Amid Worsening Affordability Crisis, Senator Fahy Introduces Legislation to Significantly Expand Earned Income Tax Credit (EITC)

February 12, 2025

ALBANY, N.Y. (Feb. 12) – Senator Patricia Fahy (D—Albany) announced the re-introduction of legislation (S.4425 Fahy/A.XXXX forthcoming) expanding and increasing the Earned Income Tax Credit (EITC), while urging its inclusion in the FY2025-26 fiscal plan. In 2024 alone, more than one million workers and families in New York received the EITC. This proposal builds on the success of the New York EITC by increasing the value of the credit, expanding eligibility for the credit, and creating an option for recipients of the credit to receive advance payments quarterly. EITC is also one of the most successful poverty alleviation programs in the nation, lifting more than 8 million Americans out of poverty every year.

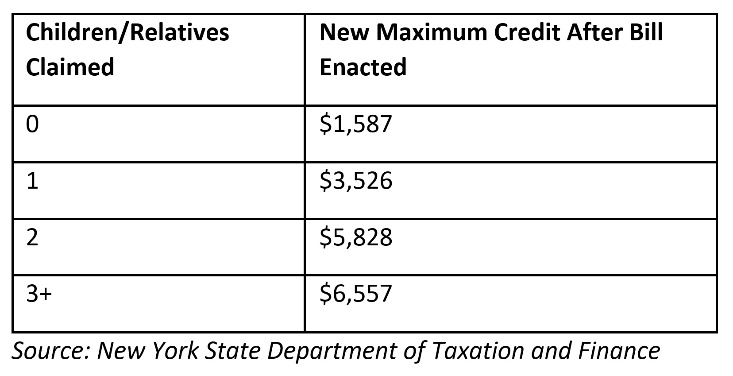

In addition to expanding NY’s EITC eligibility by raising income phase-out limits to include more eligible New Yorkers, this bill also expands eligibility for the credit to those who do not have children, those aged 18-24 and those older than 65, and those who file income taxes without a Social Security Number. Notably, the phase-out start point would dramatically grow from $8,790 to $24,960 for childless adults and single parents, and from $14,680 to $29,960 for joint filers to include more New York families. The phase-out end point would be set at $45,692 for single filers without children and $61,095 for joint filers with up to 2 children. This bill also raises the total value of NY's EITC from 30% to 40% of the federal EITC. Filers would see the following increased state credits:

Most notably, a non-custodial or childless single adult would see the maximum tax credit increased from $464 right now, to $1,587. The EITC is designed to reward New York workers, with the credit’s value increasing as a recipient’s earnings grow.

“New Yorkers are struggling to afford eggs, food, and housing, while a trade war and tariffs with Canada and Mexico looms, USAID funding to combat the spread of bird flu freezes up, and farmers’ exports remain stuck in ports across the country,” said bill sponsor and Senator Patricia Fahy (D — Albany). “Amidst a worsening affordability crisis, an expanded Earned Income Tax Credit (EITC) in New York will direct critically needed income into the pockets of working families and individuals at a time it’s needed most. Low-income families, especially young adults, have been hit the hardest by the affordability crisis, which demands bold action. The EITC is an effective investment both in our workforce and in helping families afford basic staples. Expanding the EITC under this legislation will lift thousands of New Yorkers out of poverty each year while incentivizing work, boosting local economies and businesses as New Yorkers have more in their pockets to spend and address the kitchen-table issues that matter the most. Now more than ever, New Yorkers need meaningful support to weather this economic uncertainty and anxiety.”

Full changes made under the bill include:

- Raising the income threshold for phaseout, nearly doubling it for filers with dependents (from $11,610 to $24,960, indexed to inflation).

- Increasing the state EITC credit percentage from 30% of the federal credit to 35% in 2025 and 40% in 2026+.

- Doubling the phase-in percentage for filers with no dependents (from 7.65% to 15.3%).

- Expanding eligibility:

- Aligning phase-in and phase-out amounts for filers with no dependents to those with one dependent.

- Lowering the minimum age to 19 (from 25) and removing the upper age limit (previously 64).

- Allowing individuals without a Social Security number or those 65+ to claim the credit.

These adjustments ensure that more individuals and families can benefit from this essential tax credit, which has served as a critical poverty-reduction tool. Furthermore, studies show that families and workers who have received EITC use their benefits on essential expenses such as rent, food, and transportation, directing their money back into their communities.

In New York, expanding the EITC would directly benefit over 1.4 million workers and families, boosting economic activity across the state. By raising the phaseout thresholds, offering quarterly payments, and broadening eligibility, the expansion would ensure that those most in need receive critical financial support.

“Tax credits for working families are an important way to get cash into the hands of people who need it,” said Kate Breslin, Chief Executive Officer, Schuyler Center for Analysis and Advocacy. “This proposal will help the State’s Earned Income Tax Credit to keep up with inflation and reach hard working people who have previously been excluded from the credit – young adults, seniors, and people who file taxes using an individual tax identification number. Coupled with a robust expansion of the child tax credit, New York can make a dent in affordability and move the needle on child poverty.”

“United Way proudly supports Senator Fahy’s proposal to expand the Earned Income Tax Credit (EITC), a proven tool that helps hardworking families make ends meet," said Peter Gannon, President & CEO of United Way of the Greater Capital Region. "With the rising cost of living putting more pressure on New Yorkers, expanding EITC eligibility means putting more money back in the pockets of those who need it most. In New York State, more than half of children live in households that fall below the ALICE threshold, struggling to afford basic necessities like housing, food, healthcare, and childcare. This expansion would mark a crucial step toward building financial stability for families and individuals across the Capital Region."

###

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom