented commitment to education in New York,” said Harckham. “They provide a real victory for students, taxpayers and middle-class families endeavoring to send their children to college. And in regard to Foundation Aid, there is no reason why students and taxpayers should suffer from such inequitable state funding.”

SMALL BUSINESSES

- Small businesses grant program to be funded at $800 million. This initiative was modelled after the NY Forward Grant program legislation Harckham introduced.

- Other state economic development investments in the budget include $25 million for New York Restaurant Resiliency Fund and a $35 million tax credit for restaurants to hire back workers.

- New York State Council of the Arts funding increased by $40 million to help non-profit arts organizations. Included in this amount is $1 million for ArtsWestchester’s “ReStart the Arts” initiative, which Harckham sponsored.

- Along with federal assistance and state tax credits for small businesses, restaurants, concert venues and theaters, Harckham said about $4 billion is heading to small businesses in New York.

- Film and tax credits extended for another five years.

“This extraordinary commitment to New York’s economic recovery starts on Main Street and with our cultural institutions,” said Harckham. “By providing real assistance to small businesses, the backbone of our communities, we will be able to revive our local economies and restore jobs.”

TAXES

- Continuing the middle-class tax breaks, enacted in 2019, which will produce a projected $4.2 billion in annual savings for six million households.

- Property Tax Circuit Breaker program will receive $440 million and benefit 1.3 million households statewide.

- STAR program maintained at full benefit to residents. Initially, the Executive Budget transferred STAR costs to school districts, which was rejected.

“The middle-class have been struggling to make ends meet for too long, and it is only right that they receive some much-deserved help,” said Harckham. “In the new budget there is a very strong commitment to income tax and property tax relief for middle-class residents, many who are overwhelmed by rising costs.”

INFRASTRUCTURE

- $100 million increase in funding for the Consolidated Local Street and Highway Improvement Program (CHIPS). “Our roadways are heavily traveled, and with the economy reviving it is vitally important that they are in good condition and safe,” said Harckham.

- $50 million increase in the PAVE NY initiative.

- $35 million increase in the Emergency Winter Recovery Fund for severe weather repaving.

“These big investments in our roadways are also major investments in our communities,” said Harckham. “Local municipalities have been asking for this level of investment for years, and now the Senate Majority has delivered for them.”

OTHER BUDGET INVESTMENTS

- $2.1 billion for an excluded worker fund to help workers unable to collect federal or state assistance during the pandemic because of immigration issues.

Noting the state aided over four million “traditional” workers with $65 billion of unemployment assistance during the pandemic, Harckham said, “Excluded workers deserve our strong support. They contribute billions of dollars to the U.S. economy and to federal, state and local taxes. And as essential workers, they have braved the pandemic to keep our country moving forward. This is money that will help landlords, small businesses and local communities get back on track.”

- $5 million for training of Drug Recognition Experts (DREs) focusing on cannabis DUI enforcement.

“With marijuana now legalized in New York, it is imperative that we keep our roadways safe,” said Harckham.

- Full restoration of funding for the Joseph P. Dwyer Veterans Peer to Peer program.

“This effective program provides resources for preventing suicide, averting homelessness and treating Substance Use Disorder,” said Harckham. “With its incredible outreach to veterans, the Dwyer program deserves a proper investment.”

- $2.3 million for Westchester County Department of Public Safety parkway patrols.

- Prevailing wage guarantees for renewable energy projects over five megawatts.

- A cost-of-living increase for state certified Substance Abuse Disorder treatment providers.

- $500 K for an addiction recovery supportive transportation services pilot program.

“We are beginning to climb out of a deep hole created by the pandemic, and these historic investments certainly will help spur a wide recovery for residents in the Hudson Valley,” said Harckham. “This new state budget reflects the reality of what we need to bounce back from, and a determination that renewed posterity should be shared by all.”