Senator Cooney, Rochester Children's Advocates Call for Increased Funding to Fight Child Poverty

March 20, 2023

FOR IMMEDIATE RELEASE

March 20, 2023

Contact: Miles Cunning, Communications Director, cunning@nysenate.gov, (585) 362-1532

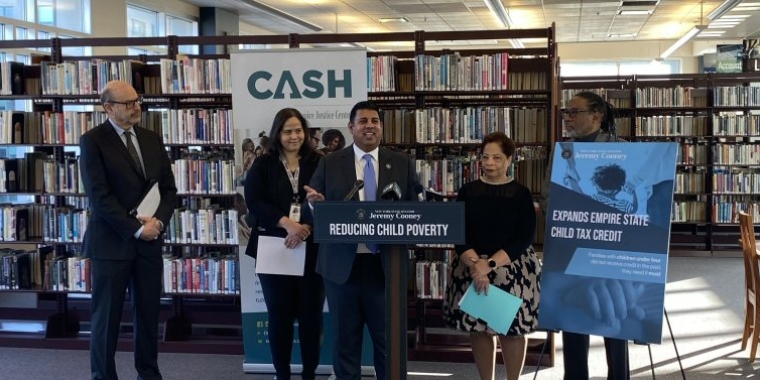

SENATOR COONEY, ROCHESTER CHILDREN'S ADVOCATES CALL FOR INCREASED STATE FUNDING TO FIGHT CHILD POVERTY

(ROCHESTER, NY) - Today, March 20, Senator Jeremy Cooney (D-Rochester) and local anti-poverty advocates called on New York State to include increased funding for the Empire State Child Tax Credit in the 2024 final New York State budget.

The current New York State Empire Child Tax Credit is a minimum $100 per child and a maximum of $330 for children ages 4 through 16. In the recent Senate “One-House” Budget that passed last week, an eligibility expansion to the Empire State Tax Credit was included to provide benefits to parents of children ages 0-3.

Senator Cooney has legislation that would increase the maximum credit for children 4 years and older to $500, and to $1,000 for children under 4. These provisions have the potential to be transformative for families with children across New York, but were not included in the one-house budgets for either legislative chamber.

Senator Cooney was joined by The Children’s Agenda, Action for a Better Community, the Rochester Monroe Anti-Poverty Initiative (RMAPI), and CASH (Creating Assets, Savings, and Hope), a community coalition led by the Empire Justice Center, in this call for greater state support for children.

New York State is stepping up for children in the absence of the federal government,” said Senator Jeremy Cooney. “We saw the impacts of the expanded federal credits during the height of COVID, and we are seeing the unfortunate impacts of that program’s expiration now. It is unconscionable that we have cities, like Rochester, where nearly half of our children live in poverty. If fully implemented, expanded child tax credit eligibility coupled with my proposed value increase would lift more than 2,000 children from poverty in Monroe County alone. The State Legislature must pass a budget that prioritizes children and families across New York.”

“New York State adopted an official goal to cut child poverty in half by 2031 when it adopted the Child Poverty Reduction Act,” said Larry Marx, CEO, The Children’s Agenda. “But family hardships and poverty are creeping up this year due to the growing unaffordability of basic needs and the end of pandemic supports. That’s why we need the Governor to sign a budget with Senator Cooney’s bill to expand the Empire State Child Credit to include families with children younger than four years-old, the families most likely to be in poverty, and the children facing the worst health, education and lifetime outcomes as a result. The Children’s Agenda’s poll last year showed that a whopping 90% of Monroe County parents would find a tax credit for young children ‘very helpful.’ New York State can use tax credits to either reduce child poverty or bolster the film and gambling industries. We vote to cut child poverty, and we are counting on Gov. Hochul and the legislature to do the same.”

“The economically marginalized children and families of today will lead this community tomorrow. Let’s invest in our people NOW rather than pay the price for neglect LATER,” said Jerome Underwood, President & CEO, Action for a Better Community.

“Last fall, when RMAPI was conducting community outreach to inform our 2023 policy agenda, community members who currently or had recently experienced poverty asked about the Child Tax Credit,” said Aqua Porter, Executive Director, RMAPI. “What happened to it? Why did it go away? They emphasized how helpful this money was – providing that extra cash each month that they could use as needed; whether that was buying food, school supplies, or clothes for growing children. RMAPI strongly supports expanding the Child Tax Credit to children ages 0-3. Increasing children’s inadequate family incomes with an expanded Child Tax Credit and reducing poverty over the long term means better lifetime health, improved educational attainment, higher earnings and better economic circumstances.”

“CASH Rochester strongly supports the Working Families Tax Credit, which would help lift New York children out of poverty, and help their families meet their basic needs, like clothing, gas, childcare, rent, and food,” said Yversha Roman, Director of CASH Rochester. “When Congress didn’t extend the Child Tax Credit, national estimates expected tax returns to come in approximately 11% less than last year. Currently at CASH (Creating, Assets, Savings and Hope), our clients are seeing an approximately 50% reduction in the average amount of federal returns. Every little bit helps, and The One-House Budgets of the Senate and Assembly included expansion of the CTC to children aged 0-3 at the $100 per year, but did not include increased allotments included in Senator Cooney’s bill. This is a step in the right direction but there is so much more we can do.”

###

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Cooney Fights Governor's Proposed Transit Budget Cuts

January 28, 2021