Senator Sean Ryan Announces Free Tax Preparation Services In North Buffalo

March 14, 2024

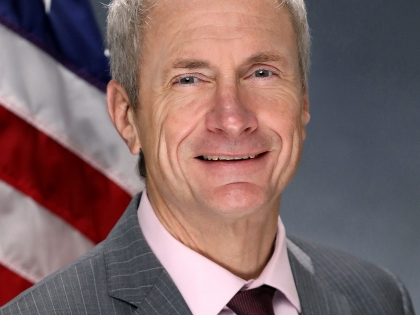

BUFFALO – Today, March 14, 2024, New York State Senator Sean Ryan announced that a group of IRS-trained and certified volunteers are providing free assistance with filing federal and state tax returns at three locations in North Buffalo.

The service is being offered by Free Tax Buffalo, a collection of IRS certified volunteers who are trained in federal and state tax return preparation. As part of the free service, the group prepares and electronically files federal and state tax returns for eligible New Yorkers earning up to $73,000 per year. Free Tax Buffalo operates as part of the IRS Volunteer Income Tax Assistance (VITA) program, and the service was made possible at these locations by a state grant secured by Senator Ryan. The local group has already prepared more than 2,000 returns this year, 17th-most among the nearly 9,000 VITA sites nationwide.

Free Tax Buffalo’s services are primarily offered at the Northwest Buffalo Community Center at Lawn Avenue and Military Road, with availability on Saturday mornings, and Monday and Wednesday evenings. Thursday appointments are available at the North Buffalo Community Center on Sanders Road and the Elaine M. Panty Branch Library on Tonawanda Street in Riverside. Tax preparation assistance at these three locations is available by appointment only, and appointments must be secured by calling 211 or 1-888-696-8211. Please note that no appointments can be made by calling the community centers and library hosting the events.

More information about the VITA program and eligibility is available at IRS.gov. The IRS has a tool to find all free tax preparation locations by zip code at irs.treasury.gov/freetaxprep. For more information about the North Buffalo locations, visit FreeTaxBuffalo.com

Share this Article or Press Release

Newsroom

Go to NewsroomRyan wants Tesla firings investigated (Investigative Post)

February 22, 2023

Senator Sean Ryan Urges State Investigation Into Tesla Firings

February 22, 2023

Op-Ed: My priorities for this year’s state budget

February 22, 2023